Term Of The Day Credit Default Swaps By Vivan Gandotra Jun 2023

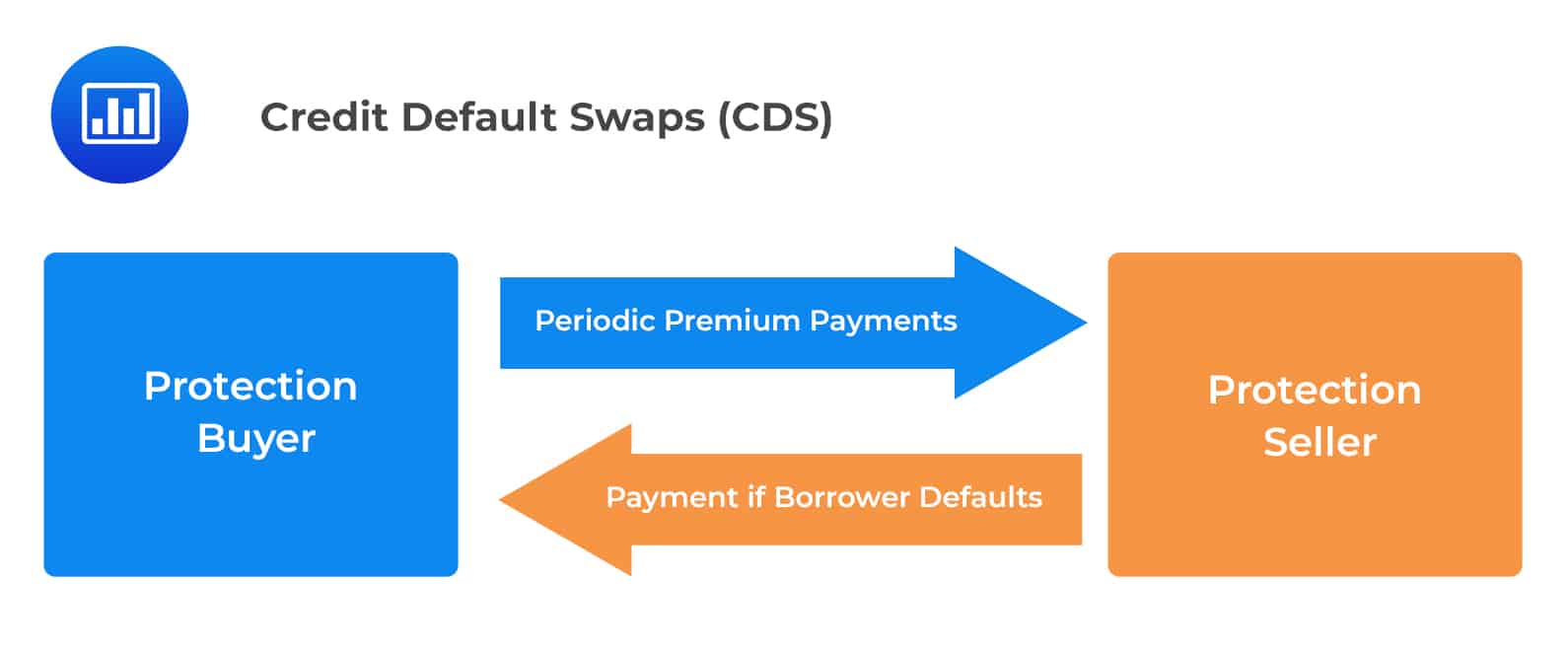

Term Of The Day Credit Default Swaps By Vivan Gandotra Jun 2023 A credit default swap (cds) is a financial derivative that allows an investor to swap or offset their credit risk with that of another investor. to swap the risk of default, the lender buys a cds…. A credit default swap (cds) is a financial derivative that allows an investor to swap or offset their credit risk with that of another… 3 min read · jun 25 see all from vivan gandotra.

Credit Default Swaps Chart Jun 24, 2023. vivan gandotra. term of the day: moral hazard. another curveball of a term created by the business world (specifically the insurance sector) that many fail to completely understand. A credit default swap is a derivative contract that transfers the credit exposure of fixed income products. it may involve bonds or forms of securitized debt—derivatives of loans sold to. Russia’s ‘failure to pay’ bond interest triggers credit default swaps. international derivatives panel’s decision paves way for $2.5bn of payouts on insurance like contracts. wednesday, 9. Credit default swaps are widely used for hedging risk and speculation. for example, if a bank has a large real estate loan, it can buy a cds to protect against the risk of default losses.

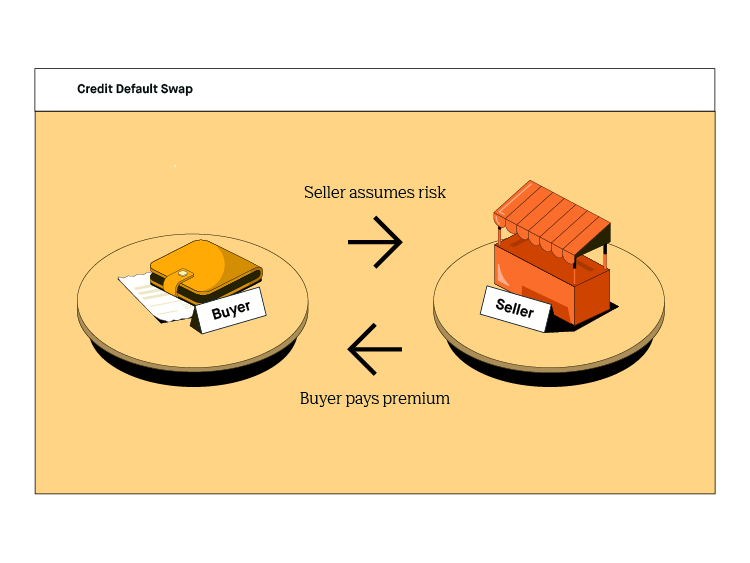

Why Credit Default Swaps Have Re Emerged As A Crucial Factor For Russia’s ‘failure to pay’ bond interest triggers credit default swaps. international derivatives panel’s decision paves way for $2.5bn of payouts on insurance like contracts. wednesday, 9. Credit default swaps are widely used for hedging risk and speculation. for example, if a bank has a large real estate loan, it can buy a cds to protect against the risk of default losses. Credit default swaps (cds) are widely used financial derivatives, or contracts, that give investors the ability to “swap” their credit risk with another investor. they’re a popular type of investment, especially for institutional investors. investors use cds for many types of credit investments, including mortgage backed securities, junk. Credit default swap. a credit default swap (cds) is a financial swap agreement that the seller of the cds will compensate the buyer in the event of a debt default (by the debtor) or other credit event. [1] that is, the seller of the cds insures the buyer against some reference asset defaulting.

Credit Default Swap Indian Economy Notes Credit default swaps (cds) are widely used financial derivatives, or contracts, that give investors the ability to “swap” their credit risk with another investor. they’re a popular type of investment, especially for institutional investors. investors use cds for many types of credit investments, including mortgage backed securities, junk. Credit default swap. a credit default swap (cds) is a financial swap agreement that the seller of the cds will compensate the buyer in the event of a debt default (by the debtor) or other credit event. [1] that is, the seller of the cds insures the buyer against some reference asset defaulting.

Understanding Credit Default Swaps Cds Benefits And Risks Explained

Credit Default Swap Definition And Meaning Market Business News

Comments are closed.