The 1031 Exchange Timeline A Roadmap For Investors Canyon View Capital

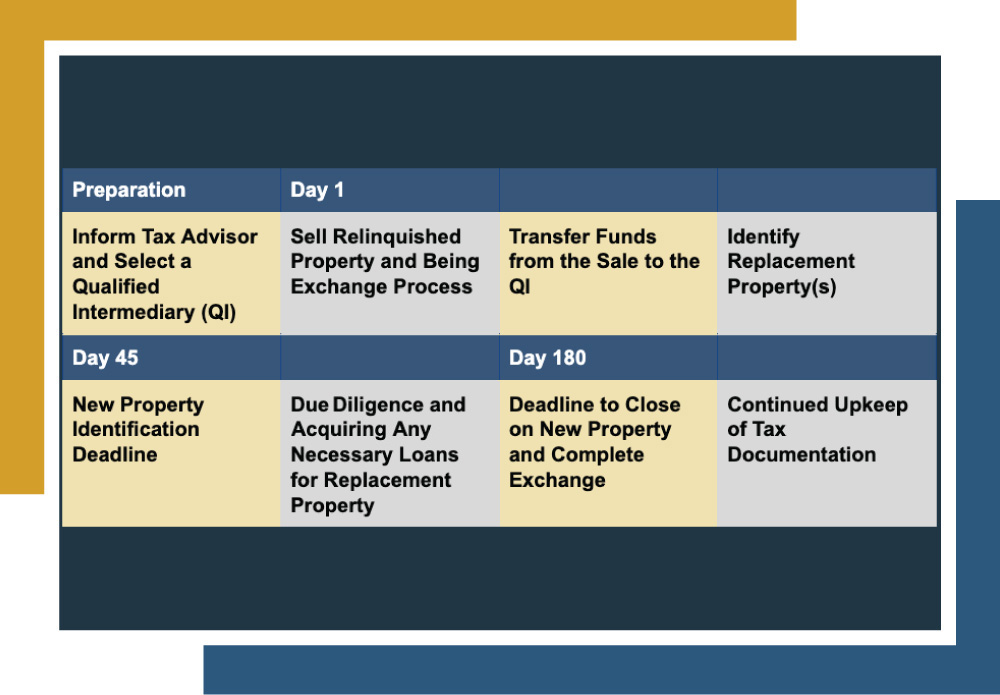

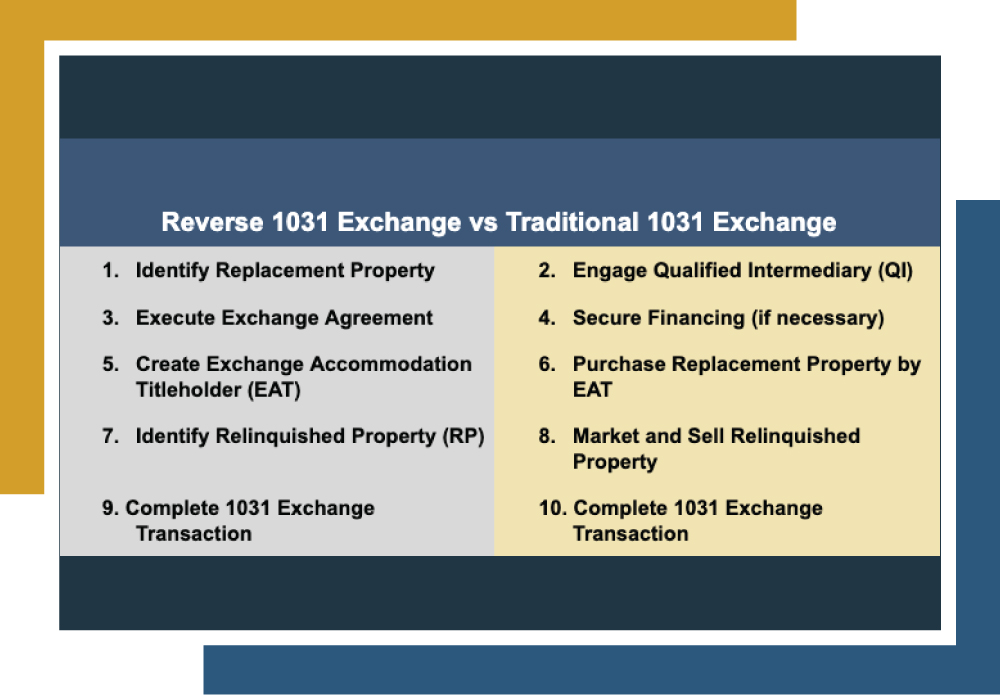

The 1031 Exchange Timeline A Roadmap For Investors Canyon View Capital The 45 day deadline for identification of the replacement property ends, and by now, you must have submitted written identification of the replacement property (s) to your qi. deadline to close on new property and complete exchange. the 180 day timeframe encompassing the entire 1031 exchange process has concluded, and by this point, you should. In contrast, the reverse 1031 exchange timeline begins with identifying the replacement property, which may make the timeliness of completion much more manageable. this added flexibility might empower investors to make more deliberate and strategic decisions when navigating the exchange process. reverse 1031 exchange timeline.

