Saving Vs Investing The Smartest Place For Your Money Nerdwallet

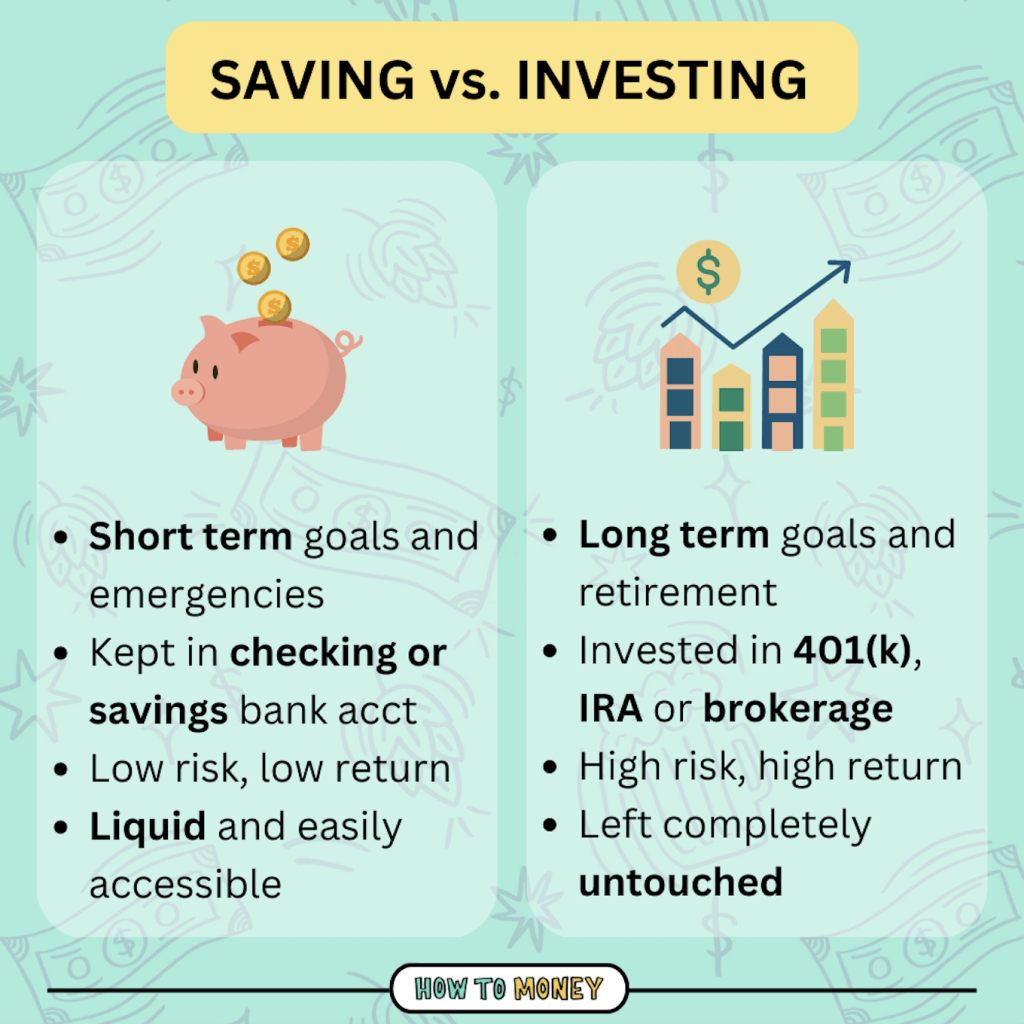

Saving Vs Investing The Smartest Place For Your Money Nerdwallet Choose saving over investing if you’ll need the cash in the near future. there’s a difference between saving and investing: saving means putting away money for later use in a secure place. We'd all like to make smart decisions with our hard earned money but sometimes knowing what decision is best for you can be a little tricky. in this video, n.

Saving Vs Investing Differences And How To Choose If you want to save specifically for education costs, 529s are worth considering. whatever your financial goals, you have solid options for where to stash your money and, ideally, see it grow. The payoff: consistently saving $6,500 in your roth ira each year won’t land you $1 million if you begin at age 30 — at a 6% return for 37 years, you’ll end up with about $876,877 at age 67. Determining how much to save in an emergency fund should take into account your monthly living expenses, including rent or mortgage payments, utilities, groceries and any other regular payments. For this purpose, high yield savings accounts are a great option because they come with zero risk — meaning your money will always be there. when you invest, your money can increase or decrease.

:max_bytes(150000):strip_icc()/TheDifferencesBetweenSavingandInvesting-bc50bd28537e4fb7b2d696047bee33eb.jpg)

Saving Vs Investing Understanding The Key Differences Determining how much to save in an emergency fund should take into account your monthly living expenses, including rent or mortgage payments, utilities, groceries and any other regular payments. For this purpose, high yield savings accounts are a great option because they come with zero risk — meaning your money will always be there. when you invest, your money can increase or decrease. Saving and investing are both key parts of a solid financial plan. whether you’re putting money into the best savings account — be that the best cd rates, best high yield savings or best money. Saving your money is less risky than investing it. if you invest your money, you stand to potentially lose your principal, or initial investment. consider a situation in which you’re looking.

Saving Vs Investing Which Is Better Saving and investing are both key parts of a solid financial plan. whether you’re putting money into the best savings account — be that the best cd rates, best high yield savings or best money. Saving your money is less risky than investing it. if you invest your money, you stand to potentially lose your principal, or initial investment. consider a situation in which you’re looking.

Savings Vs Investing What S The Difference Wealthdesk

Comments are closed.