Solo 401k Contribution Calculator Walk Thru Solo 401k

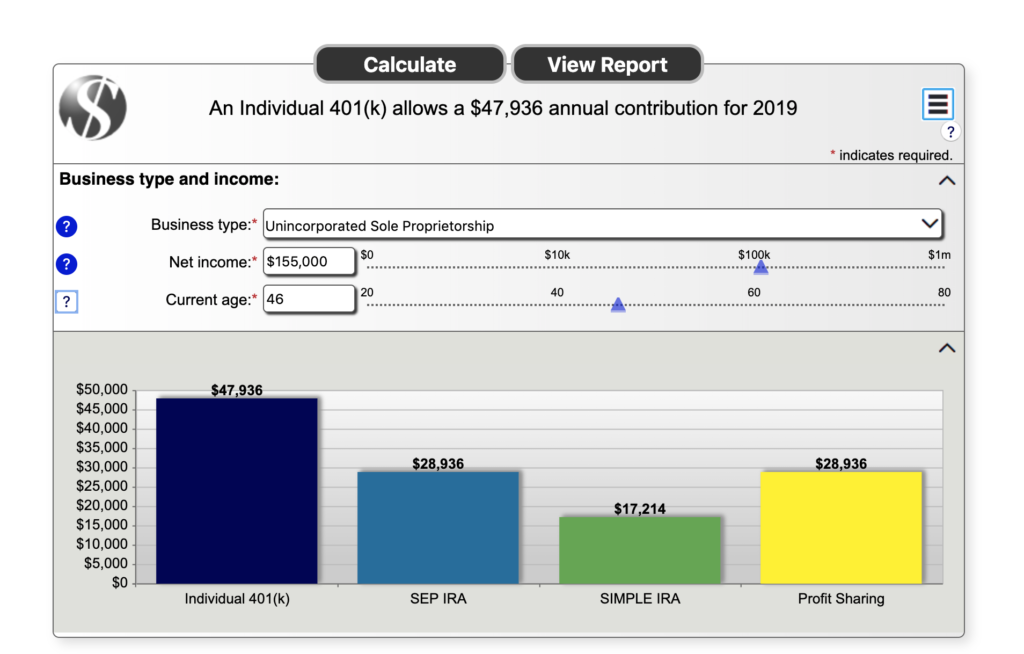

Solo 401k Contribution Calculator Walk Thru Solo 401k You can contribute up to $28,936 with a profit sharing plan. with the solo 401k, you can contribute $47,936. here’s how that solo 401k contribution calculator walk thru breaks down: $19,000 – employee salary deferral contribution $28,936 – employer profit sharing contribution = $47,936 total contribution. remember, your solo 401k. Solo 401k. $29. mo. $499 one time setup. find out how much you can contribute to your solo 401k with our free contribution calculator. save on taxes and build for a bigger retirment!.

Solo 401k Contribution Calculator Walk Thru Solo 401k Find out how much you can contribute to your solo 401k with our free contribution calculator. save on taxes and build for a bigger retirment!. Use the individual 401 (k) contribution comparison to estimate the potential contribution that can be made to an individual 401 (k) compared to profit sharing, simple, or sep plan. change the information currently provided in the calculator to match your personal information and view your results. * indicates required information. reset calculator. Solo 401k calculator. name. age. income. business entity. plan year. calculate. phone: 800 489 7571 fax: 925 262 2070 email: info@mysolo401k . my solo 401k financial offers self directed solo 401k, ira llc & robs 401k retirement plans. A solo 401 (k) is a retirement account for anyone who is self employed or owns a business or partnership with no employees apart from a spouse. in 2024, the maximum you can contribute is $23,000 as the employee plus an additional 25% of compensation as the employer. in 2025, the maximum you can contribute is $23,500 as the employee plus an.

