Sp 500 Vs World Etf Which Strategy Is Better

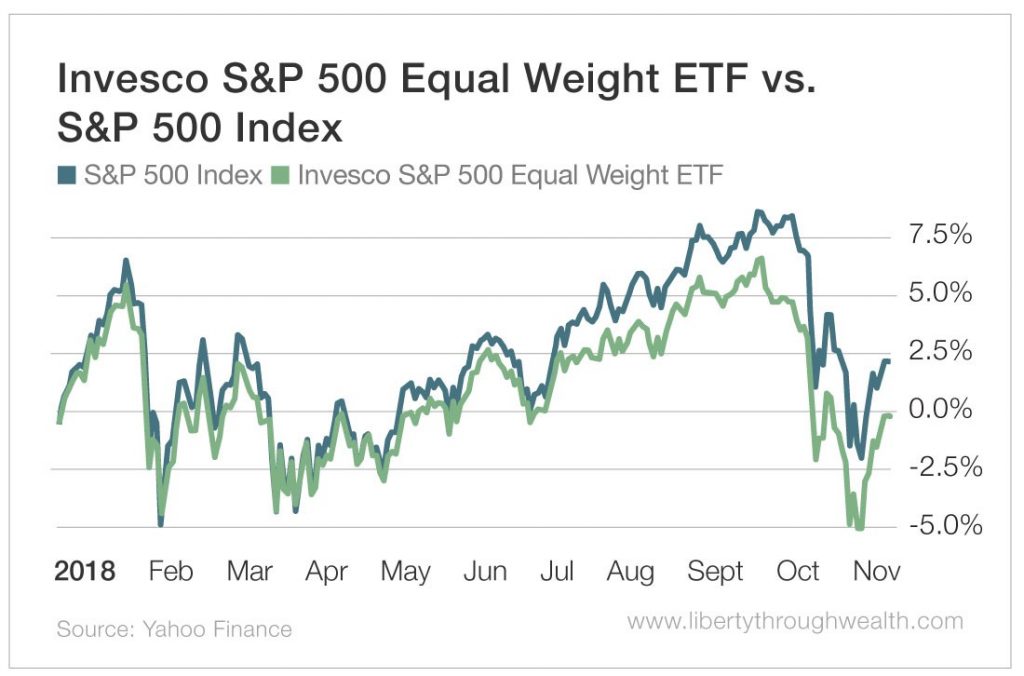

Invesco Sp 500 Equal Weight Etf Vs Sp 500 Index Jpg Liberty Through The spdr s&p 500 etf trust (spy) is the most popular etf in the world. if you're like most investors, you likely own it. even warren buffett owns spy in his berkshire hathaway (brkb) portfolio. on. The main difference is that the s&p 500 only includes us based companies, whereas the msci world index includes companies from 23 developed countries. from the global financial crisis of 2007 09, the s&p 500 has outperformed the msci world index. still, there have been periods where it was the other way around.

Which Is The Best S P 500 Etf The s&p 500 is specific to the u.s. stock market, while the msci world covers developed markets. you can invest in these indexes through a mutual fund or exchange traded fund (etf) that copies and owns the underlying stocks. european investors seem to prefer world indexes, while americans prefer their own market. 2. Voo earns a top rating of gold, while spy earns the next best rating of silver. almahasneh says the reason is fees and inefficiencies of the unit investment trust structure. the differences may be. Vanguard s&p offers a lower expense ratio (0.035%) than spy (0.095%), which means lower costs for investors and potentially higher net returns over the long term. voo might be the more economical. With 1,539 constituents, the index covers approximately 85% of the free float adjusted market capitalization in each country. while spy (spdr s&p 500 etf trust) contains the top 500 large cap companies from the usa. as such, the msci world index provides a greater diversification. this is a comparison of mcsi world index or spy.

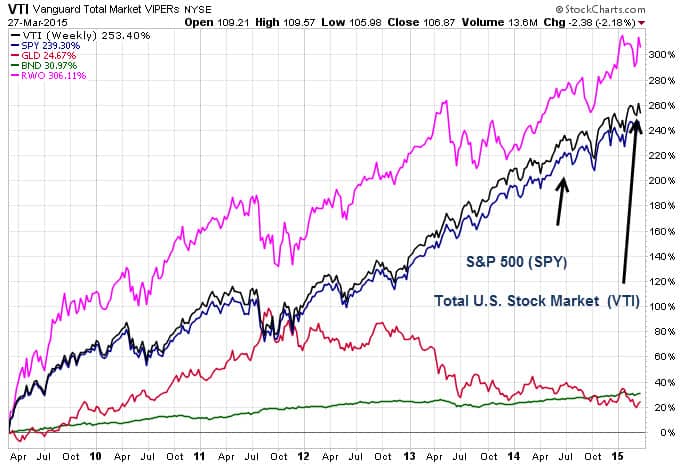

Here S Why A Total Market Approach Is Better Vs The S P 500 Etfguide Vanguard s&p offers a lower expense ratio (0.035%) than spy (0.095%), which means lower costs for investors and potentially higher net returns over the long term. voo might be the more economical. With 1,539 constituents, the index covers approximately 85% of the free float adjusted market capitalization in each country. while spy (spdr s&p 500 etf trust) contains the top 500 large cap companies from the usa. as such, the msci world index provides a greater diversification. this is a comparison of mcsi world index or spy. Sector allocation (as of latest available data) s&p 500: technology: largest sector, often around 25 30% of the index. healthcare: significant allocation, around 13 15%. financials: around 10 15%. msci world: technology: large allocation, though slightly less than the s&p 500. financials: more balanced representation. Spy has an expense ratio of 0.09%, which, while low, is still higher than that of voo,’s 0.03%, one of the lowest expense ratios for s&p 500 etfs. this makes voo more cost effective for long.

Smart Beta Etfs And Sector Investing Sector allocation (as of latest available data) s&p 500: technology: largest sector, often around 25 30% of the index. healthcare: significant allocation, around 13 15%. financials: around 10 15%. msci world: technology: large allocation, though slightly less than the s&p 500. financials: more balanced representation. Spy has an expense ratio of 0.09%, which, while low, is still higher than that of voo,’s 0.03%, one of the lowest expense ratios for s&p 500 etfs. this makes voo more cost effective for long.

Comments are closed.