Taxation Salary Income Chapter6 Part1 Employment Employee Employer And Perquisites

Taxation Salary Income Chapter 6 Part 1 Employment Employee 3. perquisites. “perquisite” may be defined as any casual emolument or benefit attached to an office or position in addition to salary or wages. “perquisite” is defined in the section 17 (2) of the income tax act as including: (i) value of rent free concessional rent accommodation provided by the employer. Video explain the salary income the source of salary income what is include in salary income head#pay,wages#leave pay #overtime# bonus# gratuity#workconditio.

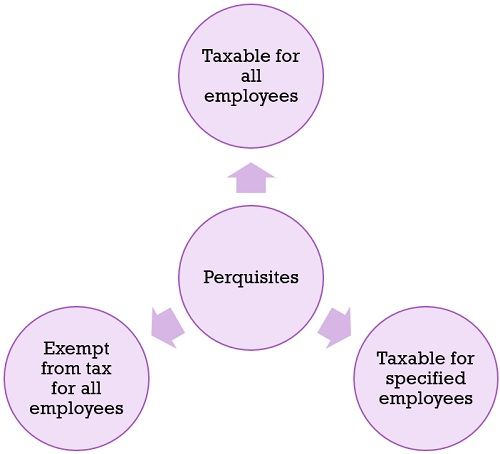

Valuation Of Perquisites Of Salaried Taxpayer Illustrative list of exemption from tax in respect of perquisites includes the following: medical reimbursement up to ₹15,000 per annum, health insurance premiums related to insurance taken by the employer, meal vouchers up to ₹50 per meal, leave travel allowance under stipulated conditions. q7. Taxable & non taxable perquisites under 'salary income'. perquisites which are taxable in the hands of all categories of employees. perquisites which are taxable only when the employee belongs to a specified group i.e. he is a specified employee. specified security or sweat equity shares allotted or transferred by the employer to the assessee. Tax treatment – salary income, allowances & perquisites. 1. chargeability — s. 15 and s. 17. salary is chargeable to tax on “due” or “receipt” basis whichever is earlier and includes wages, annuity or pension, gratuity, fees, commission, perquisites or profits in lieu of salary, advance salary, leave encashment, etc. 2. 2. taxation of perquisites. 2.1 perquisites taxable in the hands of the employee as a part of salary income broadly, in this system, the perquisites taxable in the hands of the employee as a part of salary income include: 1) value of rent free or concessional rent accommodation provided by the employer. 2) value of any benefit amenity granted.

Chapter 6 Income Taxation Accountancy Studocu Tax treatment – salary income, allowances & perquisites. 1. chargeability — s. 15 and s. 17. salary is chargeable to tax on “due” or “receipt” basis whichever is earlier and includes wages, annuity or pension, gratuity, fees, commission, perquisites or profits in lieu of salary, advance salary, leave encashment, etc. 2. 2. taxation of perquisites. 2.1 perquisites taxable in the hands of the employee as a part of salary income broadly, in this system, the perquisites taxable in the hands of the employee as a part of salary income include: 1) value of rent free or concessional rent accommodation provided by the employer. 2) value of any benefit amenity granted. Value of perquisites in relation to the employer's tax payment. computation of perquisite tax example. assume that a normal employee's salary reported under "salaries" is rs. 800000, inclusive of rs. 90000 in non cash benefits provided by the employer. the perquisite tax in india will be based on the income tax act and will be. Section 15. the following income shall be chargeable to income tax under the head "salaries"— (a) any salary due from an employer or a former employer to an assessee in the previous year, whether paid or not; (b) any salary paid or allowed to him in the previous year by or on behalf of an employer or a former employer though not due or before.

Difference Between Allowances And Perquisites With Comparison Chart Value of perquisites in relation to the employer's tax payment. computation of perquisite tax example. assume that a normal employee's salary reported under "salaries" is rs. 800000, inclusive of rs. 90000 in non cash benefits provided by the employer. the perquisite tax in india will be based on the income tax act and will be. Section 15. the following income shall be chargeable to income tax under the head "salaries"— (a) any salary due from an employer or a former employer to an assessee in the previous year, whether paid or not; (b) any salary paid or allowed to him in the previous year by or on behalf of an employer or a former employer though not due or before.

Comments are closed.