Step By Step 1031 Qi Requirements For The 1031 Exchange

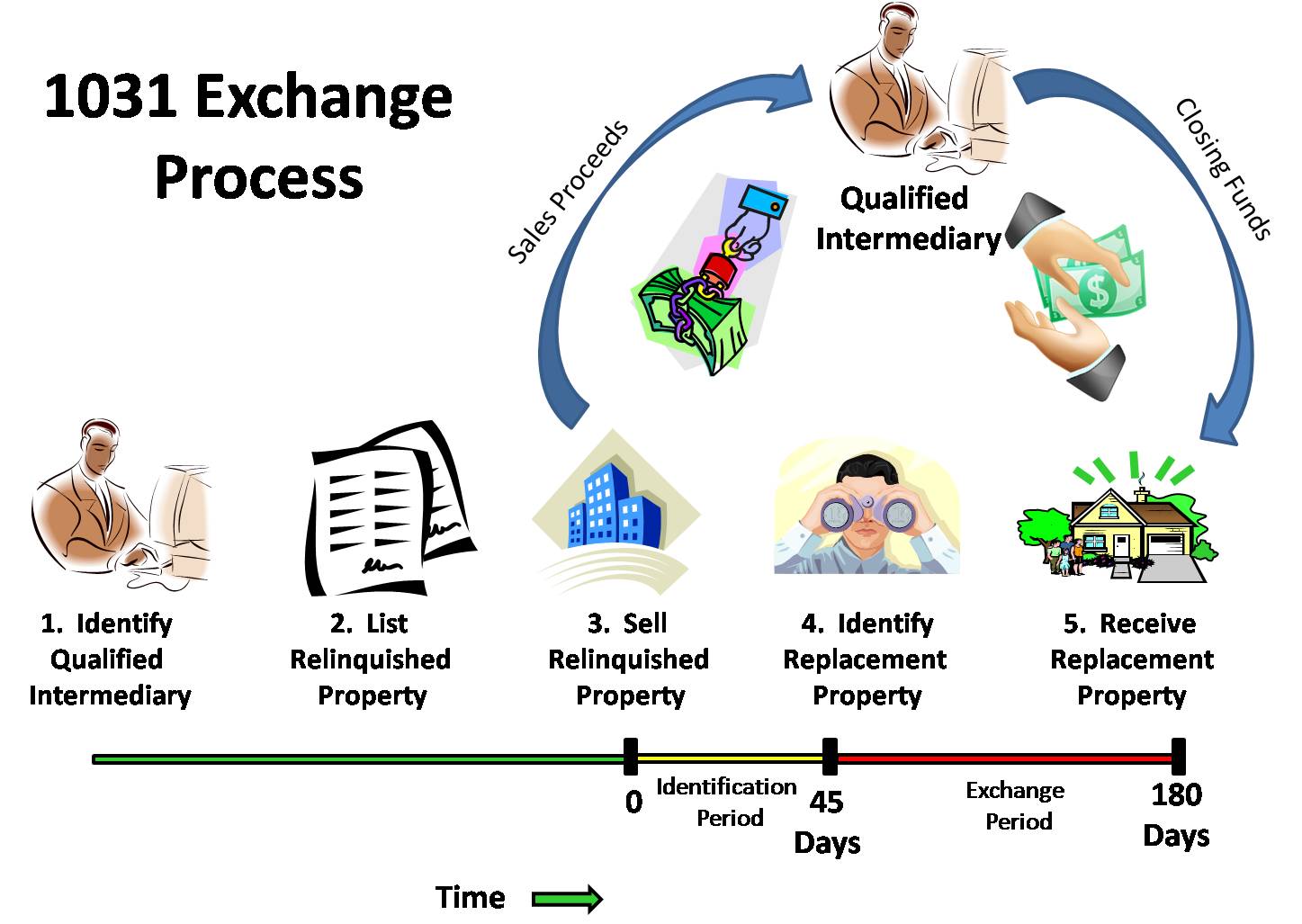

Step By Step 1031 Qi Requirements For The 1031 Exchange Hire a qualified intermediary first. before you consider a 1031 exchange, hire someone to act as your qualified intermediary. this professional or organization can guide you through the entire process. importantly, this person can also hold (or park) the proceeds of the sale of one property and release it when it’s time to purchase another. Step 2: engaging a qualified intermediary (qi) working with a qualified intermediary (qi) is an essential component of a successful 1031 exchange. a qi helps facilitate the exchange by preparing the necessary documentation, holding the funds, and ensuring compliance with irs regulations.

