State Lawmakers Clash Over Proposed Flat Income Tax Youtube

State Lawmakers Clash Over Proposed Flat Income Tax Youtube On top of ohio speaker of the house jason stephens' list of priorities is house bill 1, legislation seeking to lower and flatten taxes.stay informed about co. Updated: feb 17, 2023 06:51 am est. columbus, ohio (wcmh) — on top of ohio speaker of the house jason stephens’ list of priorities is house bill 1, legislation seeking to lower and flatten.

What You Need To Know About Iowa S Proposed Flat Tax Amendment How a proposed flat rate income tax would impact oklahomans: david hamby, communications director at the oklahoma policy institute, said flattening the state income tax as proposed by the republican majority in hb 2950 would benefit the wealthy and hurt low and middle income earners. David hamby, communications director at the center left think tank oklahoma policy institute, said flattening the state income tax as proposed by the republican majority in hb 2950 would benefit the wealthy and hurt low and middle income earners. today, oklahomans filing single and making more than $13,550, or filing married and making double. Mississippi’s flat tax, which took effect in 2023, was initially set at a rate of 5 percent, but that rate was reduced to 4.7 percent in 2024 and is scheduled to decrease to 4.4 percent in 2025 and 4.0 percent in 2026. georgia ’s flat tax legislation, which was also adopted in 2022, was the most recent to take effect, with the transition to. Lawmakers used a portion of the state’s $600 million surplus to accelerate state income tax cuts. the state’s personal income tax rate was set to decrease from 6.4 to 6.3 percent for 2024 per previous legislation but will now drop to 6.2 percent. the acceleration will cost the state an additional $100 million a year.

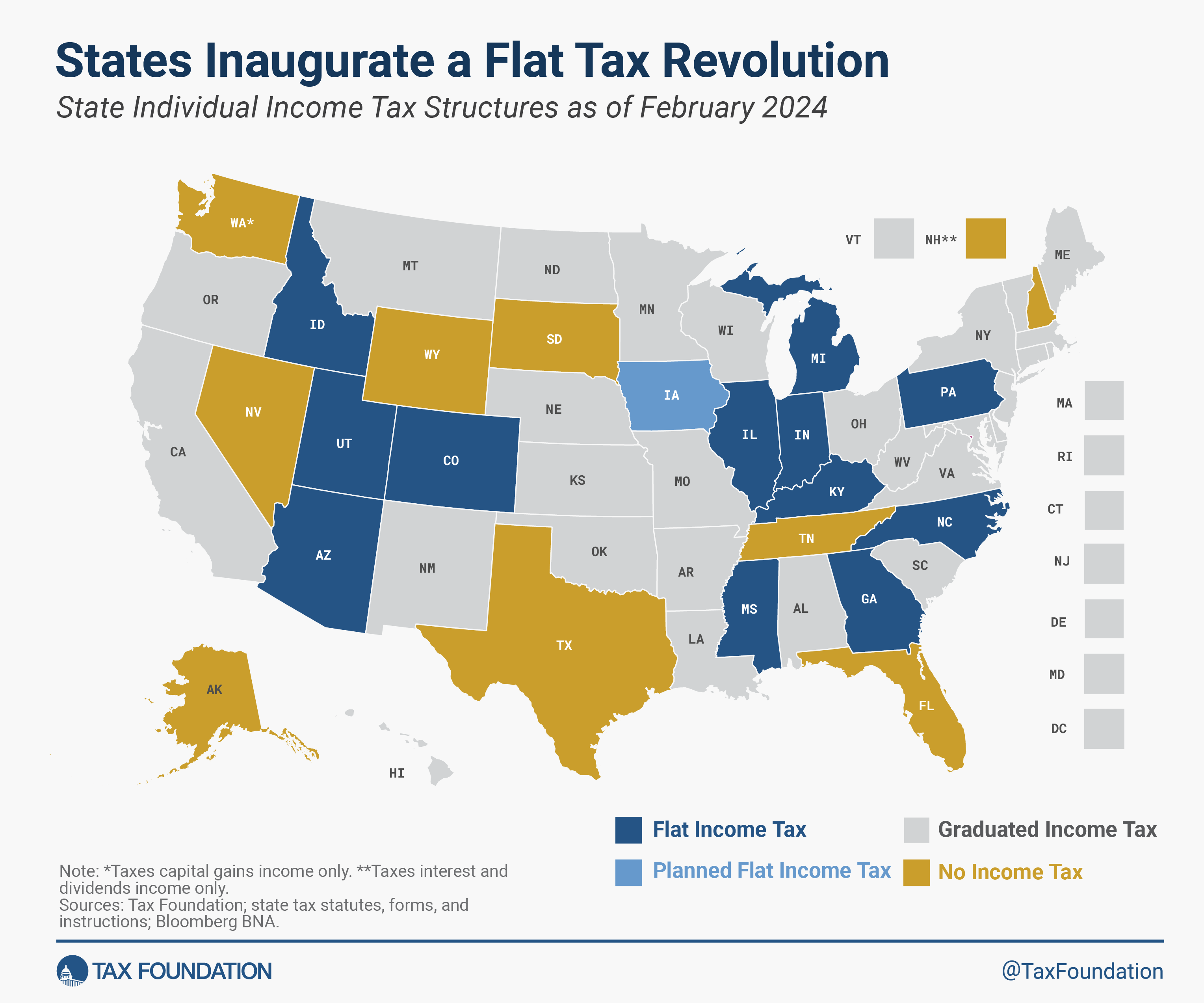

The State Flat Tax Revolution Where Things Stand Today Taxes Alert Mississippi’s flat tax, which took effect in 2023, was initially set at a rate of 5 percent, but that rate was reduced to 4.7 percent in 2024 and is scheduled to decrease to 4.4 percent in 2025 and 4.0 percent in 2026. georgia ’s flat tax legislation, which was also adopted in 2022, was the most recent to take effect, with the transition to. Lawmakers used a portion of the state’s $600 million surplus to accelerate state income tax cuts. the state’s personal income tax rate was set to decrease from 6.4 to 6.3 percent for 2024 per previous legislation but will now drop to 6.2 percent. the acceleration will cost the state an additional $100 million a year. Stitt's latest proposal involves eliminating the income tax bracket and implementing a single, flat rate of 4.75% for the majority of oklahomans. stitt estimated this would cost upwards of $300 million, but treat insists that the governor needs to identify cuts elsewhere to fund it. Itep’s most recent comprehensive study of state and local tax codes found that the middle 20 percent of individuals and families in states with flat rate taxes paid on average 2.9 percent of what they earn in income taxes. in states with graduated rate taxes, by contrast, that figure is just 2.3 percent. [8].

Gop Lawmakers Approve A Flat Income Tax Governor S Veto Looms The Stitt's latest proposal involves eliminating the income tax bracket and implementing a single, flat rate of 4.75% for the majority of oklahomans. stitt estimated this would cost upwards of $300 million, but treat insists that the governor needs to identify cuts elsewhere to fund it. Itep’s most recent comprehensive study of state and local tax codes found that the middle 20 percent of individuals and families in states with flat rate taxes paid on average 2.9 percent of what they earn in income taxes. in states with graduated rate taxes, by contrast, that figure is just 2.3 percent. [8].

Iowa Switching To Flat Income Tax System Joining Three Other States In

Comments are closed.