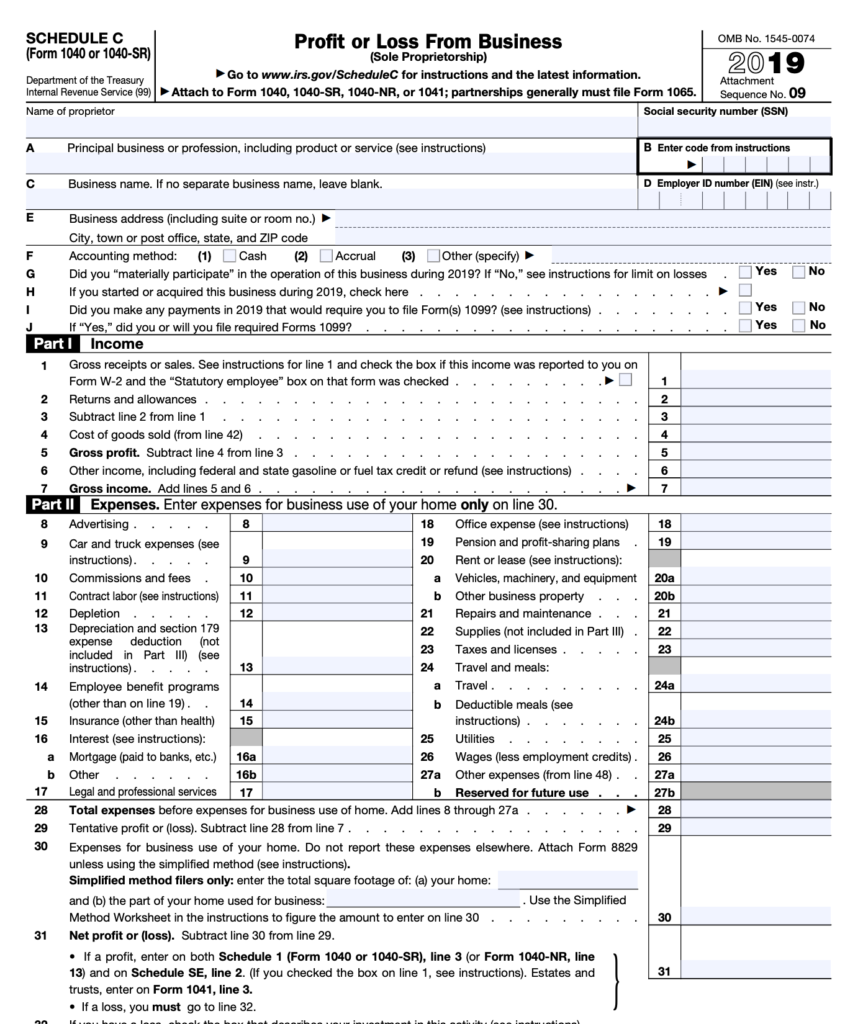

Solo 401k Contribution Calculator Walk Thru Solo 401k Solo 401k calculator. name. age. income. business entity. plan year. calculate. phone: 800 489 7571 fax: 925 262 2070 email: info@mysolo401k . my solo 401k financial offers self directed solo 401k, ira llc & robs 401k retirement plans. A solo 401 (k) is a retirement account for anyone who is self employed or owns a business or partnership with no employees apart from a spouse. in 2024, the maximum you can contribute is $23,000 as the employee plus an additional 25% of compensation as the employer. in 2025, the maximum you can contribute is $23,500 as the employee plus an. Solo 401k calculator. name. age. income. business entity. plan year. calculate. join the self directed retirement nation. subscribe to stay updated on everything self directed retirement, and learn how your investments are affected by current events and changes in the law. How to use the solo 401k contribution calculator. step 1: date of birth. this step is used to determine whether you’re eligible for catch up contributions. for a solo 401k, you can contribute up to $7,500 more for 2023 if you’ll be at least 50 years of age by december 31, 2023. step 2: business structure. select whether your business.

Solo Roth 401k Contribution Calculation For Small Business Owner Step Solo 401k calculator. name. age. income. business entity. plan year. calculate. join the self directed retirement nation. subscribe to stay updated on everything self directed retirement, and learn how your investments are affected by current events and changes in the law. How to use the solo 401k contribution calculator. step 1: date of birth. this step is used to determine whether you’re eligible for catch up contributions. for a solo 401k, you can contribute up to $7,500 more for 2023 if you’ll be at least 50 years of age by december 31, 2023. step 2: business structure. select whether your business.

Comments are closed.