The Best Investment Accounts For Kids Greatest Gift

The Best Investment Accounts For Kids Greatest Gift 3. coverdell education savings accounts. similar to 529 plans, coverdell education savings accounts are investment accounts for your child’s education. contributions grow tax free, and. Discover great ways to save and invest for children. tl;dr the four main types of investment accounts for kids include utma accounts, 529 plans, custodial roth iras, and youth investment accounts. choosing the right account can help reach different financial goals. setting up an investment account for your kid is a great way to save for the.

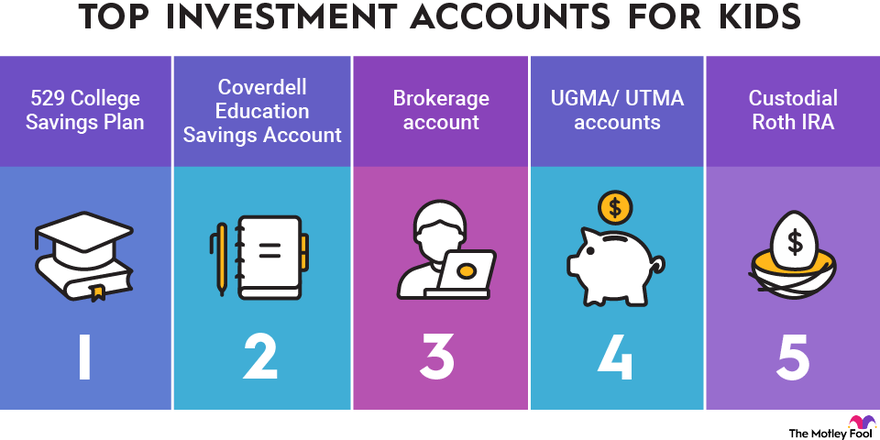

Best Investment Accounts For Kids In 2024 The Motley Fool This can also be a time to explain the benefits of opening multiple investment accounts for various purposes. 7. roth ira. if your children are older and have earned income from a part time job. Charles schwab (schw 0.15%) also offers an account for minors the schwab one custodial account for people younger than 18. no minimum deposit is required to open the account, and there are no. Best investment accounts for kids. teen owned brokerage account. 529 college savings plan. coverdell education savings account. custodial roth ira. ugma or utma custodial accounts. Here again, this feature of the schwab brokerage platform is ideal for use in a custodial account where part of the point is often to teach kids about investing with a small amount of money. 5.

Investing For Kids Greatest Gift Best investment accounts for kids. teen owned brokerage account. 529 college savings plan. coverdell education savings account. custodial roth ira. ugma or utma custodial accounts. Here again, this feature of the schwab brokerage platform is ideal for use in a custodial account where part of the point is often to teach kids about investing with a small amount of money. 5. Opening a greatest gift account is free, and there are no monthly fees. also, we don't ask the sender or receiver for any tips for our services. our lowest fees are 1.5% 25¢. when sending a $100 gift, that means the gift receiver keeps $98.25 of the gift, and we only take $1.75 in fees. 1. best for education: 529 savings plan. a 529 savings plan offers key tax incentives to start saving for your children’s education. as long as you use the money toward qualifying educational expenses, you won’t have to pay taxes on distributions, which can result in major savings. in some states, your contributions toward a 529 plan can.

The Best Investment Accounts For Kids Greatest Gift Opening a greatest gift account is free, and there are no monthly fees. also, we don't ask the sender or receiver for any tips for our services. our lowest fees are 1.5% 25¢. when sending a $100 gift, that means the gift receiver keeps $98.25 of the gift, and we only take $1.75 in fees. 1. best for education: 529 savings plan. a 529 savings plan offers key tax incentives to start saving for your children’s education. as long as you use the money toward qualifying educational expenses, you won’t have to pay taxes on distributions, which can result in major savings. in some states, your contributions toward a 529 plan can.

Comments are closed.