Series 7 License Meaning Requirements Exam Structure Uses

Series 7 License Meaning Requirements Exam Uses The series 7 exam is a requirement for anyone looking to work in financial services. this includes insurance agents, financial planners, stockbrokers, and advisors. the series 7 license signifies that the professional has the knowledge and ability to buy, trade, or sell all security products, including mutual funds, corporate securities, hedge. The new series 7 exam emphasizes clients and portfolio construction for them. this usually necessitates more practical understanding than technical knowledge. know the bell curve rule the first and last 25 questions are typically the easiest. as a result, don't be alarmed if the central questions seem more difficult.

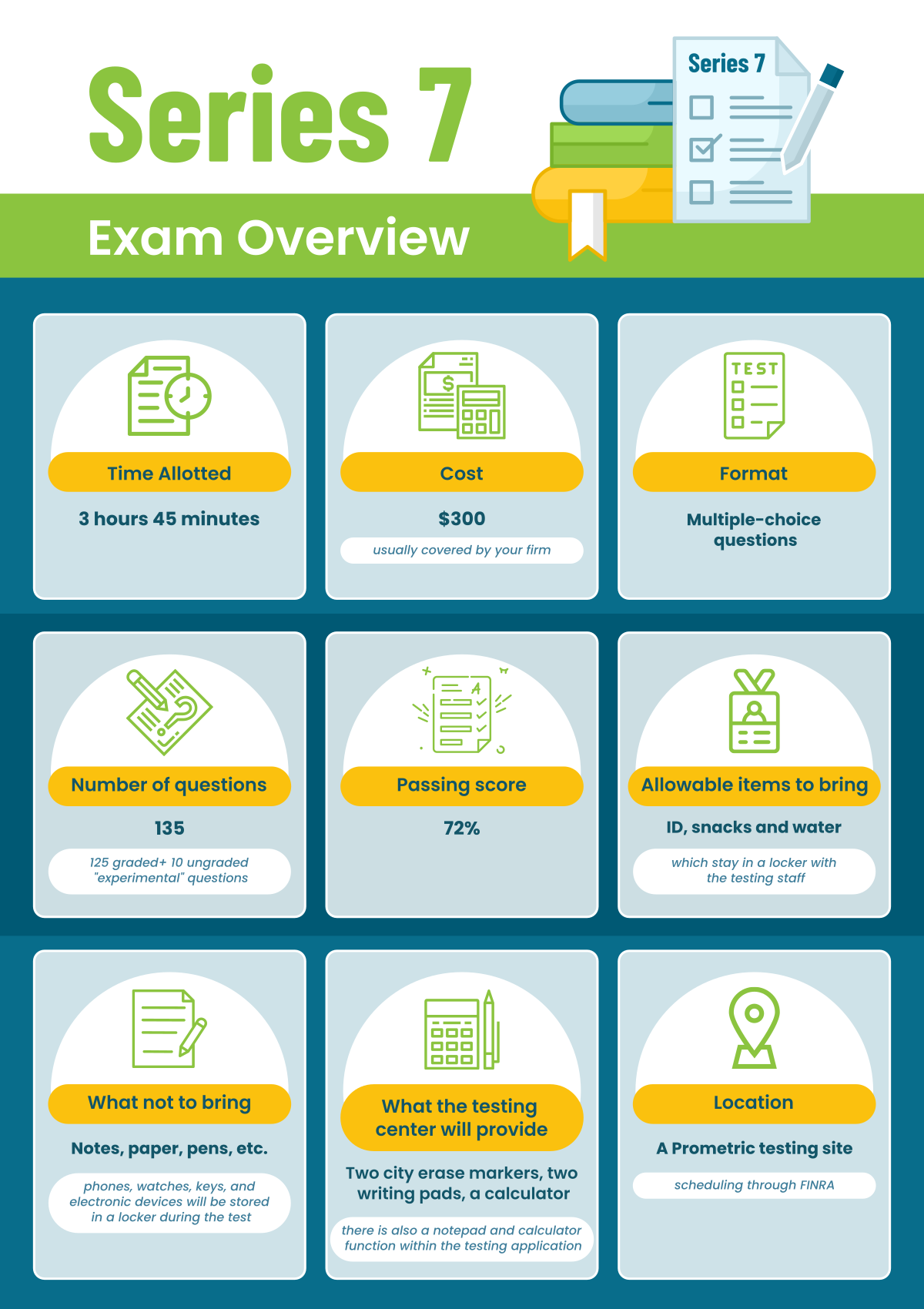

Series 7 License Meaning Requirements Exam Structure Uses The series 7 content outline provides a comprehensive guide to the range of topics covered on the exam, as well as the depth of knowledge required. the outline is comprised of the four major job functions of a general securities representative. the table below lists the allocation of exam items for each major job function. Definition, cost and requirements. all registered representatives and stockbrokers must pass the series 7 exam. here's what the process looks like to obtain the license. Series 7 license cost. the cost of the exam itself is $245. the sponsoring firm typically pays this even though the student themselves can also pay. however, this cost does not include study materials, which the candidate needs to purchase themselves. subsequently, study materials and books can range anywhere from $50 to $200. Series 7 exam structure. the series 7 exam comprises 125 multiple choice questions that candidates are required to complete within 3 hours and 45 minutes. it means that the candidate is allowed one minute and 48 seconds per question. the passing score for the exam is 72%, which candidates must achieve to obtain a practicing license.

Series 7 License Meaning Requirements Exam Structure Uses Series 7 license cost. the cost of the exam itself is $245. the sponsoring firm typically pays this even though the student themselves can also pay. however, this cost does not include study materials, which the candidate needs to purchase themselves. subsequently, study materials and books can range anywhere from $50 to $200. Series 7 exam structure. the series 7 exam comprises 125 multiple choice questions that candidates are required to complete within 3 hours and 45 minutes. it means that the candidate is allowed one minute and 48 seconds per question. the passing score for the exam is 72%, which candidates must achieve to obtain a practicing license. The series 7 exam: qualifications & preparation smartasset. if passed, the series 7 exam entitles license holders to sell most types of securities. here's how to qualify and prepare for the exam, and what to expect. Step 2: secure a sponsorship. to take the series 7 exam, you must be sponsored by a finra member firm or a self regulatory organization (sro). firms apply for candidates to take the exam by filing a uniform application for security industry registration or transfer (form u4). there is also an exam fee that is commonly covered by the sponsoring.

The Ultimate Guide To Series 7 Licensing Series 7 Practice Exam The series 7 exam: qualifications & preparation smartasset. if passed, the series 7 exam entitles license holders to sell most types of securities. here's how to qualify and prepare for the exam, and what to expect. Step 2: secure a sponsorship. to take the series 7 exam, you must be sponsored by a finra member firm or a self regulatory organization (sro). firms apply for candidates to take the exam by filing a uniform application for security industry registration or transfer (form u4). there is also an exam fee that is commonly covered by the sponsoring.

Comments are closed.