The 3 Major Reporting Agencies That Control Your Credit Report Credit

The 3 Major Reporting Agencies That Control Your Credit Report Credit The three major credit bureaus are equifax, experian and transunion. the credit bureaus manage records on your accounts, balances and the payments you make. each credit bureau operates. The three main credit reporting agencies are equifax, experian and transunion. obligated to report information to all three major credit bureaus, your credit reports may have slight.

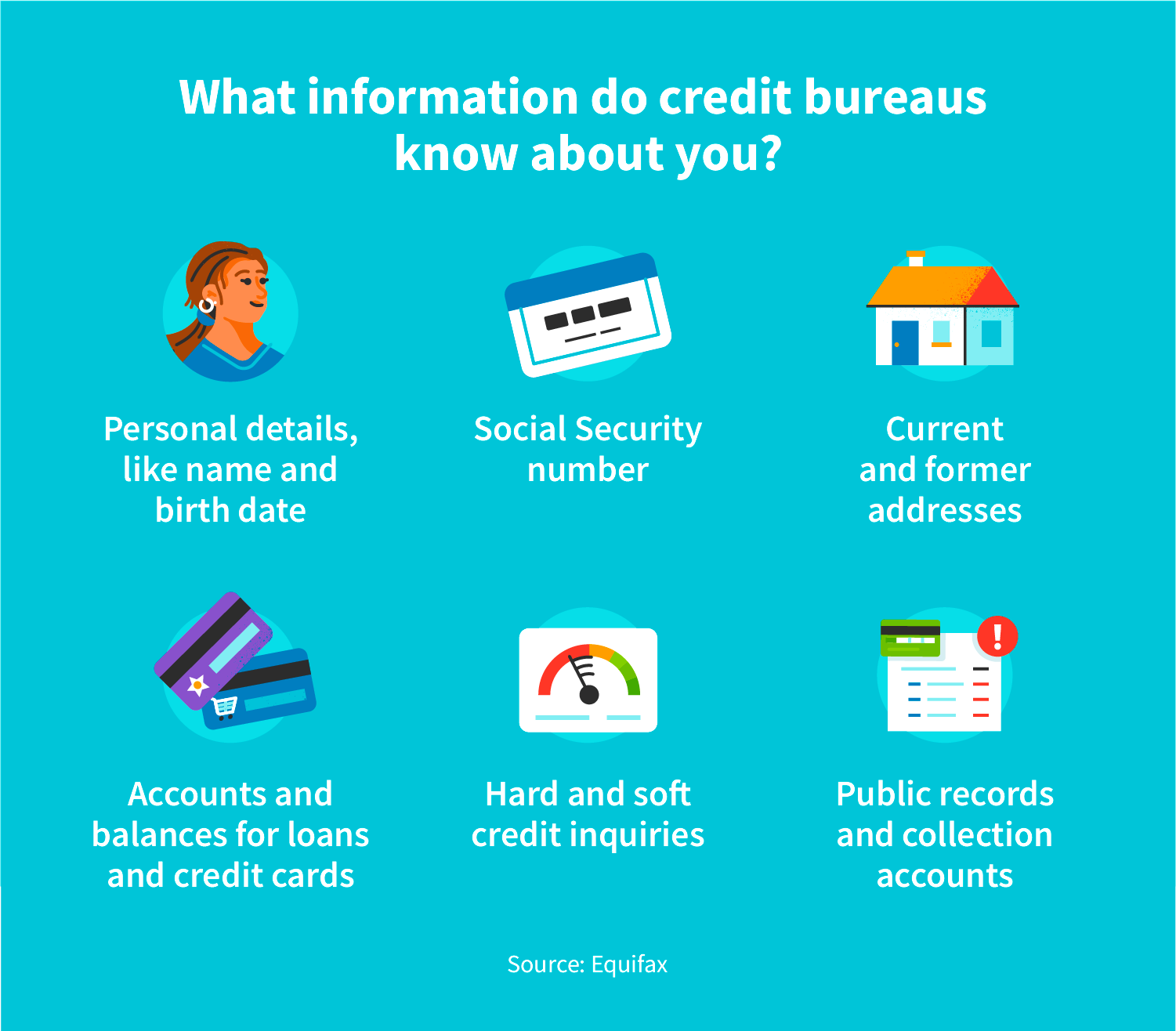

Credit Reporting Agencies 3 Major Credit Bureaus You can request your credit report in spanish directly from each of the three major credit bureaus: transunion : call 800 916 8800. equifax : visit the link or call 888 378 4329. Although fico compiles credit scores based on data from the major credit bureaus, it does not collect credit report data on its own. how the credit bureaus are regulated the federal government has legislation—the fair credit reporting act (fcra) —that regulates how these and other credit bureaus can and must operate. The top 3 credit bureaus. in the u.s., the top three consumer reporting bureaus are equifax, experian, and transunion. this trio dominates the market for collecting information about consumers in. Each of the big three credit bureaus collects and processes your credit information, but they don’t always have the exact same data. creditors may not report to all three bureaus, and each bureau might handle updates at different times. let’s take a closer look at the three bureaus and how they shape your credit. 1. experian.

