Stocks Vs Real Estate Returns Which Is Better Investment Financial

Stocks Vs Real Estate Which Is The Better Investment Pros Cons Returns. historically, stocks have offered better returns than real estate investments. "stocks have returned, on average, about 8% to 12% per year while real estate has generated returns of 2% to. Some years are up, some years are down, but over time, if you invested in an s&p 500 index fund, you'd average about 10% minus inflation. from 1972 to 2019, reits, on average, returned an 11.8%.

Stocks Vs Real Estate What Is The Better Investment Financial Investing in real estate or stocks is a personal choice that depends on your financial situation, risk tolerance, goals, and investment style. it's safe to assume that more people invest in the. Although real estate and stocks have historically performed well, stocks outpace real estate in returns. alternatively, stocks have had more peaks and valleys, making them a riskier investment. This often leads to better long term returns, as real estate usually appreciates over time. the stock market has psychological factors that can hurt investment strategies. investors may panic sell. 3) stocks have much lower transaction costs. online transaction costs are now free no matter how small the transaction. the real estate industry is still an oligopoly and still charges a 3.5% – 6% commission to sell. the cost to sell a home is egregious now that the internet has lowered costs for every industry.

Real Estate Vs Stocks Which One Is The Better Investme This often leads to better long term returns, as real estate usually appreciates over time. the stock market has psychological factors that can hurt investment strategies. investors may panic sell. 3) stocks have much lower transaction costs. online transaction costs are now free no matter how small the transaction. the real estate industry is still an oligopoly and still charges a 3.5% – 6% commission to sell. the cost to sell a home is egregious now that the internet has lowered costs for every industry. Real estate vs. stocks (what 145 years of returns tells us) looking for the best return on investment? here, we examine past performance to explain the benefits of real estate versus stocks. Real estate is illiquid; reits and real estate funds can be traded. stocks are very liquid and can be bought or sold daily when the markets are open. volatility. real estate is considered to be.

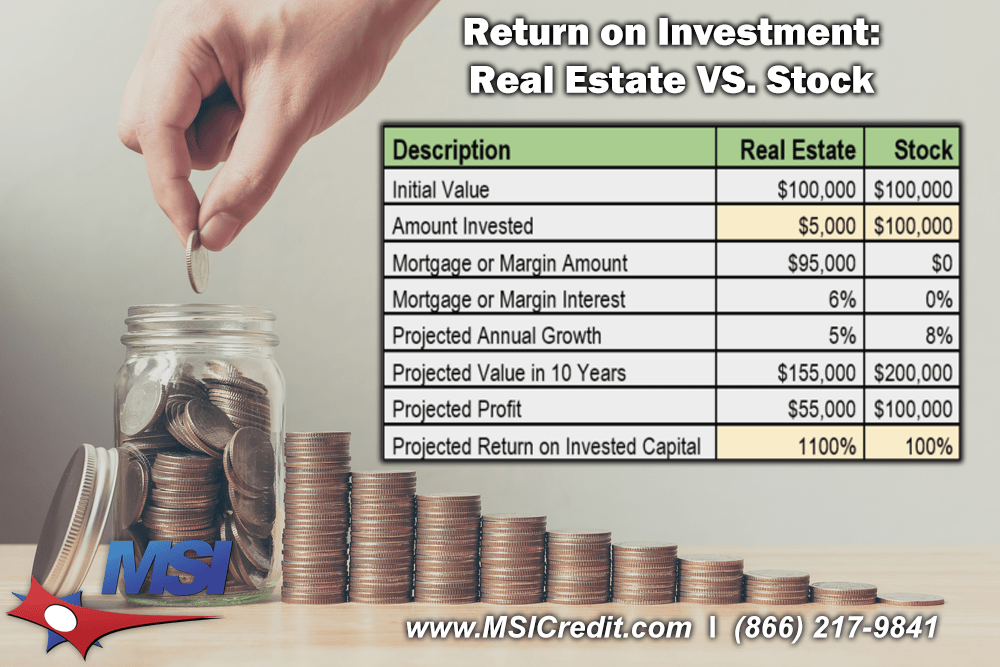

Roi Real Estate Vs Stock Msi Credit Solutions Real estate vs. stocks (what 145 years of returns tells us) looking for the best return on investment? here, we examine past performance to explain the benefits of real estate versus stocks. Real estate is illiquid; reits and real estate funds can be traded. stocks are very liquid and can be bought or sold daily when the markets are open. volatility. real estate is considered to be.

:max_bytes(150000):strip_icc()/real-estate-vs-stocks-which-is-the-better-investment-357992_final-68cce93ae0e8483395d1e7c47368e8b5.png)

Investing In Real Estate Vs Stocks What S The Difference

Comments are closed.