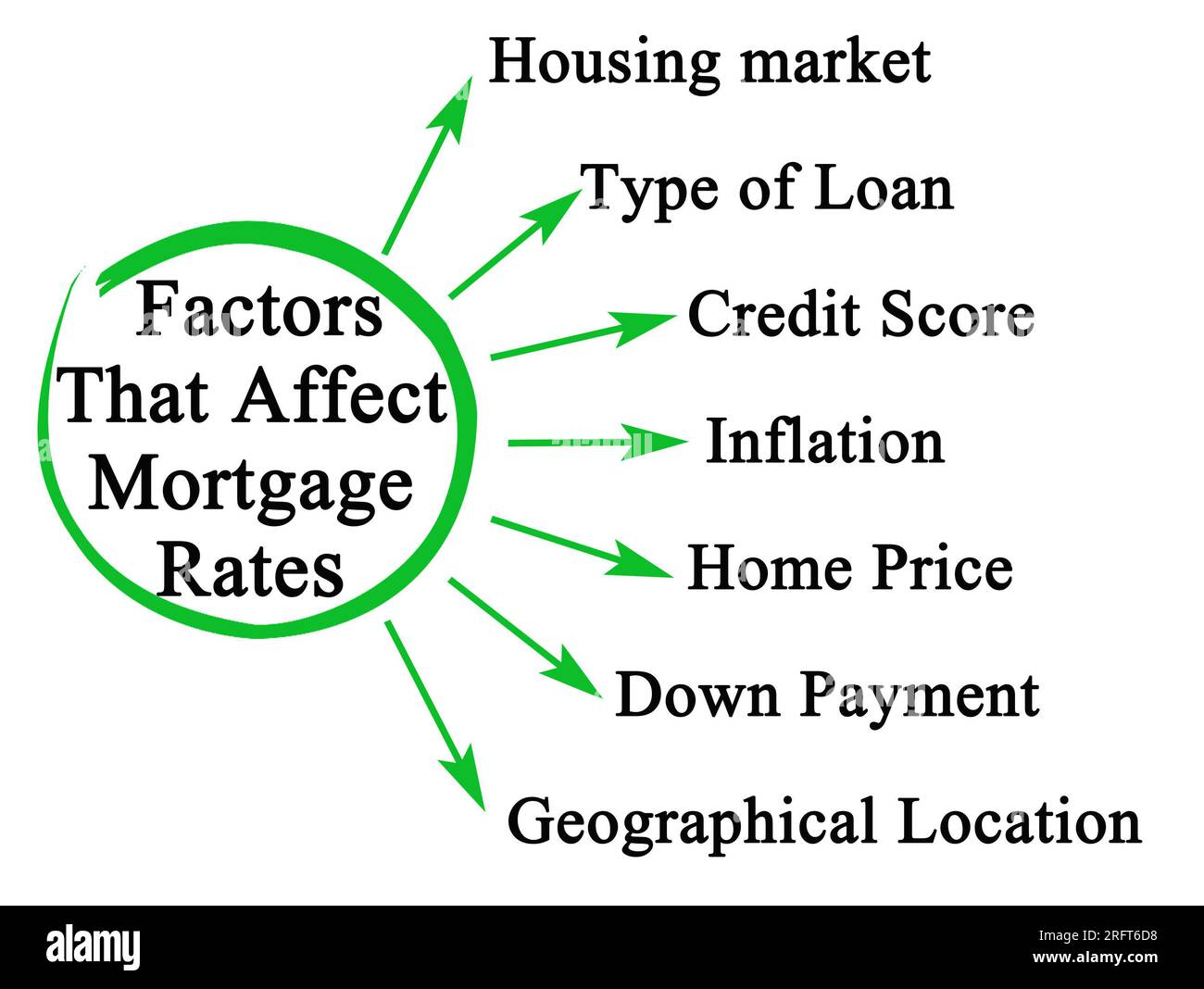

Seven Factors Affecting Mortgage Rates Stock Photo Alamy

Seven Factors Affecting Mortgage Rates Stock Photo Alamy Download this stock image: seven factors affecting mortgage rates 2rft6d8 from alamy's library of millions of high resolution stock photos, illustrations and vectors. Download this stock image: factors affecting mortgage insurance rates 2rcpr26 from alamy's library of millions of high resolution stock photos, illustrations and vectors.

