Section 54 Of Income Tax Act

Section 54 Income Tax Act Capital Gains Exemption Chart Teachoo Section 54 v s section 54f. earning income automatically casts a responsibility on the taxpayers to discharge income tax on such income and so is the case with capital gains too. however, the income tax laws allow taxpayers to claim certain exemptions against capital gains, which will help reduce their tax outgo. Learn how to claim tax exemption on long term capital gains from selling a residential property and buying another one under section 54 of the income tax act. find out the eligibility criteria, conditions, and latest amendments for this section.

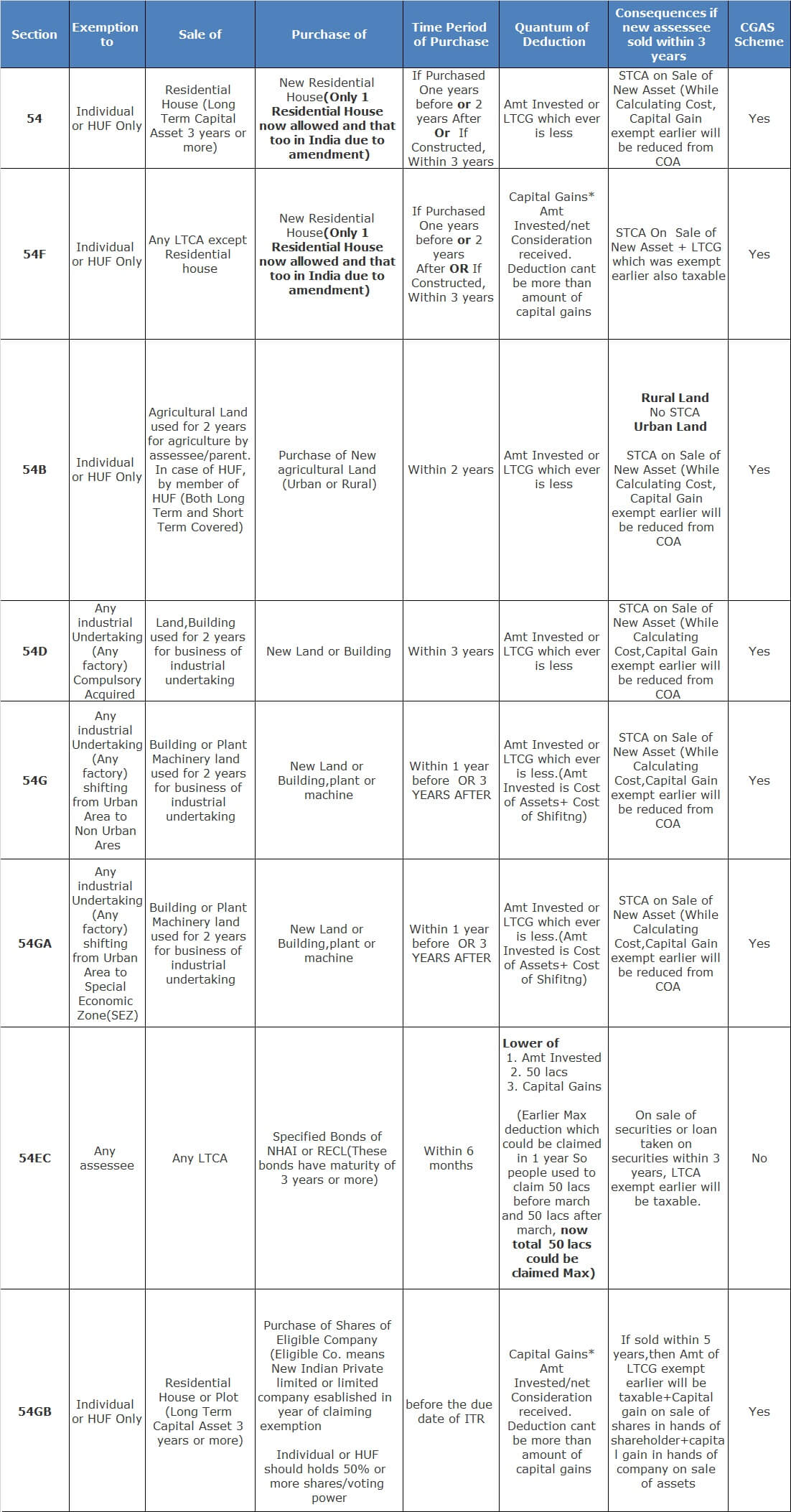

Section 54 Of Income Tax Act Exemptions Deductions How To Claim Summary: the income tax act provides capital gain exemptions under sections 54, 54f, and 54ec for individuals or hufs. section 54 offers relief for long term capital gains (ltcg) from the sale of residential property, allowing reinvestment into a new house within specific timeframes. if the cost of the new asset exceeds the ltcg, the entire. Each section of the income tax act, including 54, 54b, 54d, 54ec, 54f, 54g, and 54ga, caters to different scenarios and asset types, ensuring comprehensive coverage. individuals and hindu undivided families (hufs) can benefit from exemptions on long term residential properties, agricultural lands, industrial undertakings, specified assets, and. 3. detailed explanation of section 54. section 54 of the income tax act provides for a tax exemption on the capital gains arising from the sale of a long term capital asset, specifically a residential house property. this exemption is applicable if the capital gains are reinvested into purchasing another residential property. The section 54 exemption under the income tax act, 1961, offers a valuable opportunity for individuals to save on capital gains when transferring residential property. this comprehensive guide provides insights into the basic conditions for eligibility, the amount of exemption available, and the potential consequences if the new house is.

Understanding Section 54 Of Income Tax Act Marg Erp Blog 3. detailed explanation of section 54. section 54 of the income tax act provides for a tax exemption on the capital gains arising from the sale of a long term capital asset, specifically a residential house property. this exemption is applicable if the capital gains are reinvested into purchasing another residential property. The section 54 exemption under the income tax act, 1961, offers a valuable opportunity for individuals to save on capital gains when transferring residential property. this comprehensive guide provides insights into the basic conditions for eligibility, the amount of exemption available, and the potential consequences if the new house is. Learn how to claim tax exemption on capital gains from selling a residential property and reinvesting in another residential property under section 54 of the income tax act. find out the eligibility criteria, conditions, limits, documents, and benefits of this provision. Section 54ga. capital gains on the transfer of capital assets (land, equipment, plant, and buildings) of an industrial business situated in an urban area are excluded under section 54ga of the income tax act. the industrial venture must relocate to a special economic zone (sez) in order to qualify for this exemption.

A Guide For Taxpayer On What Is Section 54 Of Income Tax Act Learn how to claim tax exemption on capital gains from selling a residential property and reinvesting in another residential property under section 54 of the income tax act. find out the eligibility criteria, conditions, limits, documents, and benefits of this provision. Section 54ga. capital gains on the transfer of capital assets (land, equipment, plant, and buildings) of an industrial business situated in an urban area are excluded under section 54ga of the income tax act. the industrial venture must relocate to a special economic zone (sez) in order to qualify for this exemption.

Section 54 Of Income Tax Act

Comments are closed.