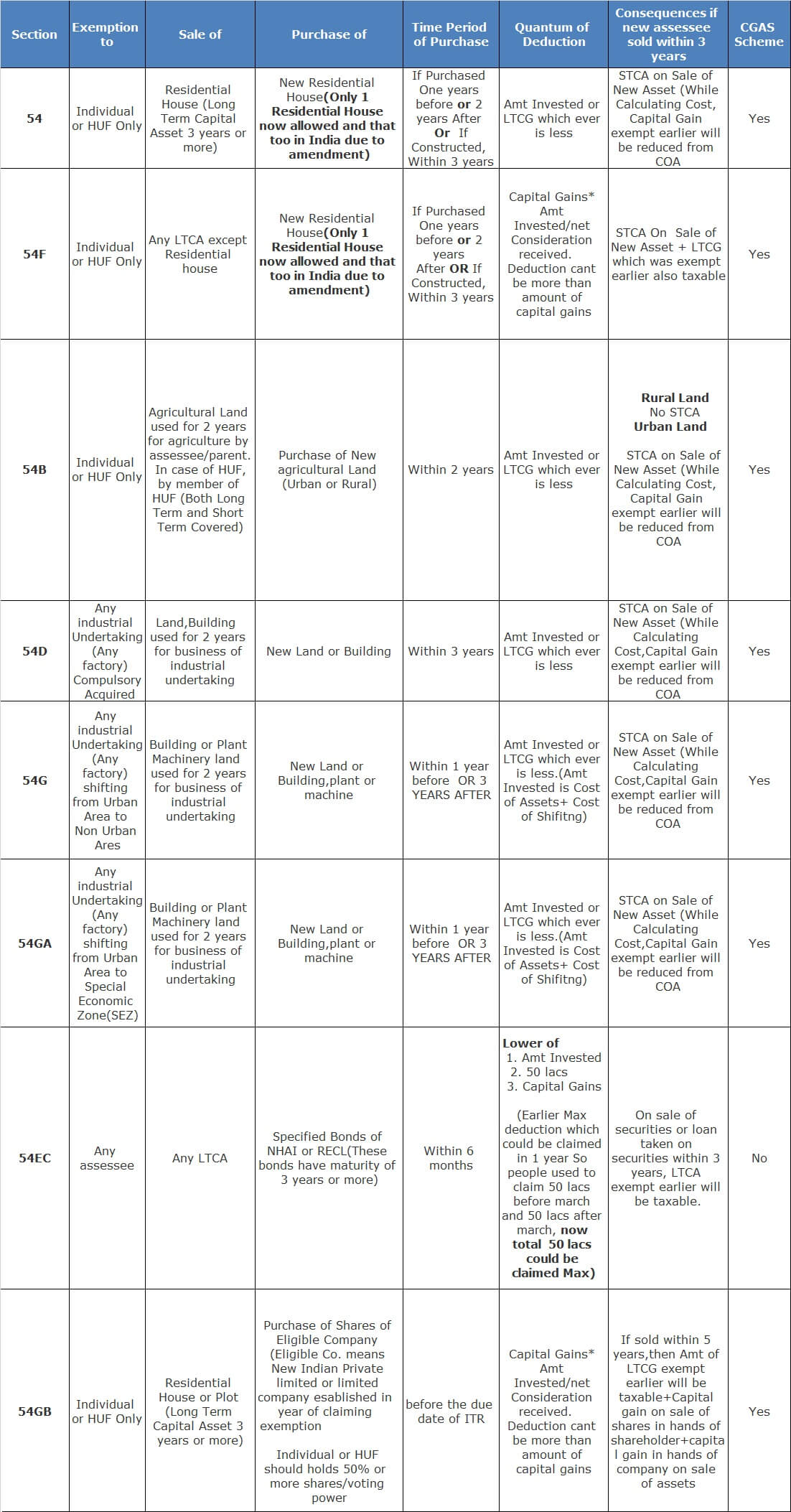

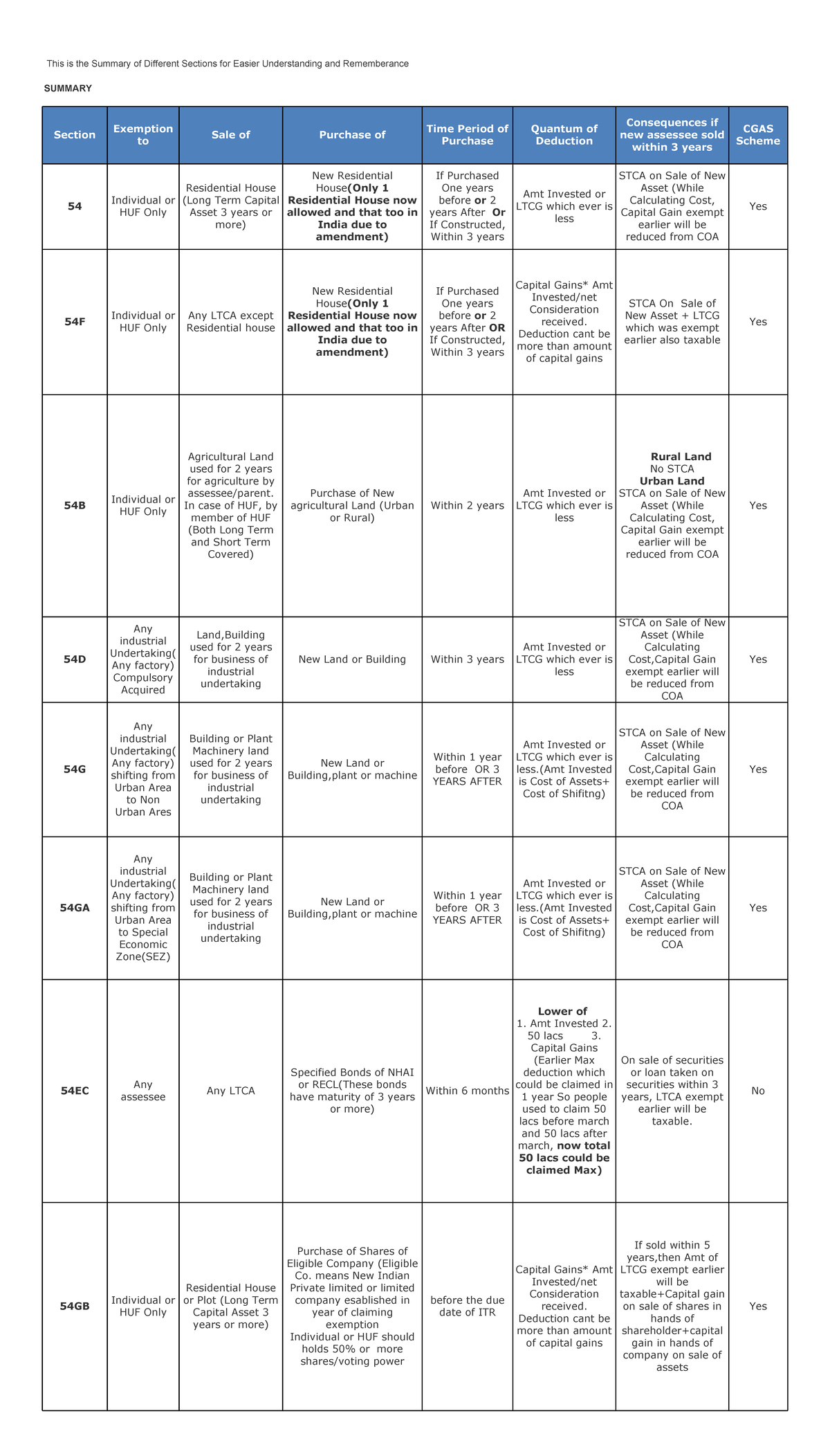

Section 54 Income Tax Act Capital Gains Exemption Chart Teachoo

Section 54 Income Tax Act Capital Gains Exemption Chart Teachoo Cgas scheme. 54. individual or huf only. residential house (long term capital asset 3 years or more) new residential house (only 1 residential house now allowed and that too in india due to amendment) if purchased one years before or 2 years after or if constructed, within 3 years. amt invested or ltcg which ever is less. Exemptions in income from capital gains are basically of two types. 1. section 10 exemption. 2.exemption under section 54 54b 54d etc. videos in hindi are provided for better understanding. this will help you score well in your exams. all amendments updated for november 2018 exams of ca and december 2018 exams of cs and cwa.

Capital Gains Section 54 Chart This Is The Summary Of Different Deduction is available only to individual and huf. this deduction is on ltcg only (not stcg) only sale of residential house covered (residential house means building and land appurtenant to building, vacant land not covered) income from such house should be chargeable under income from house property. person should invest the amount of ltcg in. The definition of capital asset under section 2(14) of the income tax act includes property of any kind movable or immovable, tangible or intangible held by the assessee for any purpose. as per the income tax act, for the purpose