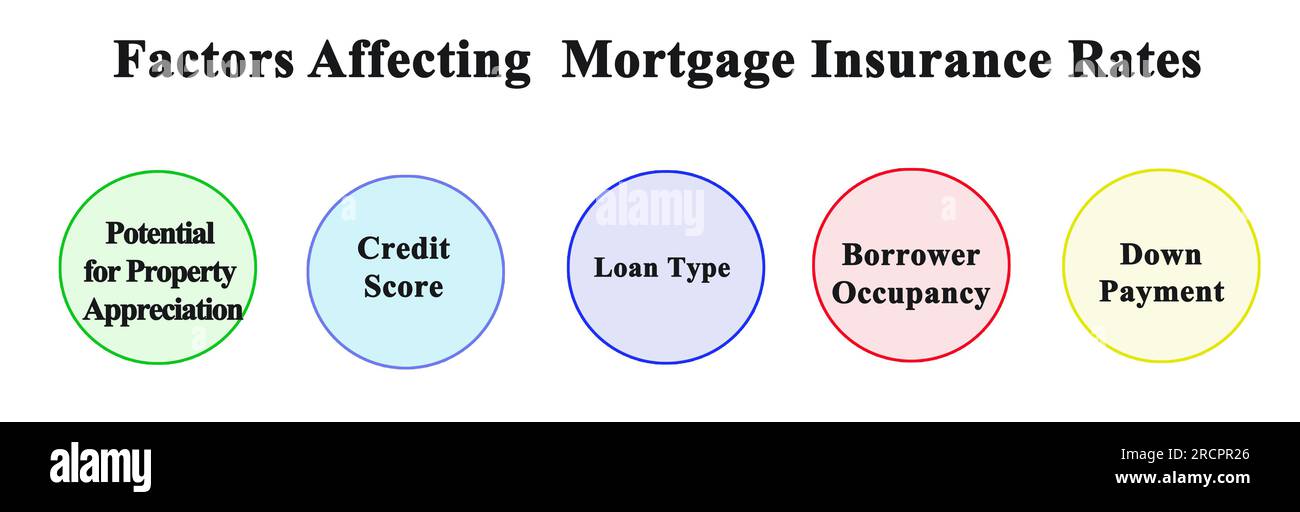

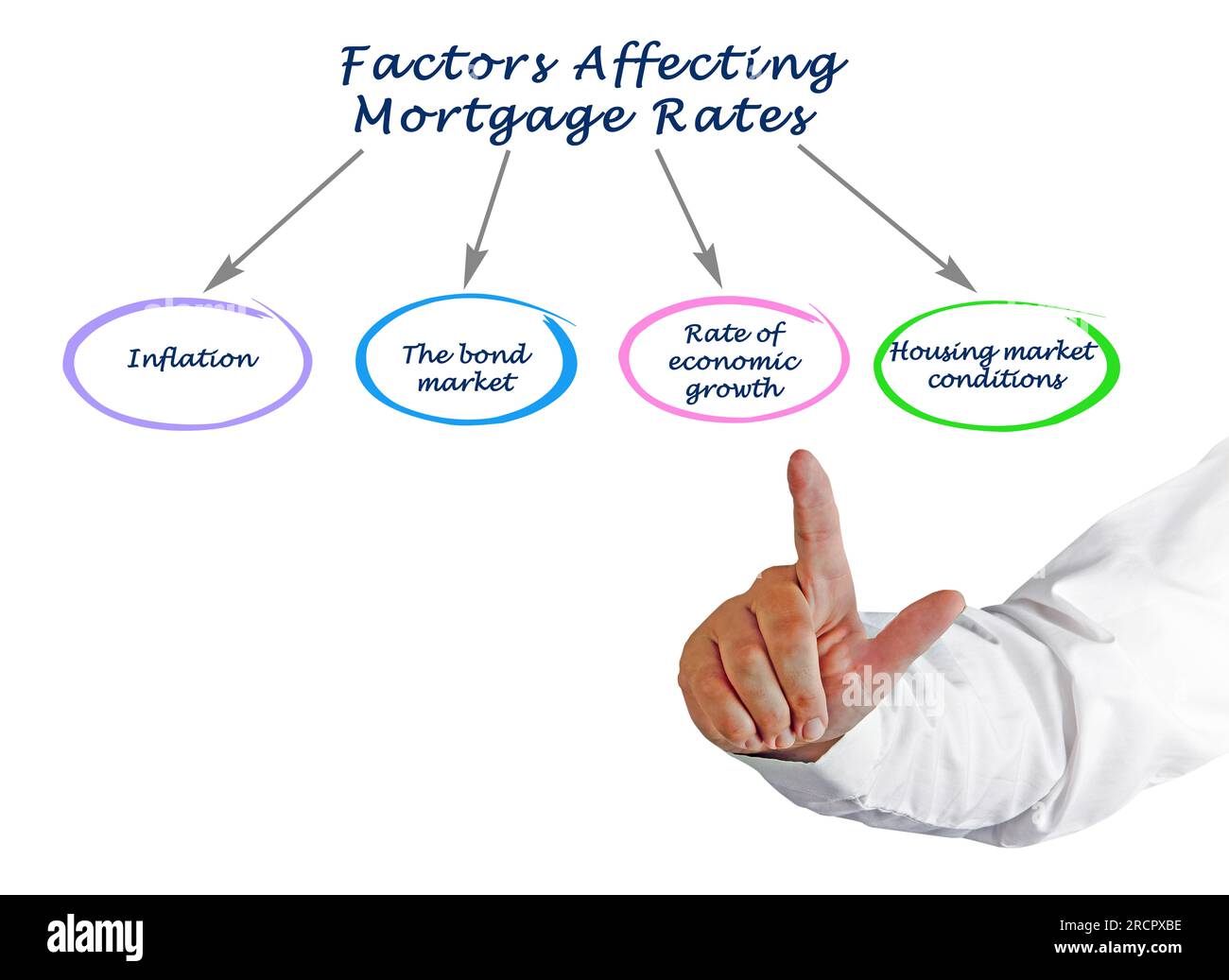

Factors Affecting Mortgage Insurance Rates Stock Photo Alamy Download this stock image: four factors affecting mortgage rates 2rcpxh2 from alamy's library of millions of high resolution stock photos, illustrations and vectors. Here are seven key factors that affect your interest rate that you should know. 1. credit scores. your credit score is one factor that can affect your interest rate. in general, consumers with higher credit scores receive lower interest rates than consumers with lower credit scores. lenders use your credit scores to predict how reliable you. The table below highlights average mortgage rates for first time homebuyers for the 30 year fixed, 15 year fixed, and 7 year 6 month adjustable rate loan for some of the major banks as of dec. 12. Key takeaways. mortgage rates are affected by market factors like inflation, the cost of borrowing, bond yields and risk. mortgage rates are also affected by personal financial factors, such as.

Factors Affecting Mortgage Insurance Rates Stock Photo Alamy The table below highlights average mortgage rates for first time homebuyers for the 30 year fixed, 15 year fixed, and 7 year 6 month adjustable rate loan for some of the major banks as of dec. 12. Key takeaways. mortgage rates are affected by market factors like inflation, the cost of borrowing, bond yields and risk. mortgage rates are also affected by personal financial factors, such as. For example, for a mortgage with $100,000 principal, a borrower would save a median of $981 by adding one more broker to the mix and $1,393 by adding two. and with $200,000 principal, the savings are $1,866 and $2,664.” so there you have them, seven factors that can influence your mortgage interest rate. Mortgage rates are determined by numerous factors. what determines mortgage rates can be broken down into these two areas: market factors. personal factors. let’s break down each of these.

Factors Affecting Mortgage Rates Stock Image Image Of Score Price For example, for a mortgage with $100,000 principal, a borrower would save a median of $981 by adding one more broker to the mix and $1,393 by adding two. and with $200,000 principal, the savings are $1,866 and $2,664.” so there you have them, seven factors that can influence your mortgage interest rate. Mortgage rates are determined by numerous factors. what determines mortgage rates can be broken down into these two areas: market factors. personal factors. let’s break down each of these.

Four Factors Affecting Mortgage Rates Stock Photo Alamy

:max_bytes(150000):strip_icc()/factors-affect-mortgage-rates_final-e70ed5b382434255928bf3246b6f4b8f.png)

The Most Important Factors Affecting Mortgage Rates

Comments are closed.