The Benefits Of Annuities For Retirement Income Planning Inflation

5 Annuity Advantages In A Successful Retirement Plan Inflation Protection Retirement savings are affected by rapid inflation because retirement portfolios generally have a large allocation of fixed income investments, such as bonds and annuities. while much less volatile than stocks, these types of investments are vulnerable to inflation, which lowers the purchasing power of fixed payment streams. A fixed index annuity is a type of annuity that provides options for a level income, increasing income, or inflation adjusting income. a variety of fixed index annuities have an add on benefit, called an income rider, that can help drive these options. the level income rider guarantees that the recipient’s income will stay the same each year.

The Benefits Of Annuities For Retirement Income Planning Inflation Inflation adjusted annuities play an essential role in retirement planning by providing a stable income stream that keeps up with the rising cost of living. an inflation adjusted annuity is a financial product that provides a stream of income that increases with inflation. this type of annuity is designed to help individuals maintain their. ( inflation adjusted annuities )retirement planning can be a maze of financial instruments and options, with each choice carrying its own set of potential risks and rewards. for the retiree seeking to secure a durable income stream, an annuity remains a stalwart; a financial product offered by insurance companies that can provide predetermined. Key takeaways. annuities can be both a boost to retirement savings and a dependable source of future income. these investments can also help manage market volatility, the possibility you could outlive your savings, and the risk inflation will eat away at your savings in retirement. they can help you grow retirement savings, even if you’ve. Inflation as part of the planning process. go2income planning attempts to simplify the planning for inflation and all retirement risks: set a long term assumption as to the inflation level that.

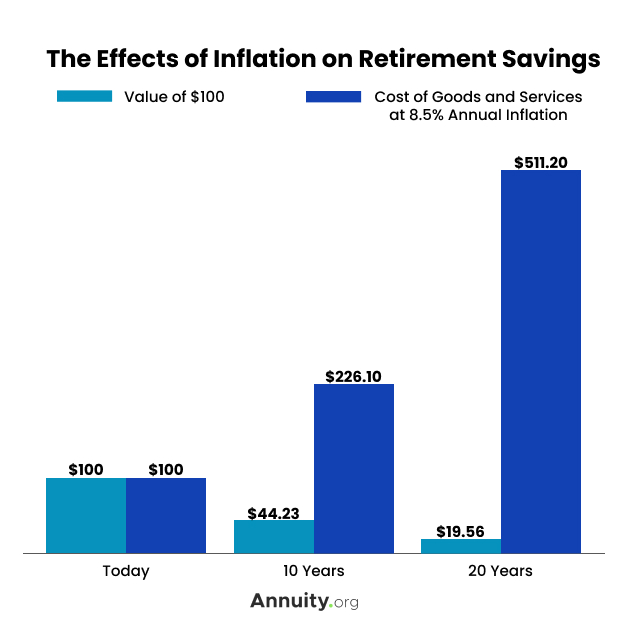

Advantages And Disadvantages Of Retirement Annuities Inflation Protection Key takeaways. annuities can be both a boost to retirement savings and a dependable source of future income. these investments can also help manage market volatility, the possibility you could outlive your savings, and the risk inflation will eat away at your savings in retirement. they can help you grow retirement savings, even if you’ve. Inflation as part of the planning process. go2income planning attempts to simplify the planning for inflation and all retirement risks: set a long term assumption as to the inflation level that. Giving up control and liquidity. with a traditional income annuity, you give up access to that cash in exchange for the promise of regular, reliable income. if something changes in your situation, you won’t be able to get that lump sum of cash back. 3. potential lack of inflation protection. In the summer of 2022, we all say the headlines, “consumer price index increases to 9%1.”. in other words, the cost of living got a whole lot more expensive for everyone that summer. anyone on a fixed income was justifiably distressed. in fact, back in 2021, 71% of retirees had already listed inflation as their biggest concern.

How Can Inflation Impact Your Retirement Plan Giving up control and liquidity. with a traditional income annuity, you give up access to that cash in exchange for the promise of regular, reliable income. if something changes in your situation, you won’t be able to get that lump sum of cash back. 3. potential lack of inflation protection. In the summer of 2022, we all say the headlines, “consumer price index increases to 9%1.”. in other words, the cost of living got a whole lot more expensive for everyone that summer. anyone on a fixed income was justifiably distressed. in fact, back in 2021, 71% of retirees had already listed inflation as their biggest concern.

Benefits Of A Retirement Annuity Are They Worth It Henceforward

Comments are closed.