Section 54 To 54h Of Income Tax Act Download Chart Section 54 To

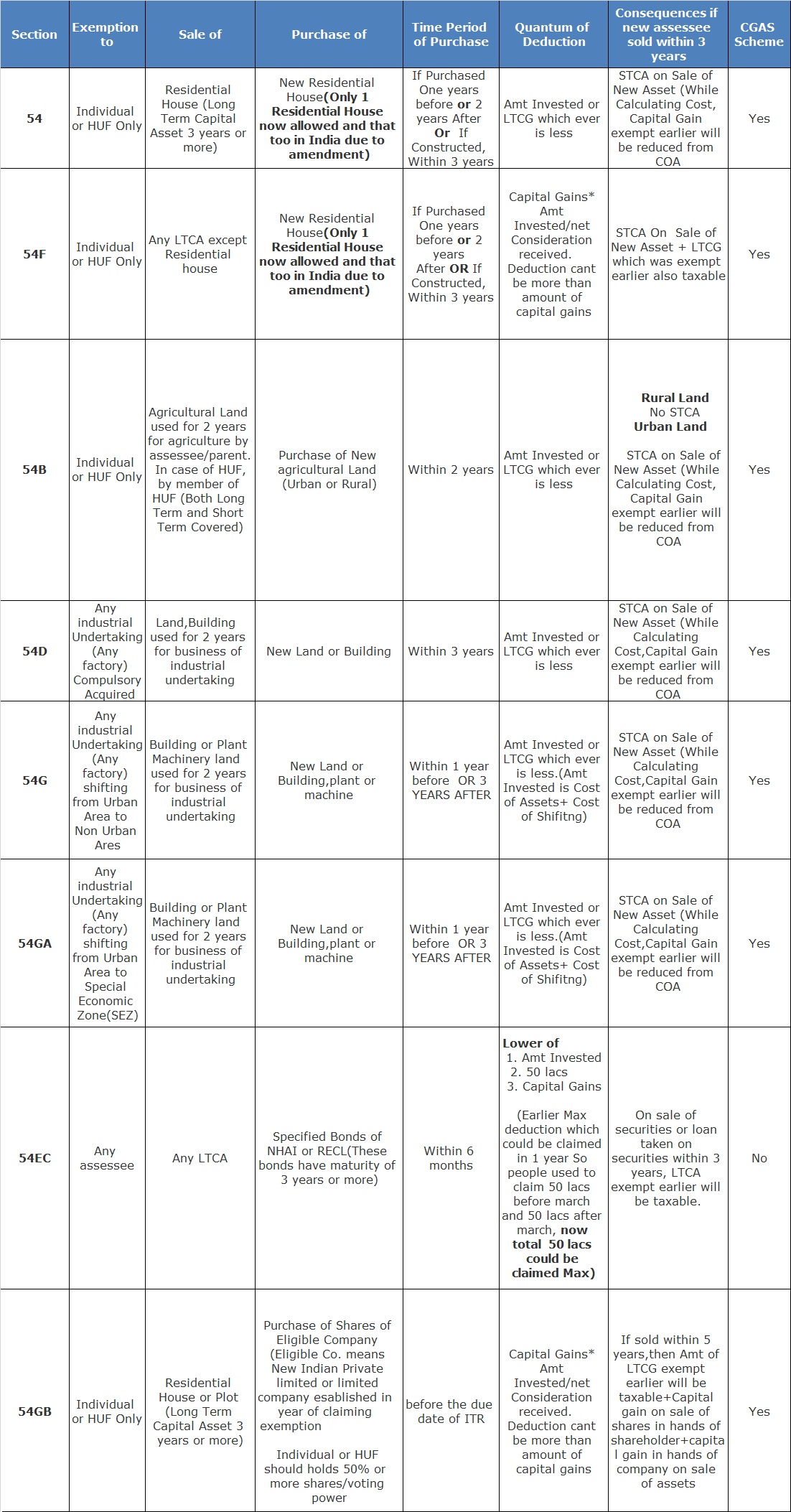

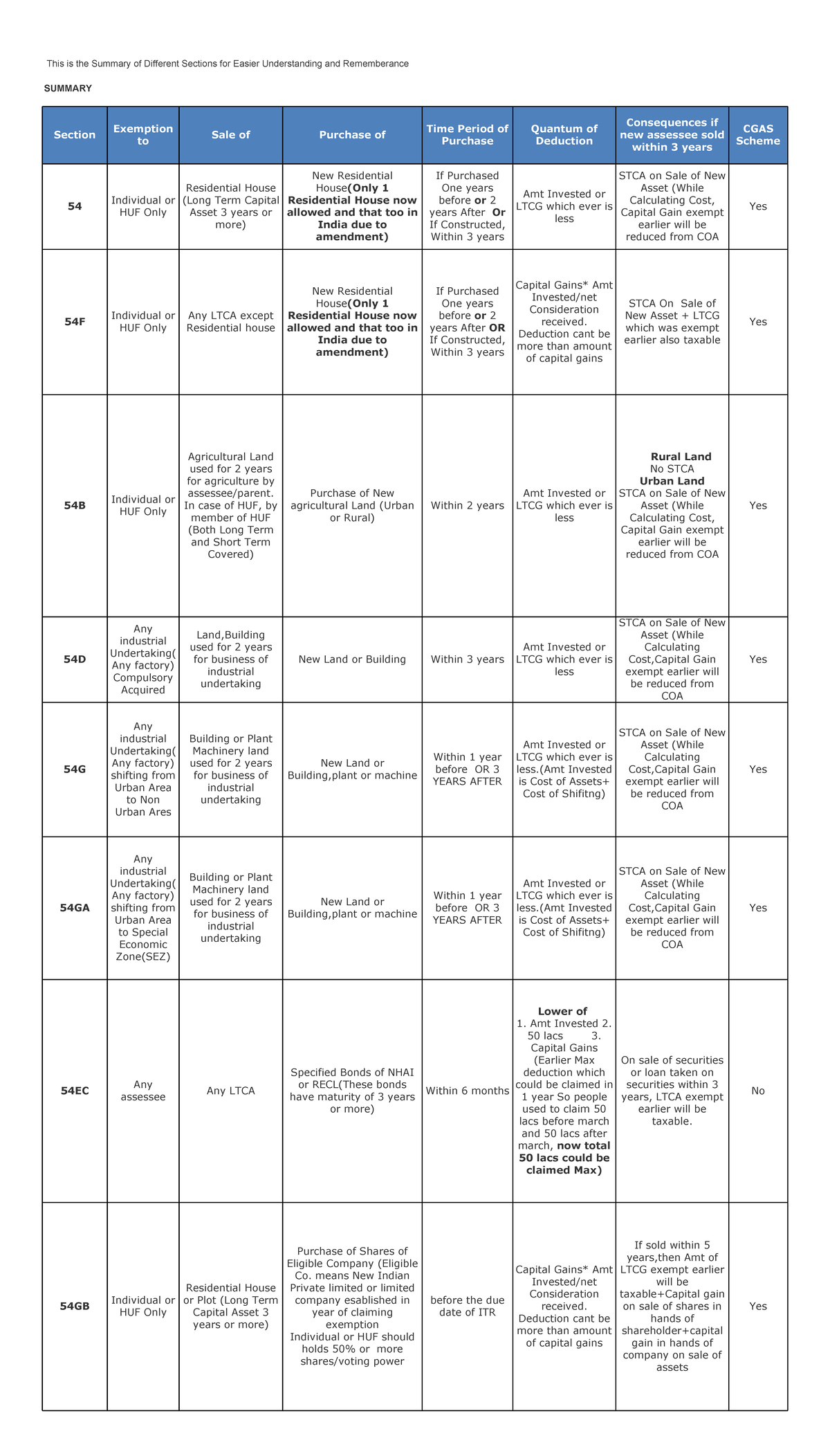

Section 54 To 54h Of Income Tax Act Download Chart Section 54 To Cgas scheme. 54. individual or huf only. residential house (long term capital asset 3 years or more) new residential house (only 1 residential house now allowed and that too in india due to amendment) if purchased one years before or 2 years after or if constructed, within 3 years. amt invested or ltcg which ever is less. Section 54 v s section 54f. earning income automatically casts a responsibility on the taxpayers to discharge income tax on such income and so is the case with capital gains too. however, the income tax laws allow taxpayers to claim certain exemptions against capital gains, which will help reduce their tax outgo.

Section 54 Of Income Tax Act Exemptions Deductions How To Claim Each section of the income tax act, including 54, 54b, 54d, 54ec, 54f, 54g, and 54ga, caters to different scenarios and asset types, ensuring comprehensive coverage. individuals and hindu undivided families (hufs) can benefit from exemptions on long term residential properties, agricultural lands, industrial undertakings, specified assets, and. Section 54f. section 54 of the income tax act states exemption on long term capital gains for the sale of a residential property. an entire capital gain needs to be invested to claim full exemption. when all capital gains are not invested, the leftover amount is charged for taxation as long term capital gains. As per section 54h, the period for acquiring the new asset by the assessee referred to in sections 54, 54b, 54d, 54ec and 54f (i.e., six months, one year before or two three years after the date of transfer of the asset) shall be reckoned from the date of receipt of such compensation and not from the date on