Tax Deductions For Real Estate Agents Atg Title

Tax Deductions For Real Estate Agents Atg Title For realtors, this equates to tax breaks on relevant business purchases. under this bill, you can benefit from immediate tax deductions for large purchases, up to the full amount of the purchase. for instance, if you purchased a $30,000 car, you could deduct up to $25,000 for the tax year in which it was purchased. (703) 934 2100 info@atgtitle tax deductions for real estate agents made easy (2019 & 2020 edition) how to save on your taxes as a real estate agent, investor, and landlord fill out the form below and we’ll email you your free copy! first name * last name * email address * phone (optional) website … tax deductions for real estate agents read more ».

Tax Deduction Cheat Sheet For Real Estate Agents Independence Title Such a cheat sheet is exactly what’s below, thanks to two folks: 1) fred podris of podris tax service who compiled the list, and realtor® brenda douglas who kindly posted it to facebook for all to benefit from. one problem, though. this cheat sheet, which was originally intended as a print out, isn’t legible in digital format (see below). Basically, if your real estate property or investment is a source of losses, you may be able to deduce those losses under certain circumstances. if your agi is $100,000 or less, you can claim up to $25,000 in property losses. if you make between $100,000 and $150,000, you may still be able to collect but deductions will be gradually reduced. The resulting amount is your taxable income, which is used to calculate your tax liability. . for example, if your gross income is $100,000 and you have $20,000 in eligible deductions, your taxable income would be $80,000. your tax liability is then calculated based on this $80,000, not the original $100,000. You can deduct the cost of gas and wear and tear on your car as a real estate agent. you claim the expense in miles traveled for work, and you can claim both local travel for showings and longer travel for business trips. the irs pays a standard mileage rate for business travel, which is 67 cents per mile for 2024 and $0.65 cents per mile in 2023.

Real Estate Tax Deduction Sheet The resulting amount is your taxable income, which is used to calculate your tax liability. . for example, if your gross income is $100,000 and you have $20,000 in eligible deductions, your taxable income would be $80,000. your tax liability is then calculated based on this $80,000, not the original $100,000. You can deduct the cost of gas and wear and tear on your car as a real estate agent. you claim the expense in miles traveled for work, and you can claim both local travel for showings and longer travel for business trips. the irs pays a standard mileage rate for business travel, which is 67 cents per mile for 2024 and $0.65 cents per mile in 2023. 3. marketing & advertising . this deduction includes all costs related to marketing and promoting a real estate business, like digital advertising, print ads, billboards, and promotional materials. these expenses are 100% tax deductible, so agents can deduct all costs of marketing their business. Tax deductions can reduce your income, saving thousands of dollars in yearly taxes. some common tax deductions for real estate agents include advertising costs, auto travel expenses, and professional services fees, such as those paid to an accountant or marketing firm. one significant real estate tax deduction is the business gifts deduction.

101 Real Estate Agent Tax Deductions Infographic Tax Deductions 3. marketing & advertising . this deduction includes all costs related to marketing and promoting a real estate business, like digital advertising, print ads, billboards, and promotional materials. these expenses are 100% tax deductible, so agents can deduct all costs of marketing their business. Tax deductions can reduce your income, saving thousands of dollars in yearly taxes. some common tax deductions for real estate agents include advertising costs, auto travel expenses, and professional services fees, such as those paid to an accountant or marketing firm. one significant real estate tax deduction is the business gifts deduction.

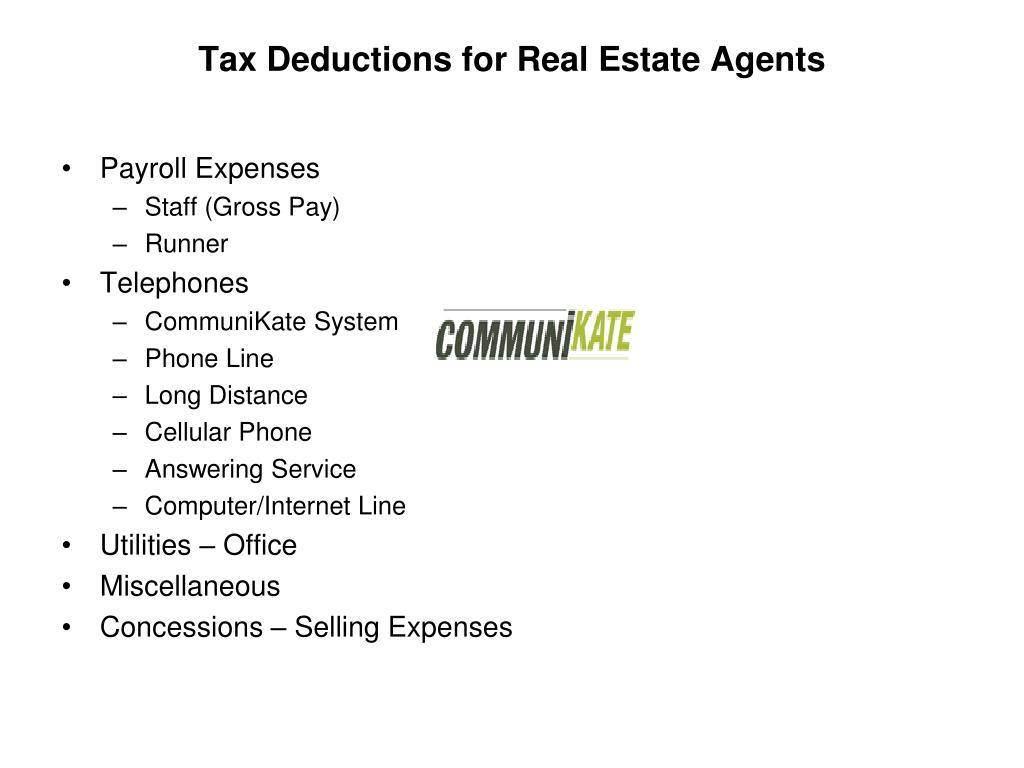

Ppt Tax Information For Real Estate Agents Powerpoint Presentation

Comments are closed.