Setup Daytrading Indicador Rsi Estrategia Com Indicador Gratis

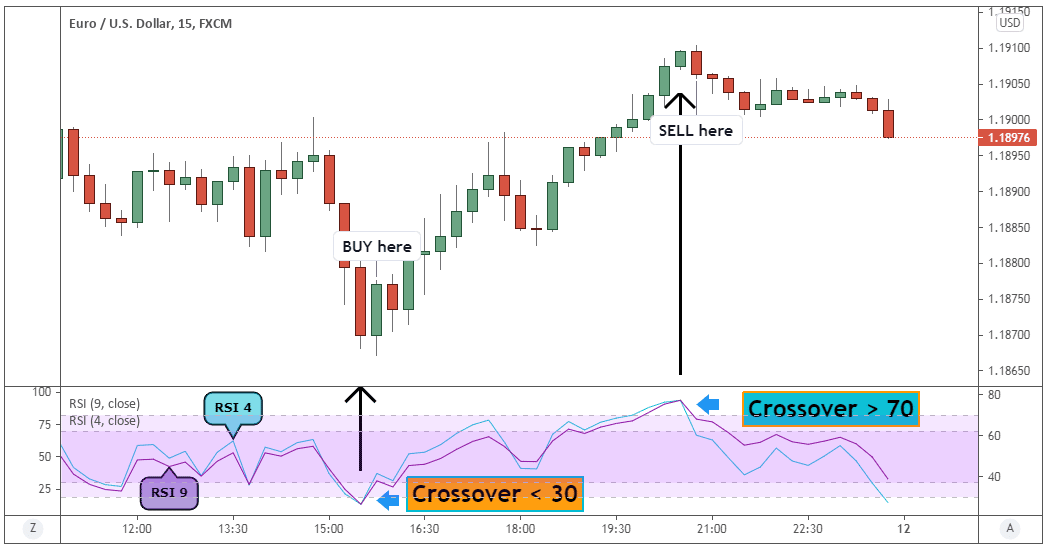

Setup Daytrading Indicador Rsi Estratégia Com Indicador Grátis Rsi oversold and overbought. the first common approaches to use the rsi is to identify the oversold and overbought level. a financial asset is said to be oversold when it has moved so much lower. an rsi level below 30 is said to be oversold. most traders view this situation as the best place to buy an asset. Scalpers need quick and efficient indicators for finding rapid signals. a 7 period rsi with settings of 10 and 90 works best. the tighter timeframe and thresholds help spot immediate trading opportunities. with settings of 10 and 90 a scalper can: enter long positions when rsi dips below 10.

Estratégia Day Trade C Rsi Melhor Setup Para Ganhar Dinheiro No Forex Stochastic indicator. 60 min. 43%. the 10 best indicators for day trading: backtested & proven by data. 1. price rate of change – 93% win rate. the price rate of change (roc) is a powerful technical analysis chart indicator. roc was the most profitable indicator we tested using a heikin ashi chart. roc allows traders to gauge both the speed. Rsi = 100 – (100 (1 rs)) rs = average of up closes of the last n days average of down closes of the last n days. in practice it works like this for a fourteen day period: add the percentage gains on up days (from close to close). divide the sum by 14. add the percentage of down days (from close to close). Rsi has a 53% success rate based on multiple backtests using rsi 14 on an hourly chart. rsi is an oscillating indicator that measures the speed and change of price movements. rsi oscillates between 0 and 100. readings above 70 indicate an overbought market, while readings below 30 indicate an oversold market. The relative strength index (rsi) is a widely used technical indicator in the field of stock trading. developed by j. welles wilder jr., the rsi helps traders identify overbought and oversold levels in a stock's price. this article aims to provide a comprehensive understanding of the rsi, its calculation, interpretation, and its significance in.

How To Use The Relative Strength Indicator Rsi For Day Trading Rsi has a 53% success rate based on multiple backtests using rsi 14 on an hourly chart. rsi is an oscillating indicator that measures the speed and change of price movements. rsi oscillates between 0 and 100. readings above 70 indicate an overbought market, while readings below 30 indicate an oversold market. The relative strength index (rsi) is a widely used technical indicator in the field of stock trading. developed by j. welles wilder jr., the rsi helps traders identify overbought and oversold levels in a stock's price. this article aims to provide a comprehensive understanding of the rsi, its calculation, interpretation, and its significance in. Rsi indicator: best settings for day trading strategies. we will now discuss how to use the rsi indicator for day trading. for many traders, using the rsi indicator in a day trading strategy is very beneficial. the default rsi setting of 14 periods is suitable for most traders, especially for swing traders. but some intraday traders use. The actual rsi value is calculated by indexing the indicator to 100, through the use of the following rsi formula example: rsi = 100 (100 1 rs) if you are using metatrader (mt4), you can attach the indicator on your mt4 chart, and simply drag and drop it to the main chart window.

Top 3 Rsi Indicator Strategies For Day Trading Traders Union Rsi indicator: best settings for day trading strategies. we will now discuss how to use the rsi indicator for day trading. for many traders, using the rsi indicator in a day trading strategy is very beneficial. the default rsi setting of 14 periods is suitable for most traders, especially for swing traders. but some intraday traders use. The actual rsi value is calculated by indexing the indicator to 100, through the use of the following rsi formula example: rsi = 100 (100 1 rs) if you are using metatrader (mt4), you can attach the indicator on your mt4 chart, and simply drag and drop it to the main chart window.

Rsi Trading Strategy Master 80 20 Strategy Updated 2023

Day Rsi Indicator Mt4 Free Download

Comments are closed.