which the asset was originally. Exemption of capital gains under sections 54, 54b, 54d, 54ec, 54ee, 54f, 54g. 54ga and 54gb. 1. exemption of capital gain on transfer of house property used for residence [section 54] (iv) the assessee has purchased one residential house in india within one year before or 2 years after the date on which the transfer took place, or constructed.

Capital Gains Section 54 Chart This Is The Summary Of Different As per section 54h, the period for acquiring the new asset by the assessee referred to in sections 54, 54b, 54d, 54ec and 54f (i.e., six months, one year before or two three years after the date of transfer of the asset) shall be reckoned from the date of receipt of such compensation and not from the date on which the asset was originally. Exemption of capital gains under sections 54, 54b, 54d, 54ec, 54ee, 54f, 54g. 54ga and 54gb. 1. exemption of capital gain on transfer of house property used for residence [section 54] (iv) the assessee has purchased one residential house in india within one year before or 2 years after the date on which the transfer took place, or constructed. Section 54 of the income tax act provides an exemption from capital gains tax on the sale of a residential property if the proceeds are reinvested in another residential property. this exemption is available under certain conditions. conditions for exemption under section 54: 1. sale of residential property: the exemption is available only if. Selling a home can be an emotional and significant financial decision. while the excitement of moving on to a new chapter is undeniable, the thought of paying capital gains tax can add stress to the process. thankfully, section 54 of the income tax act offers relief by allowing individuals and hindu undivided families (hufs) to claim an exemption on the capital gains from the sale of a.

Comments are closed.