Streamline Your Statement Reconciliation Ap Matching

Streamline Your Statement Reconciliation Ap Matching Accounts payable (ap) reconciliation makes this possible by ensuring that all transactions in your general ledger match supplier invoices and bank statements. effective ap reconciliation is a strategic tool that enhances cash flow management, prevents fraud, and catches costly mistakes early. you can streamline the processes and maintain robust. Allowing a greater strategic focus – relieved of mundane and repetitive tasks, your ap team is freed to concentrate on continual improvement to support ap statement matching process optimization as well as strategic initiatives that support the overarching goals of enterprise financial management. automated statement reconciliation with.

Streamline Your Statement Reconciliation Ap Matching Step 1: check the beginning balance. before you even think about reconciling your accounts payable, see if the beginning balance of the reports for the current period is the same as the ending balance for the previous period. if they don't match, go back to the last accounting period when they did. that's where you'll want to start your. The statement reconciliation process also works cross company if you have vendors that invoice multiple legal entities, but send you consolidated statements. matching also works cross vendor if you have multiple vendor accounts on your erp system for the same vendor. statement matching applies the reconciliation process rules automatically. How to improve buyer supplier relationships with statement matching. manual reconciliation poses several challenges to accounts payable departments. the process can be lengthy, exhausting precious hours, and isolates team members from other tasks, overburdening their colleagues, and causing a fall in productivity. Explanation of ap reconciliation. accounts payable (ap) reconciliation is the process of comparing and verifying the financial records of a company’s ap department with those of its suppliers to ensure accuracy and consistency. it involves matching invoices, purchase orders, and payment records to identify discrepancies or errors.

Streamline Your Statement Reconciliation Ap Matching How to improve buyer supplier relationships with statement matching. manual reconciliation poses several challenges to accounts payable departments. the process can be lengthy, exhausting precious hours, and isolates team members from other tasks, overburdening their colleagues, and causing a fall in productivity. Explanation of ap reconciliation. accounts payable (ap) reconciliation is the process of comparing and verifying the financial records of a company’s ap department with those of its suppliers to ensure accuracy and consistency. it involves matching invoices, purchase orders, and payment records to identify discrepancies or errors. Statement monitoring reconciliation module capture open credits and expand supplier coverage faster. flextrap enables your ap team to streamline and automate account reconciliation so that you can capture more open credits and unclaimed value, faster (and without the need for 3rd party auditors). Three way matching is an ap process used to verify a supplier invoice by checking it against its corresponding purchase order and order receipt. it reduces the chances of fraudulent invoices going undetected and, worse, being paid. companies can set thresholds to determine which invoices require three way matching.

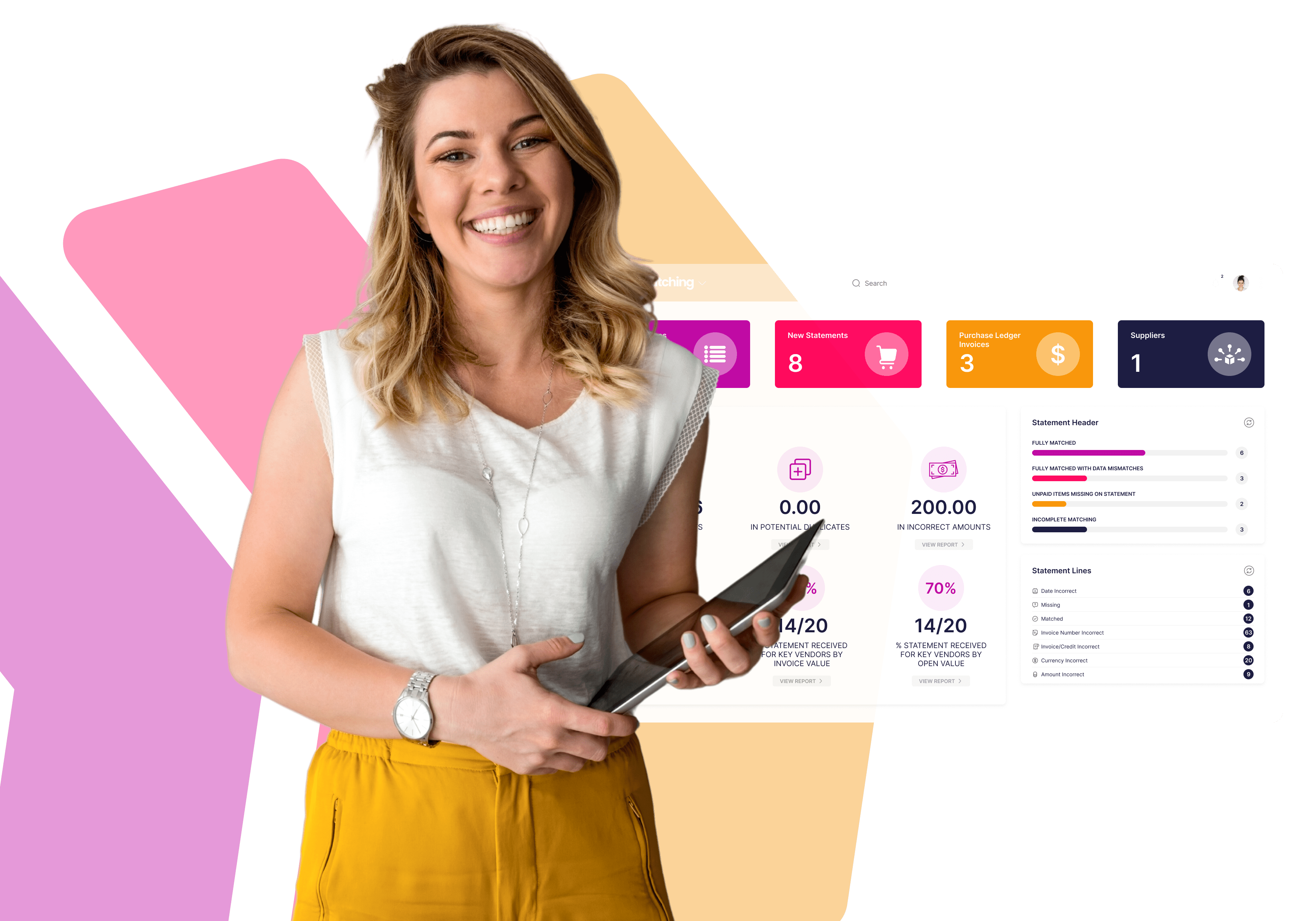

Automated Supplier Statement Reconciliation Ap Matching Statement monitoring reconciliation module capture open credits and expand supplier coverage faster. flextrap enables your ap team to streamline and automate account reconciliation so that you can capture more open credits and unclaimed value, faster (and without the need for 3rd party auditors). Three way matching is an ap process used to verify a supplier invoice by checking it against its corresponding purchase order and order receipt. it reduces the chances of fraudulent invoices going undetected and, worse, being paid. companies can set thresholds to determine which invoices require three way matching.

Comments are closed.