Tax Tables For Iowa 2024 Datha Cosetta

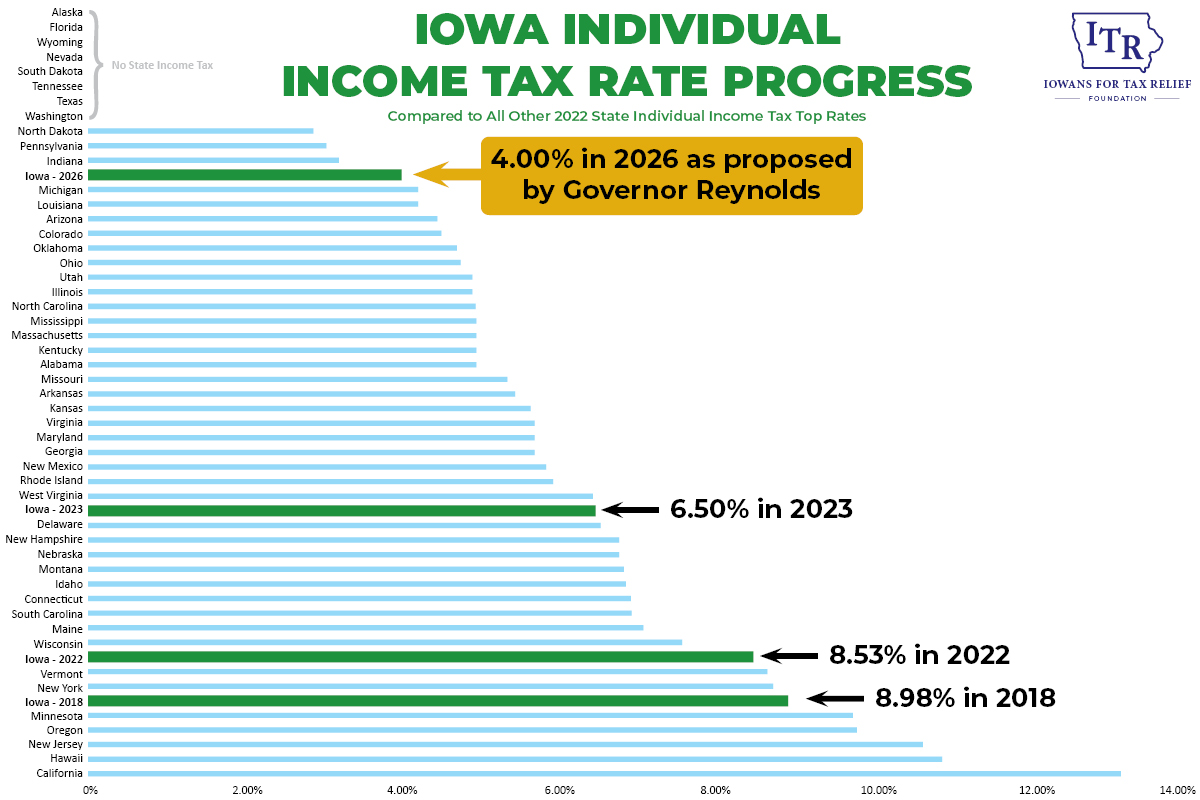

Iowa Tax Withholding Tables 2024 Lani Shanta Iowa code sections 422.4 and 422.5 define procedures for the calculation of inflation factors and the indexation of income tax brackets. indexation is meant to protect taxpayers from paying higher income taxes solely as a result of inflation. tax year 2024 iowa income tax brackets are shown in the tables below. The department updates withholding formulas and tables when necessary to account for inflation and for changes in individual income tax liability resulting from changes in iowa law. new for 2024. the iowa withholding formula and the ia w 4 have been revised to accommodate certain changes enacted by the iowa legislature in 2023 under senate file.