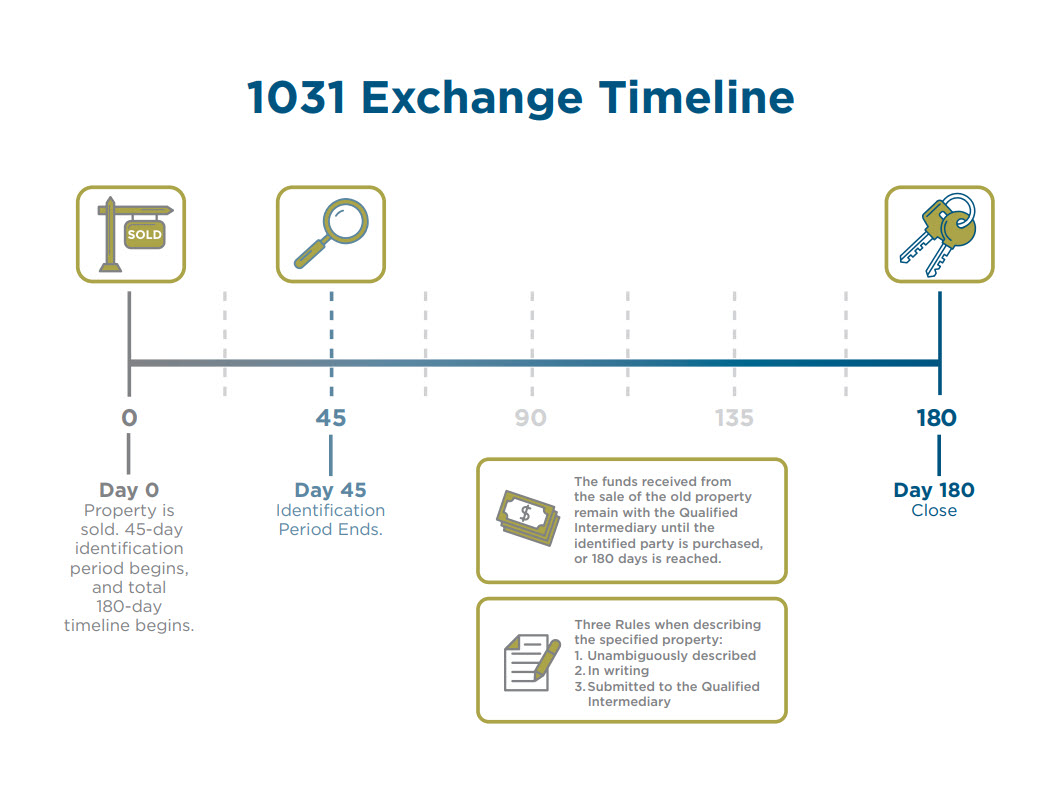

Reverse 1031 Exchange Timeline Canyon View Capital Timeline for completion: the entire 1031 exchange process must be completed within a tight 180 day window. deferred capital gains: by following the rules of a 1031 exchange, you will defer the capital gains taxes that would have otherwise been due to the irs at the time of sale. essentially, the deferred gain is rolled into the new property. The 180 day deadline in a 1031 exchange is a crucial benchmark. it establishes the maximum time frame of 180 calendar days from the sale of the relinquished property for the taxpayer to acquire the replacement property. keeping to this deadline is essential to upholding the property exchange’s tax deferred status. The 1031 exchange timeline: a roadmap for investors. the 1031 exchange 200 rule: a guide for investors canyon view capital canyonviewcapital. A reverse 1031 exchange is just that–the process of a 1031 exchange, but reversed. with a reverse exchange, an investor can buy a replacement property first, and then sell their existing property after that. it sounds straightforward, but there are certain guidelines investors must follow, outlined by the irs.

1031 Exchange Timeline Overview And Considerations Accruit The 1031 exchange timeline: a roadmap for investors. the 1031 exchange 200 rule: a guide for investors canyon view capital canyonviewcapital. A reverse 1031 exchange is just that–the process of a 1031 exchange, but reversed. with a reverse exchange, an investor can buy a replacement property first, and then sell their existing property after that. it sounds straightforward, but there are certain guidelines investors must follow, outlined by the irs. A 1031 exchange, named after section 1031 of the u.s. internal revenue code, is a strategic tool for deferring tax on capital gains. you can leverage it to sell an investment property and reinvest. Canyon view capital helps ease the burden of 1031 exchange deadlines 1031 exchange deadlines often challenge investors looking to use these powerful tax deferral tools. canyon view capital can help streamline the 1031 exchange process, particularly the tiny, 45 day identification window with our extensive portfolio of multifamily properties .

Comments are closed.