Ten Years On A Decade After The Crisis How Are The World S Banks

Ten Years On A Decade After The Crisis How Are The World S Banks Between 2011 and mid 2016 the world’s 30 “globally systemically important” banks boosted their common equity by around €1trn ($1.3trn), mostly through retained earnings, says the bank for. Related world bank research bank regulation and supervision ten years after the global financial crisis october 2019 – policy research working paper 9044 deniz anginer, ata can bertay, robert cull, asli demirgüç kunt, and davide s. mare this paper summarizes the latest update of the world bank regulation and supervision survey.

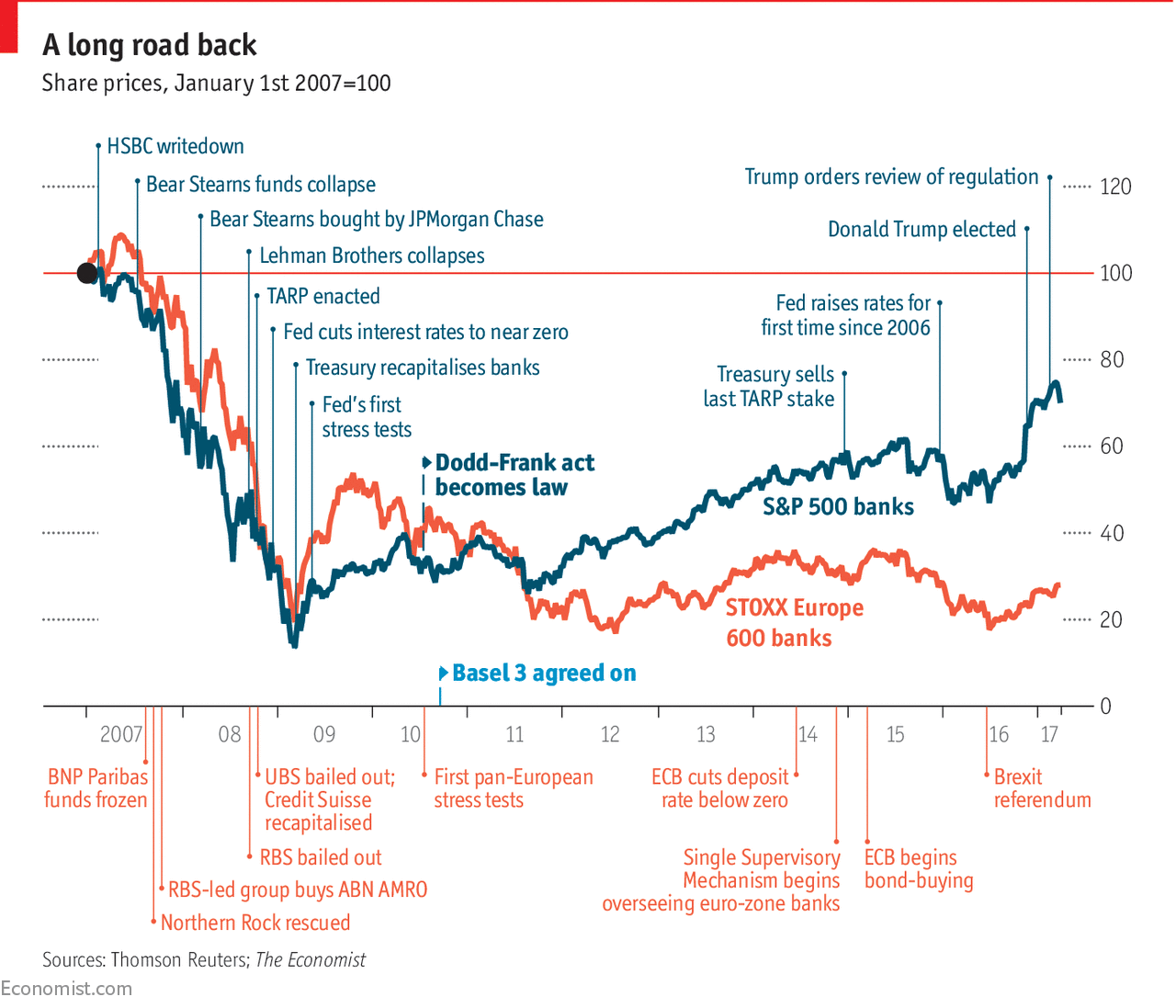

A Decade After The Crisis How Are The World S Banks Doing Ten Years On It has been more than 10 years since the global financial crisis. as happens after every crisis, this crisis also triggered extensive regulatory reforms, since strong regulation and supervision is essential for the stability and inclusiveness of the banking sector and the crisis revealed many shortcomings. a decade after the crisis is a good. Regulations, capitalization of banks, market discipline, and supervisory power since the global financial crisis. it shows that regulatory capital increased, but some elements of capital regulations became laxer. market discipline may have deteriorated as the financial safety nets became more generous after the crisis. After the crisis, policy makers and regulators worldwide took steps to strengthen banks against future shocks. the tier 1 capital ratio has risen from less than 4 percent on average for us and european banks in 2007 to more than 15 percent in 2017. 1 the tier 1 capital ratio, a measure of financial health, is calculated by dividing a bank’s. Join us online and in washington, dc at world bank headquarters on november 6 for the launch of the global financial development report 2019 2020: bank regulation and supervision a decade after the global financial crisis. drawing on 10 years of data and analysis, this 5 th edition in the global financial development report series provides new.

A Decade After The Crisis How Are The World S Banks Doing Ten Years On After the crisis, policy makers and regulators worldwide took steps to strengthen banks against future shocks. the tier 1 capital ratio has risen from less than 4 percent on average for us and european banks in 2007 to more than 15 percent in 2017. 1 the tier 1 capital ratio, a measure of financial health, is calculated by dividing a bank’s. Join us online and in washington, dc at world bank headquarters on november 6 for the launch of the global financial development report 2019 2020: bank regulation and supervision a decade after the global financial crisis. drawing on 10 years of data and analysis, this 5 th edition in the global financial development report series provides new. Approaches towards capital regulation. basel i (1988) first international initiative to define and regulate capital. focused on member countries, but adopted almost worldwide. induced banks to maintain higher capital ratios. but its simplicity in measuring risks led to regulatory arbitrage. Abstract. this paper summarizes the latest update of the world bank bank regulation and supervision survey. the paper explores and summarizes the evolution in bank capital regulations, capitalization of banks, market discipline, and supervisory power since the global financial crisis.

10 Year Anniversary Of The Financial Crisis Rankings Of The Largest Approaches towards capital regulation. basel i (1988) first international initiative to define and regulate capital. focused on member countries, but adopted almost worldwide. induced banks to maintain higher capital ratios. but its simplicity in measuring risks led to regulatory arbitrage. Abstract. this paper summarizes the latest update of the world bank bank regulation and supervision survey. the paper explores and summarizes the evolution in bank capital regulations, capitalization of banks, market discipline, and supervisory power since the global financial crisis.

Ten Years On A Decade After The Crisis How Are The World S Banks

Comments are closed.