of capital gains, assets are classified into 2 types depending on the holding period of the asset:. Conclusion: exemptions under capital gains, as outlined in sections 54, 54b, 54d, 54ec, 54f, 54g, and 54ga, offer valuable tax saving opportunities to individuals and entities. by understanding the nuances of each section, taxpayers can strategically plan asset transactions to minimize tax liabilities. adherence to eligibility criteria, time. Summary: the income tax act provides capital gain exemptions under sections 54, 54f, and 54ec for individuals or hufs. section 54 offers relief for long term capital gains (ltcg) from the sale of residential property, allowing reinvestment into a new house within specific timeframes. if the cost of the new asset exceeds the ltcg, the entire.

Exemptions From Capital Gains Under Sections 54 Conclusion: exemptions under capital gains, as outlined in sections 54, 54b, 54d, 54ec, 54f, 54g, and 54ga, offer valuable tax saving opportunities to individuals and entities. by understanding the nuances of each section, taxpayers can strategically plan asset transactions to minimize tax liabilities. adherence to eligibility criteria, time. Summary: the income tax act provides capital gain exemptions under sections 54, 54f, and 54ec for individuals or hufs. section 54 offers relief for long term capital gains (ltcg) from the sale of residential property, allowing reinvestment into a new house within specific timeframes. if the cost of the new asset exceeds the ltcg, the entire. Section 54f. section 54 of the income tax act states exemption on long term capital gains for the sale of a residential property. an entire capital gain needs to be invested to claim full exemption. when all capital gains are not invested, the leftover amount is charged for taxation as long term capital gains. Exemption of capital gains under sections 54, 54b, 54d, 54ec, 54ee, 54f, 54g. 54ga and 54gb. 1. exemption of capital gain on transfer of house property used for residence [section 54] (iv) the assessee has purchased one residential house in india within one year before or 2 years after the date on which the transfer took place, or constructed.

Capital Gain Exemption Under Section 54 54f 54ec Of The Income Tax Section 54f. section 54 of the income tax act states exemption on long term capital gains for the sale of a residential property. an entire capital gain needs to be invested to claim full exemption. when all capital gains are not invested, the leftover amount is charged for taxation as long term capital gains. Exemption of capital gains under sections 54, 54b, 54d, 54ec, 54ee, 54f, 54g. 54ga and 54gb. 1. exemption of capital gain on transfer of house property used for residence [section 54] (iv) the assessee has purchased one residential house in india within one year before or 2 years after the date on which the transfer took place, or constructed.

Understanding Section 54e Of The Income Tax Act Exemption On Long Term

Comments are closed.