The 3 Greatest Risks In Retirement And How To Manage Them

The 3 Greatest Risks In Retirement And How To Manage Them Youtube Social security benefits counter the three greatest risks of retirement: longevity risk, inflation, and market risk. social security seems boring to many people. instead of focusing on the long. Here are the seven biggest risks retirees should avoid at all costs, along with tips to address them. 1. longevity risk. average life expectancy has increased from 68.14 years in 1950 to 76.4.

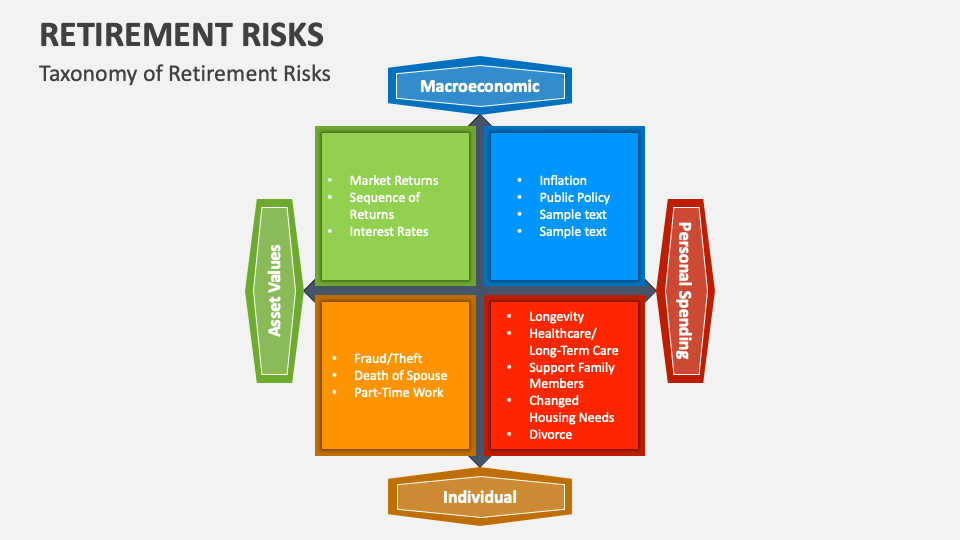

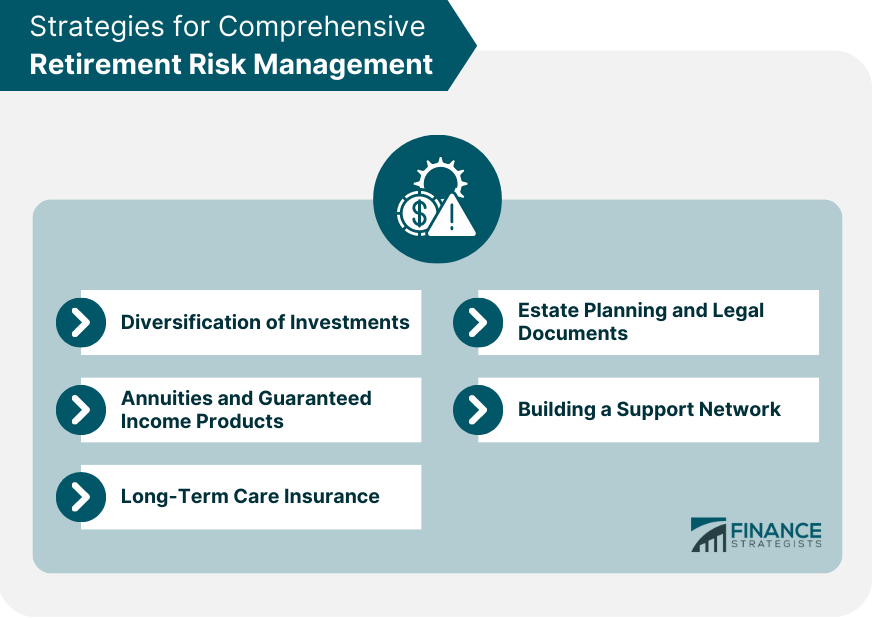

Retirement Risks Powerpoint And Google Slides Template Ppt Slides Disclosure 1 and historically, stocks have offered the greatest growth potential of any asset class. bonds and cash investments offer greater stability but much less growth. the longer you have until you’ll draw on your savings, the more market risk you can afford to take in pursuit of continued growth. so if you still have a decade until. Tax and policy risk. what it is —changes in rules governing health coverage, retirement savings or benefits, or estate planning. how to prepare for it —make sure your portfolio contains a variety of asset classes and account types, which can give you more flexibility if policies change. how an advisor can help —your advisor can provide. This is the idea that you can take more risk in the markets than most people. for example: you have a $100,000 annual lifestyle in retirement and $100,000 of annual income through a combination of. 877 918 7024. home retirement risks. retirement risks. retirement is a time of relaxation, but it also carries a lot of risk. four major retirement risks include outliving your savings, health care and long term care risks, market risk and spending shocks. fortunately, there are many strategies to reduce these threats to your retirement plan.

3 Risks To Your Retirement How To Avoid Them Blog Keil Financial This is the idea that you can take more risk in the markets than most people. for example: you have a $100,000 annual lifestyle in retirement and $100,000 of annual income through a combination of. 877 918 7024. home retirement risks. retirement risks. retirement is a time of relaxation, but it also carries a lot of risk. four major retirement risks include outliving your savings, health care and long term care risks, market risk and spending shocks. fortunately, there are many strategies to reduce these threats to your retirement plan. 3. inflation. even a modest amount of inflation reduces your spending power over time. people in retirement are especially vulnerable. over a 10 year period, a relatively low inflation rate of 2% can bring the value of every $100,000 saved down to $81,707. and over a 25 year period — probably a reasonable expectation for the length of your. Protecting your financial legacy. retirement is supposed to be comfortable, fun, and relaxing. the process to get there, however, can be stressful, tiring, and arduous. the transition from living your life with a mentality focused on saving to spending the money you’ve put away is significant. addressing the six major risks you’ll face.

Retirement Risk Management Definition Aspects Strategies 3. inflation. even a modest amount of inflation reduces your spending power over time. people in retirement are especially vulnerable. over a 10 year period, a relatively low inflation rate of 2% can bring the value of every $100,000 saved down to $81,707. and over a 25 year period — probably a reasonable expectation for the length of your. Protecting your financial legacy. retirement is supposed to be comfortable, fun, and relaxing. the process to get there, however, can be stressful, tiring, and arduous. the transition from living your life with a mentality focused on saving to spending the money you’ve put away is significant. addressing the six major risks you’ll face.

Comments are closed.