Section 54 Capital Gain Exemption

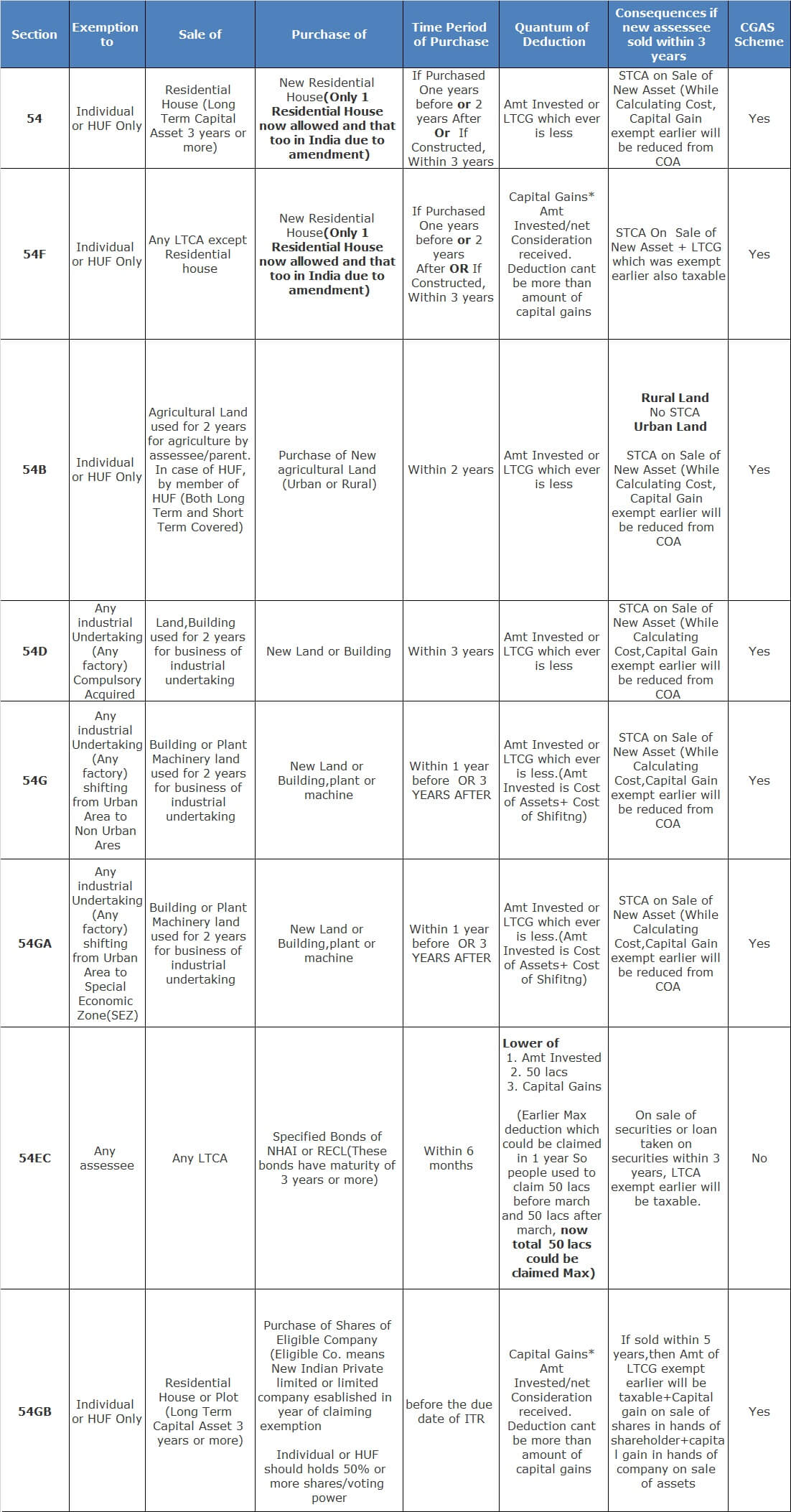

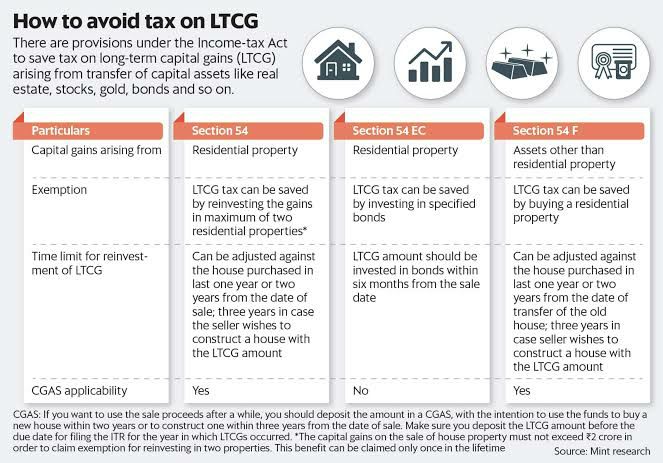

Section 54 Income Tax Act Capital Gains Exemption Chart Teachoo However, the income tax laws allow taxpayers to claim certain exemptions against capital gains, which will help reduce their tax outgo. two such very crucial exemptions one can claim are under sections 54 and 54f. as discussed above the exemption under section 54 is available on long term capital gain on sale of a house property. Conclusion: exemptions under capital gains, as outlined in sections 54, 54b, 54d, 54ec, 54f, 54g, and 54ga, offer valuable tax saving opportunities to individuals and entities. by understanding the nuances of each section, taxpayers can strategically plan asset transactions to minimize tax liabilities. adherence to eligibility criteria, time.

Exemption Of Capital Gain Section 54 To 54f Ifccl Section 54f. section 54 of the income tax act states exemption on long term capital gains for the sale of a residential property. an entire capital gain needs to be invested to claim full exemption. when all capital gains are not invested, the leftover amount is charged for taxation as long term capital gains. The exemption amount under section 54 is the lower of: 1. the long term capital gain calculated above. 2. the cost of the new residential property purchased or constructed. for example, if your capital gain is ₹50 lakhs and you purchase a new house for ₹40 lakhs, your exemption would be ₹40 lakhs. Section 54ga. capital gains on the transfer of capital assets (land, equipment, plant, and buildings) of an industrial business situated in an urban area are excluded under section 54ga of the income tax act. the industrial venture must relocate to a special economic zone (sez) in order to qualify for this exemption. Quantum of deduction under section 54. capital gains shall be exempt to the extent it is invested in the purchase and or construction of another house i.e. if the capital gains amount is equal to or less than the cost of the new house, then the entire capital gain shall be exempt. if the amount of capital gain is greater than the cost of the.

