Short Interest Hits Two Decade Low Amid Hedge Fund Underperformance

Short Interest Hits Two Decade Low Amid Hedge Fund Underperformance Cnbc's leslie picker reports on waning short interest, which hit a near two decade low. picker explains what diminished short interest could mean for the mar. According to goldman sachs, the median short interest in the s&p 500 has dropped to 1.7% in 2024, its lowest in almost twenty years. investments in short biased funds have decreased from $7.8b in 2008 to $4.6b today — with the number of constituents in the short bias hedge fund index from hedge fund research reducing by 74% during that period.

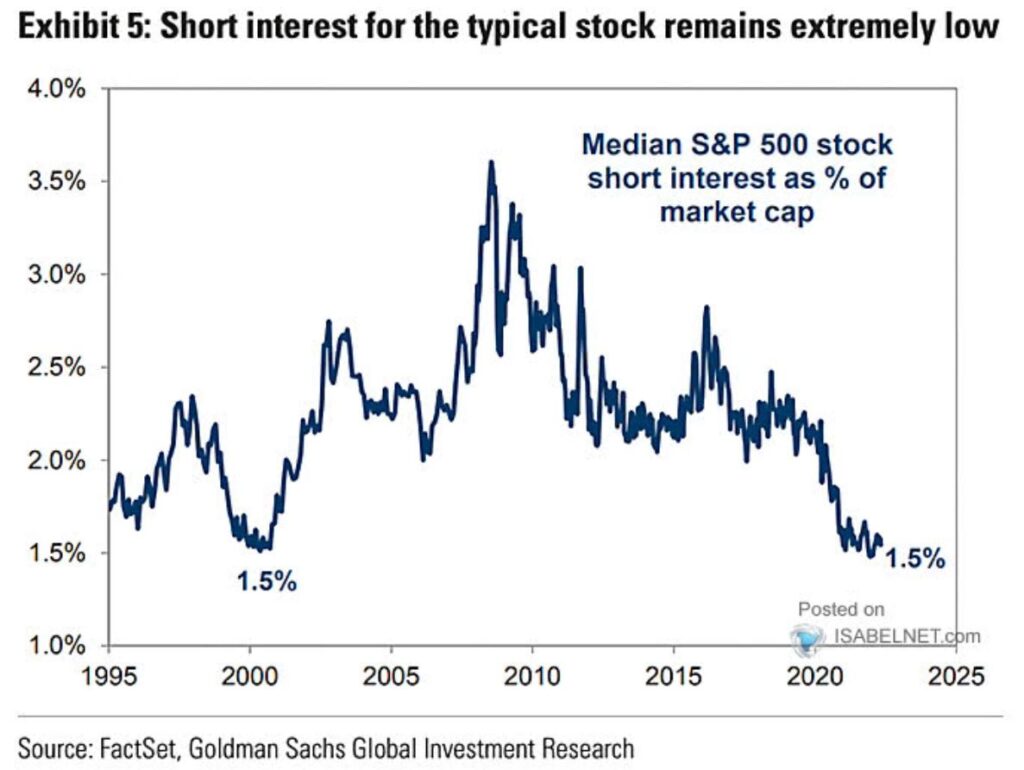

Assessing Short Interest Impact On Trading And Its Utility Another trend is that long short doesn’t seem to involve much short. “the median s&p 500 stock carries short interest equal to 1.7 per cent of market cap, well below the average of 2.2 per. Hedge funds taking long and short bets based on fundamental factors were down 0.3% on wednesday but up 7% for the year so far. gamestop and amc fell for a second straight session on thursday, as. The median s&p 500 stock carries short interest equal to 1.7% of market cap, only modestly above the record low of 1.5% reached last year and in 2000. rising etf short interest and large hedge fund short positions in equity futures indicate that funds have increasingly relied on 'macro' products as hedges in lieu of individual stock shorts. Hedge funds have also found it difficult to make money as some bets have been disrupted by often hostile retail investors. inflows into hedge funds have, in turn, proved meagre with performance.

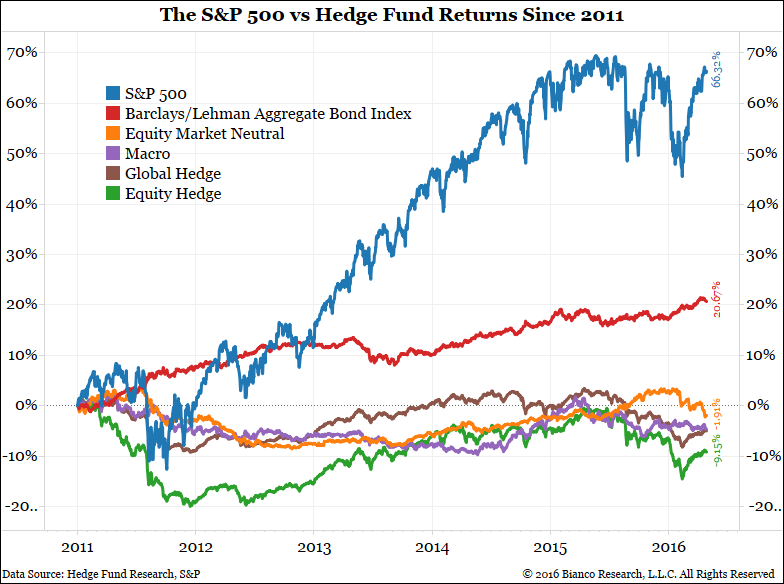

Short Interest Too Low The Sounding Line The median s&p 500 stock carries short interest equal to 1.7% of market cap, only modestly above the record low of 1.5% reached last year and in 2000. rising etf short interest and large hedge fund short positions in equity futures indicate that funds have increasingly relied on 'macro' products as hedges in lieu of individual stock shorts. Hedge funds have also found it difficult to make money as some bets have been disrupted by often hostile retail investors. inflows into hedge funds have, in turn, proved meagre with performance. Best and worst performing hedge fund strategies. fixed income arbitrage and global macro funds led the may returns with weighted average returns of 2.7% and 2.6%, respectively. both strategies. Equity long short hedge funds have had a miserable decade both in terms of performance and flows. mainft last week published a very good piece on the theme but in one small but important respect.

Sober Look Is Bad Timing The Reason For Hedge Funds Underperformance Best and worst performing hedge fund strategies. fixed income arbitrage and global macro funds led the may returns with weighted average returns of 2.7% and 2.6%, respectively. both strategies. Equity long short hedge funds have had a miserable decade both in terms of performance and flows. mainft last week published a very good piece on the theme but in one small but important respect.

Hedge Funds Exceptional Complexity Exceptional Underperformance

Hedge Funds Coping With Low Interest Rates Features Ipe

Comments are closed.