Steps To File Your Taxes In 2023

Everything You Need To Know About The 2023 Tax Season File your tax return by the deadline. for most filers, the deadline for 2023 tax returns is monday, april 15, 2024 (april 17, 2024, if you live in maine or massachusetts). find help if you need more time to file or pay. choose a way to file. e filing gives you your refund faster. see six reasons why you should file your taxes electronically. Steps to file. use these steps and resources to make filing your form 1040 easier. even if you don't have to file a tax return, you may want to file. you may get money back: if you qualify for a refundable tax credit . if your employer withheld more taxes than you owe. if you owe tax, it's important to file and pay on time to avoid penalties.

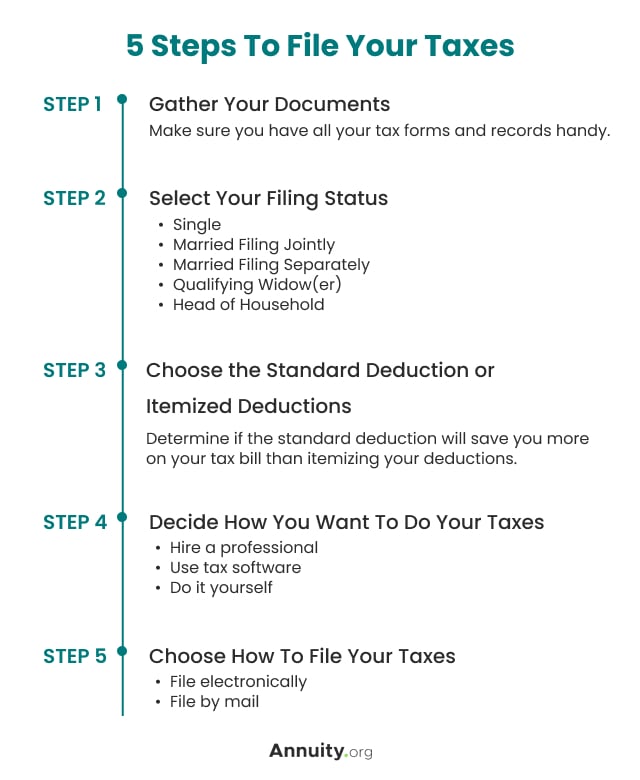

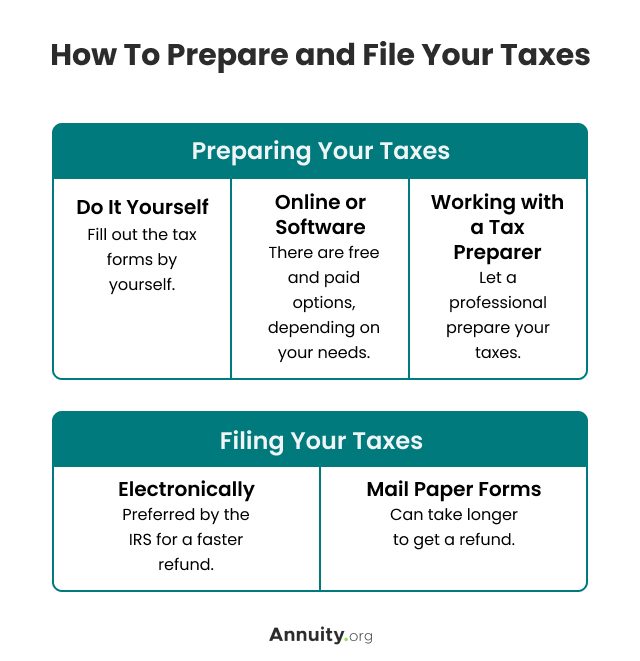

Steps To File Your Taxes In 2023 You might receive several different forms documenting the income you received in 2023 (for the return you file in 2024). some common ones include: w 2s from your employer (s) 1099 g forms for. Key takeaways. have the social security numbers and dates of birth for you, your spouse, and your dependents at hand before you start preparing your return. remember to report all income, including state and local income tax refunds, unemployment benefits, taxable alimony, and gambling winnings. have documentation for your deductions and. Try nerdwallet’s free tax calculator. 4. decide how to file your taxes. there are three main ways to file taxes: fill out irs form 1040 by hand and mail it (not recommended), file taxes online. The irs free file program, available only through irs.gov, offers eligible taxpayers brand name tax preparation software packages to use at no cost. some of the free file packages also offer free state tax return preparation. the software does all the work of finding deductions, credits and exemptions for you.

Sure Financials And Tax Services Llc Taxes 2023 Tax Return Filing Try nerdwallet’s free tax calculator. 4. decide how to file your taxes. there are three main ways to file taxes: fill out irs form 1040 by hand and mail it (not recommended), file taxes online. The irs free file program, available only through irs.gov, offers eligible taxpayers brand name tax preparation software packages to use at no cost. some of the free file packages also offer free state tax return preparation. the software does all the work of finding deductions, credits and exemptions for you. Start of tax filing season. mark your calendars! the tax filing season for individuals and businesses begins on january 23, 2023. this is the date the internal revenue service (irs) will begin accepting and processing tax returns for the 2022 tax year. remember, the sooner you file, the sooner you’ll receive your refund (if applicable) and. Irs free file: guided tax software. do your taxes online for free with an irs free file trusted partner. if your adjusted gross income (agi) was $79,000 or less, review each trusted partner’s offer to make sure you qualify. some offers include a free state tax return. use the find your trusted partner (s) to narrow your list of trusted.

Everything You Need To Know About The 2023 Tax Season Start of tax filing season. mark your calendars! the tax filing season for individuals and businesses begins on january 23, 2023. this is the date the internal revenue service (irs) will begin accepting and processing tax returns for the 2022 tax year. remember, the sooner you file, the sooner you’ll receive your refund (if applicable) and. Irs free file: guided tax software. do your taxes online for free with an irs free file trusted partner. if your adjusted gross income (agi) was $79,000 or less, review each trusted partner’s offer to make sure you qualify. some offers include a free state tax return. use the find your trusted partner (s) to narrow your list of trusted.

Comments are closed.