Spy Vs Spx Differences

Spx Vs Spy Key Differences Explained Bottom line on spy vs. spx spx is a symbol referring to the s&p 500 index, which consists of the largest 500 publicly traded companies, as measured by market capitalization. This doesn’t mean that one share of spx costs $4,200. you cannot buy shares of spx. it’s not an asset that can be owned in a portfolio. spx is used as a pure investment play against the current health of the stock market. the most common ways to trade spy vs spx are futures and options. spy tipranks report 10 24.

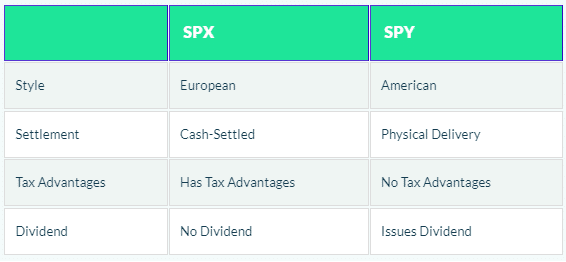

Spx Vs Spy 2023 Key Differences Explained Spx vs. spy: key differences in trading s&p 500 options index options vs equity options. index options are tied to a physical index, such as the s&p 500 (spx), and do not have any underlying stock or equity component that a trader could buy or sell. Spx refers to the s&p 500 stock market index, whereas spy is an etf designed to mirror the performance of the s&p 500 and can be bought and sold as a regular stock. for investors aiming to make informed decisions in using these instruments, grasping this difference between the etf and the index itself is essential. Final word: spy vs spx . when comparing the difference between spx and spy, remember spx is the literal s&p 500 index, but the spy is the popular spdr s&p 500 etf trust. if you’re still having trouble remembering spy vs. spx, here’s one final tip: just as “y” comes after “x” in the alphabet, the spy came after spx. ok, that was. Spx options hold a higher value than spy options because of the difference in share prices. a trader needs 10 spy options to have the same value as one spx option. while spx options hold more.

Spx Vs Spy Options 5 Major Differences Projectfinance Final word: spy vs spx . when comparing the difference between spx and spy, remember spx is the literal s&p 500 index, but the spy is the popular spdr s&p 500 etf trust. if you’re still having trouble remembering spy vs. spx, here’s one final tip: just as “y” comes after “x” in the alphabet, the spy came after spx. ok, that was. Spx options hold a higher value than spy options because of the difference in share prices. a trader needs 10 spy options to have the same value as one spx option. while spx options hold more. Spy is the most liquid equity based trading product in the world. this means options volume is high and the bid ask spread is tight. stock on spy trades over 80 million shares per day. so far today, at midday, the volume of options trading on spy is about 600k million contracts. In contrast, spy is an etf designed to track the performance of the s&p 500 index. while spx serves as a benchmark, spy is a tradable asset that aims to track the index’s movements closely. another key difference is how dividends are handled. while spx, as an index, does not distribute dividends (and it is a price index), spy, being an etf.

Spx Vs Spy Options 5 Major Differences Projectfinance Spy is the most liquid equity based trading product in the world. this means options volume is high and the bid ask spread is tight. stock on spy trades over 80 million shares per day. so far today, at midday, the volume of options trading on spy is about 600k million contracts. In contrast, spy is an etf designed to track the performance of the s&p 500 index. while spx serves as a benchmark, spy is a tradable asset that aims to track the index’s movements closely. another key difference is how dividends are handled. while spx, as an index, does not distribute dividends (and it is a price index), spy, being an etf.

Spx Vs Spy Key Differences Explained

Comments are closed.