Understanding Credit Reporting Agencies The top 3 credit bureaus. in the u.s., the top three consumer reporting bureaus are equifax, experian, and transunion. this trio dominates the market for collecting information about consumers in. Each of the big three credit bureaus collects and processes your credit information, but they don’t always have the exact same data. creditors may not report to all three bureaus, and each bureau might handle updates at different times. let’s take a closer look at the three bureaus and how they shape your credit. 1. experian. Yes. while experian, equifax, and transunion are the three major bureaus, there are other credit bureaus. innovis is another consumer credit bureau, considered the "fourth credit bureau." another. The three major credit bureaus are transunion, experian, and equifax. each credit bureau collects, updates, and sells credit information on consumers in the united states. lenders and creditors use the credit reports compiled by credit bureaus to determine your creditworthiness, which is your eligibility for loans and lines of credit.

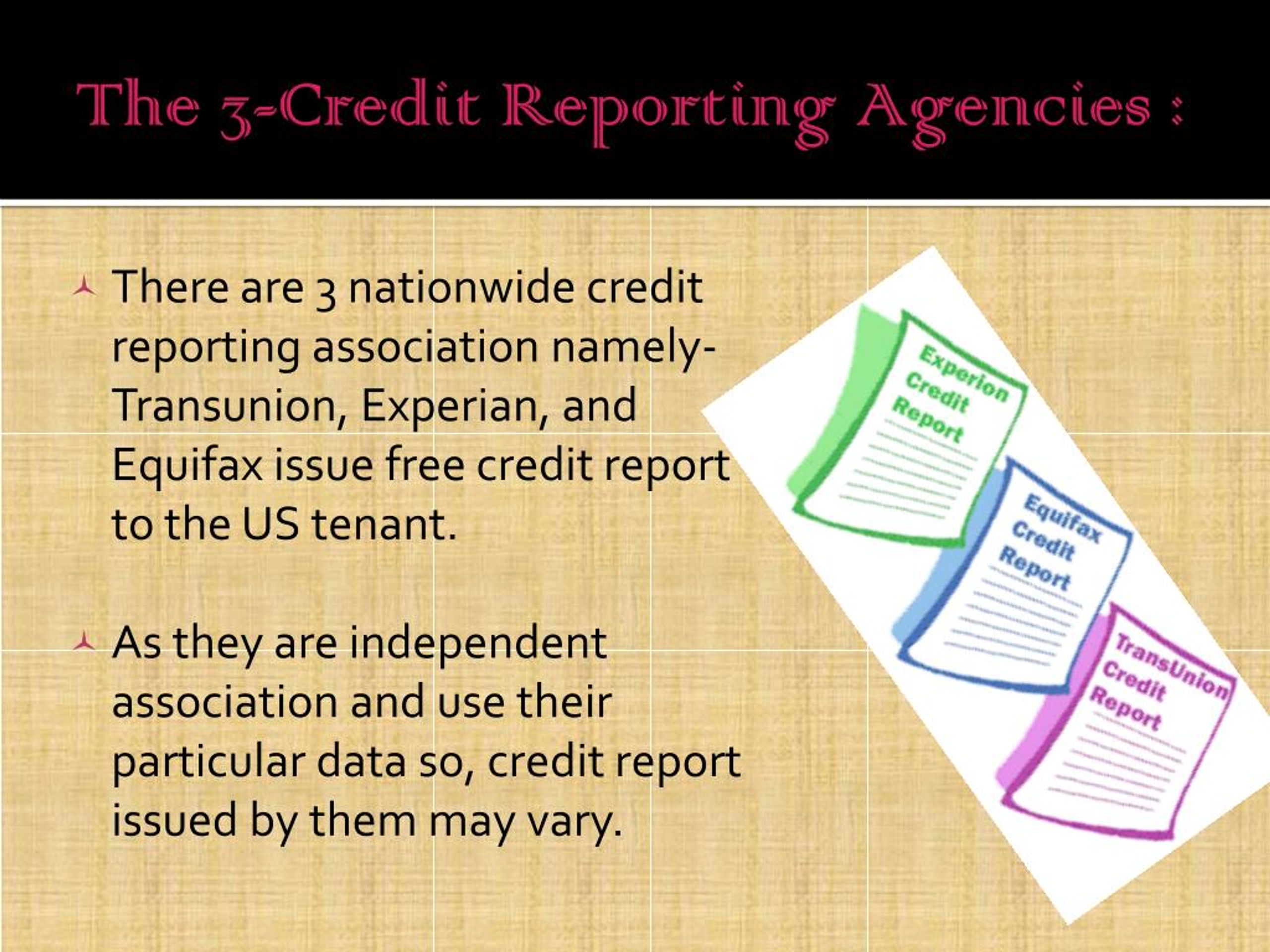

Ppt What Is A Credit Report Powerpoint Presentation Free Download Yes. while experian, equifax, and transunion are the three major bureaus, there are other credit bureaus. innovis is another consumer credit bureau, considered the "fourth credit bureau." another. The three major credit bureaus are transunion, experian, and equifax. each credit bureau collects, updates, and sells credit information on consumers in the united states. lenders and creditors use the credit reports compiled by credit bureaus to determine your creditworthiness, which is your eligibility for loans and lines of credit.

The 3 Major Reporting Agencies That Control Your Credit Report

The Three Credit Bureaus Explained Creditrepair

Comments are closed.