Capital Gain Exemption Section 54 Pioneer One Consulting Llp Section 54ga. capital gains on the transfer of capital assets (land, equipment, plant, and buildings) of an industrial business situated in an urban area are excluded under section 54ga of the income tax act. the industrial venture must relocate to a special economic zone (sez) in order to qualify for this exemption. Quantum of deduction under section 54. capital gains shall be exempt to the extent it is invested in the purchase and or construction of another house i.e. if the capital gains amount is equal to or less than the cost of the new house, then the entire capital gain shall be exempt. if the amount of capital gain is greater than the cost of the. Exemption of capital gains under sections 54, 54b, 54d, 54ec, 54ee, 54f, 54g. 54ga and 54gb. 1. exemption of capital gain on transfer of house property used for residence [section 54] capital gain arising on the transfer of a residential house is exempt u s 54 in the following circumstances: (i) the asset transferred is a residential house, the. New house property purchase price. 18,00,00,000. section 54 exemption amount. 10,00,00,000. in this case, jayni will be eligible to take an exemption of a maximum of ₹10 crores as the house property is sold after april 1, 2023, and on the remaining exceeding amount of ₹3,63,63,636 taxes will be levied at 20%.

Capital Gain Exemption Under Section 54 54f 54ec Of The Income Tax Exemption of capital gains under sections 54, 54b, 54d, 54ec, 54ee, 54f, 54g. 54ga and 54gb. 1. exemption of capital gain on transfer of house property used for residence [section 54] capital gain arising on the transfer of a residential house is exempt u s 54 in the following circumstances: (i) the asset transferred is a residential house, the. New house property purchase price. 18,00,00,000. section 54 exemption amount. 10,00,00,000. in this case, jayni will be eligible to take an exemption of a maximum of ₹10 crores as the house property is sold after april 1, 2023, and on the remaining exceeding amount of ₹3,63,63,636 taxes will be levied at 20%.

Some Of The Important Points To Consider For Section 54f Income Tax

Comments are closed.