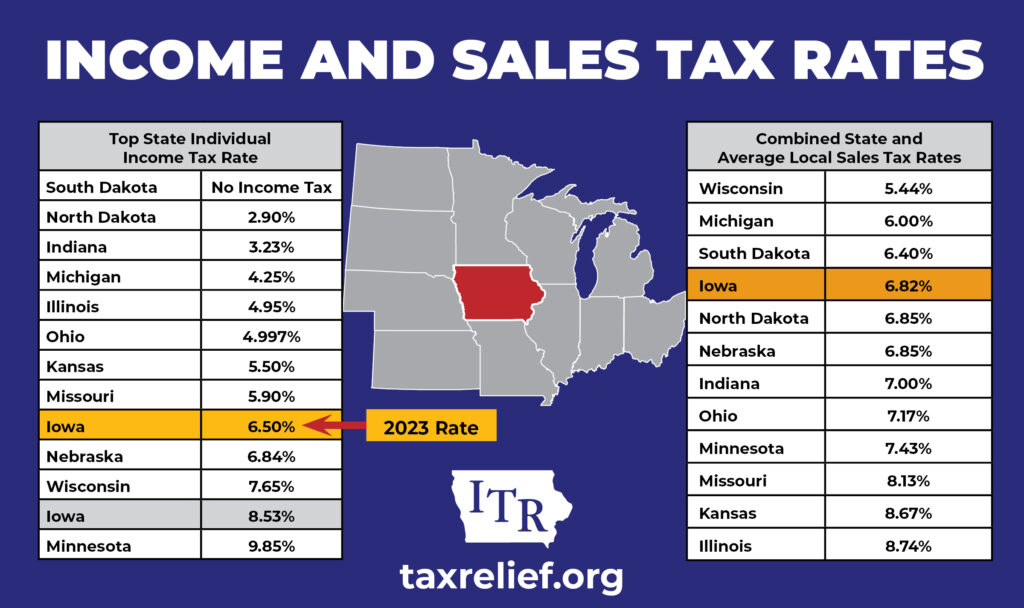

Tax Tables For Iowa 2024 Datha Cosetta Effective january 1, 2024 released december 2023 iowa withholding tables for wages paid beginning january 1, 2024 the iowa withholding tables are an alternative to the withholding formula to determine how much to withhold from your employees’ paychecks for wages paid beginning january 1, 2024. step 1. find the correct pay period table. there. The federal standard deduction for a married (joint) filer in 2024 is $ 29,200.00. the federal federal allowance for over 65 years of age married (joint) filer in 2024 is $ 1,550.00. iowa residents state income tax tables for married (joint) filers in 2024. personal income tax rates and thresholds (annual) tax rate. taxable income threshold. 10%. The taxes on your paycheck include. federal income tax (10% to 37%) state income tax (4.4% to 5.7%) local income tax. social security (6.2%) medicare (1.45% to 2.35%) the actual amount varies with your wages and other circumstances. in iowa, taxes typically take up 20% to 35% of your paycheck. updated on jul 06 2024. Georgia. on january 1, 2024, georgia transitions from a graduated individual income tax with a top rate of 5.75 percent to a flat tax with a rate of 5.49 percent. additionally, the state significantly increased its personal exemption (to $12,000 for single taxpayers and $18,500 for married couples filing a joint return).

Tax Tables For Iowa 2024 Datha Cosetta The taxes on your paycheck include. federal income tax (10% to 37%) state income tax (4.4% to 5.7%) local income tax. social security (6.2%) medicare (1.45% to 2.35%) the actual amount varies with your wages and other circumstances. in iowa, taxes typically take up 20% to 35% of your paycheck. updated on jul 06 2024. Georgia. on january 1, 2024, georgia transitions from a graduated individual income tax with a top rate of 5.75 percent to a flat tax with a rate of 5.49 percent. additionally, the state significantly increased its personal exemption (to $12,000 for single taxpayers and $18,500 for married couples filing a joint return). The department updates withholding formulas and tables when necessary to account for inflation and for changes in individual income tax liability resulting from changes in iowa law. new for 2024 the iowa withholding formula and the ia w 4 have been revised to accommodate certain changes enacted by the iowa legislature in 2023 under senate. Tax rates and tables. see the 2023 tax tables. find the 2024 tax rates. related. taxable income. how to file your taxes: step by step. irs provides tax inflation adjustments for tax year 2024. full 2023 tax tables. publication 17 (2023), your federal income tax.

Iowa Individual Income Tax Rates 2024 Nona Thalia The department updates withholding formulas and tables when necessary to account for inflation and for changes in individual income tax liability resulting from changes in iowa law. new for 2024 the iowa withholding formula and the ia w 4 have been revised to accommodate certain changes enacted by the iowa legislature in 2023 under senate. Tax rates and tables. see the 2023 tax tables. find the 2024 tax rates. related. taxable income. how to file your taxes: step by step. irs provides tax inflation adjustments for tax year 2024. full 2023 tax tables. publication 17 (2023), your federal income tax.

Iowa State Tax Table 2024 Agathe Ardelis

Comments are closed.