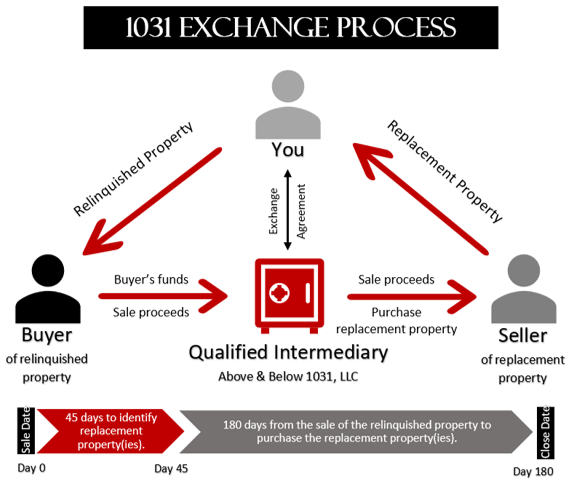

What Is A 1031 Exchange Mt Helix Lifestyles Real Estate Services A qualified intermediary cannot be the investor, their agent, their broker, their spouse, their family member, their investment banker, their employee, their business associate, or anyone who has had one of these roles in the past two years. the 10 step 1031 process. below is the step by step process to carry out a 1031 exchange. the following. Above & below 1031 opens the escrow account. after the exchange agreement is in place, a&b 1031 will open the escrow account for the benefit of the person (s) entity doing the 1031 exchange. it is segregated from other client accounts and a&b 1031 business accounts in an fdic insured bank that specializes in holding 1031 exchange funds. This type of exchange is more complex and requires the involvement of a qualified intermediary or an exchange accommodation titleholder. a reverse exchange allows investors to move swiftly in competitive real estate markets or take advantage of time sensitive investment opportunities. preparing for a 1031 exchange: essential steps to take. Step by step guide to execute the 1031 exchange process. a 1031 exchange presents a strategic opportunity for real estate investors to defer capital gains taxes while repositioning their investment assets. the below steps designed to simplify the 1031 exchange process with precision, offering you a structured pathway through its complexities: 1.

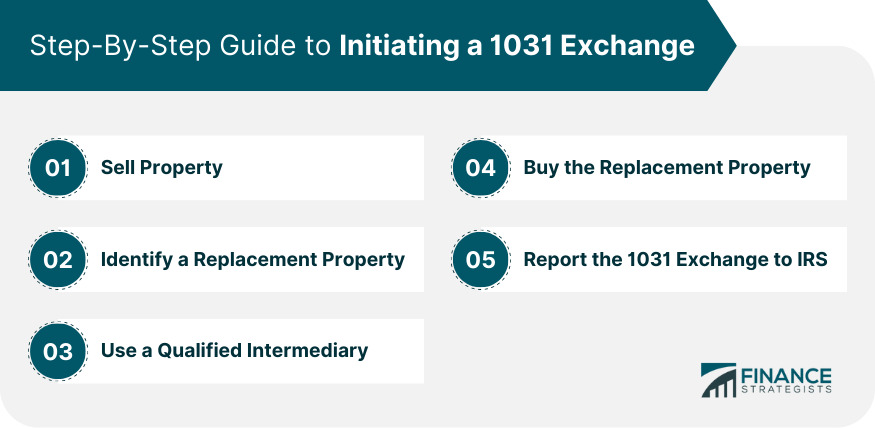

1031 Exchange Discover 1031 Investment Rules This type of exchange is more complex and requires the involvement of a qualified intermediary or an exchange accommodation titleholder. a reverse exchange allows investors to move swiftly in competitive real estate markets or take advantage of time sensitive investment opportunities. preparing for a 1031 exchange: essential steps to take. Step by step guide to execute the 1031 exchange process. a 1031 exchange presents a strategic opportunity for real estate investors to defer capital gains taxes while repositioning their investment assets. the below steps designed to simplify the 1031 exchange process with precision, offering you a structured pathway through its complexities: 1. A 1031 exchange, named after section 1031 of the u.s. internal revenue code, is a strategic tool for deferring tax on capital gains. you can leverage it to sell an investment property and reinvest. A 1031 exchange involves several key steps that must be followed in order to successfully defer capital gains taxes. these steps include signing a contract to sell the relinquished property, entering into an exchange agreement with a qualified intermediary (qi), identifying replacement properties within a specific timeframe, signing a contract.

1031 Exchange For Dummies Overview Requirements Steps A 1031 exchange, named after section 1031 of the u.s. internal revenue code, is a strategic tool for deferring tax on capital gains. you can leverage it to sell an investment property and reinvest. A 1031 exchange involves several key steps that must be followed in order to successfully defer capital gains taxes. these steps include signing a contract to sell the relinquished property, entering into an exchange agreement with a qualified intermediary (qi), identifying replacement properties within a specific timeframe, signing a contract.

1031 Exchange Locations

Comments are closed.