Structured Finance Trade Finance Global

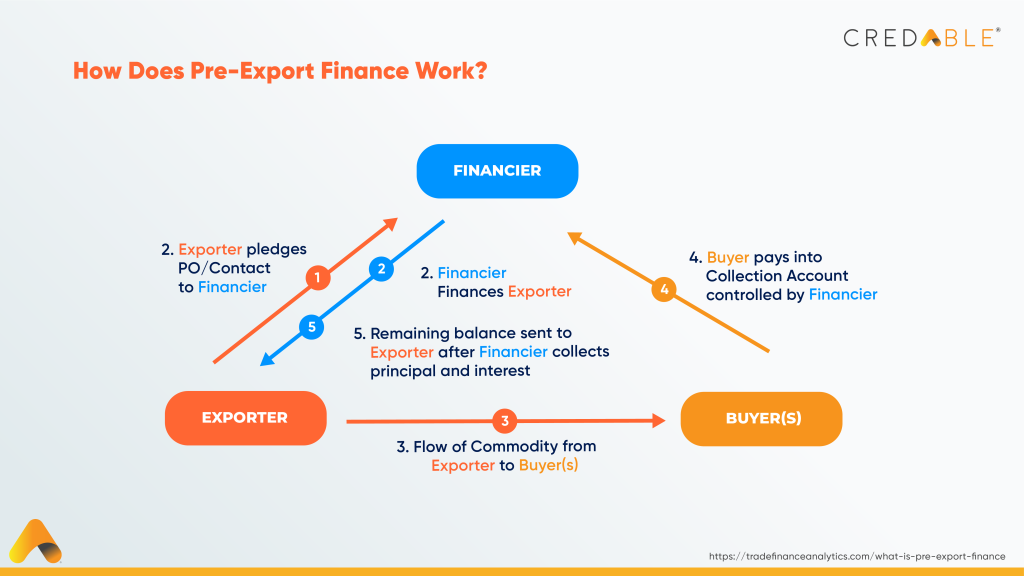

Structured Finance Trade Finance Global [updated 2024] structured finance is a complex form of financing, usually used on a scale too large for an ordinary loan or bond. collateralized debt obligations, syndicated loans and mortgage backed securities – the c4 behind the 2008 financial crisis are all examples of structured finance. Structured trade finance. structured trade finance is a specialized short–term or medium– long–term (up to 5 years) financing against commodity trade flows. it typically takes the form of pre–payment financing or pre–export financing, structured around the supply chain and commercial terms of customers, and may use export contracts.

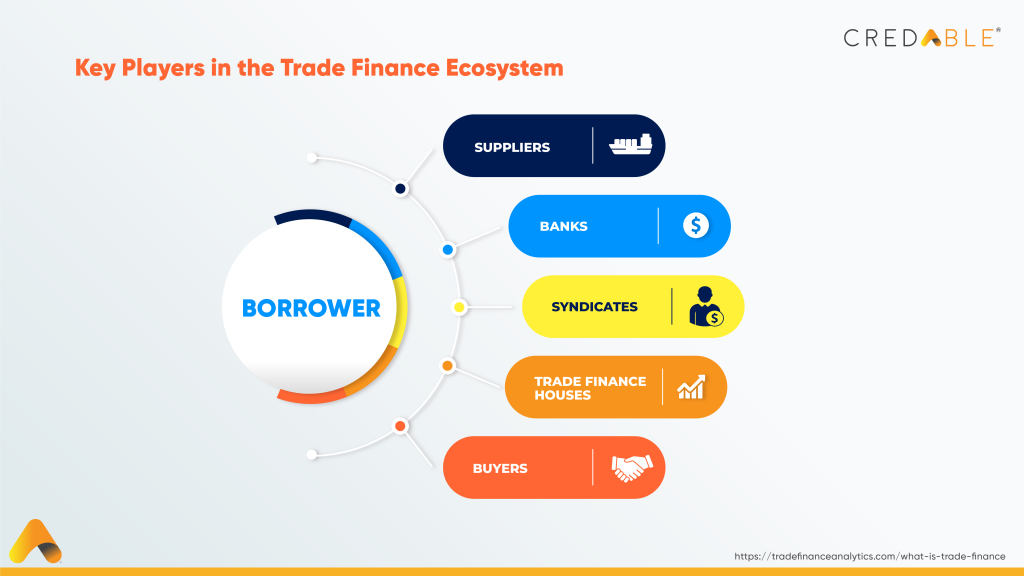

Structured Finance Trade Finance Global Our team works closely with clients to support the trade finance and export credit agency, as well as multilateral lending agencies. we provide financing solutions globally—across the americas, europe, middle east and africa, and asia. our trade solutions new york team works with our trade solutions teams located in hong kong, london. Structured trade finance offers numerous strategies and benefits for businesses involved in international trade. with its focus on providing working capital support, risk mitigation, and opportunities for global expansion, structured trade finance equips businesses to navigate the complexities of cross border transactions successfully. Structured trade finance (stf) is a crucial facet of international trade and commerce, designed to cater to the financing needs of companies that partake in global trade transactions. unlike traditional forms of finance, stf provides bespoke solutions built around the supply chain and the underlying trade flows of goods and commodities. The international trade and forfaiting association (itfa) is the worldwide trade association for companies, financial institutions and intermediaries engaged in trade and the origination, structuring, risk mitigation and distribution of trade debt. itfa also represents the wider trade finance syndication and secondary market for trade assets.

The Everything You Need To Know Guide On Structured Trade Finance Structured trade finance (stf) is a crucial facet of international trade and commerce, designed to cater to the financing needs of companies that partake in global trade transactions. unlike traditional forms of finance, stf provides bespoke solutions built around the supply chain and the underlying trade flows of goods and commodities. The international trade and forfaiting association (itfa) is the worldwide trade association for companies, financial institutions and intermediaries engaged in trade and the origination, structuring, risk mitigation and distribution of trade debt. itfa also represents the wider trade finance syndication and secondary market for trade assets. The ‘everything you need to know’ guide on structured trade finance. according to recent reports, the global trade finance market is estimated to reach us$ 68.62 bn by 2032. undoubtedly, trade is the backbone of economies worldwide and is an important driver for development. that said, in 2020, the global trade finance gap hit an all time. Structured commodity finance or scf is a type of lending used within the commodities world; where a simple and straight forward bilateral lend will not work. in order to make many commodities based transactions work; we need to look at the wider trading cycles, products, buyers, sellers, insurance and time periods of trades.

The Everything You Need To Know Guide On Structured Trade Finance The ‘everything you need to know’ guide on structured trade finance. according to recent reports, the global trade finance market is estimated to reach us$ 68.62 bn by 2032. undoubtedly, trade is the backbone of economies worldwide and is an important driver for development. that said, in 2020, the global trade finance gap hit an all time. Structured commodity finance or scf is a type of lending used within the commodities world; where a simple and straight forward bilateral lend will not work. in order to make many commodities based transactions work; we need to look at the wider trading cycles, products, buyers, sellers, insurance and time periods of trades.

The Everything You Need To Know Guide On Structured Trade Finance

Comments are closed.