Saving Vs Investing Know The Difference Quick Start Investment

:max_bytes(150000):strip_icc()/TheDifferencesBetweenSavingandInvesting-bc50bd28537e4fb7b2d696047bee33eb.jpg)

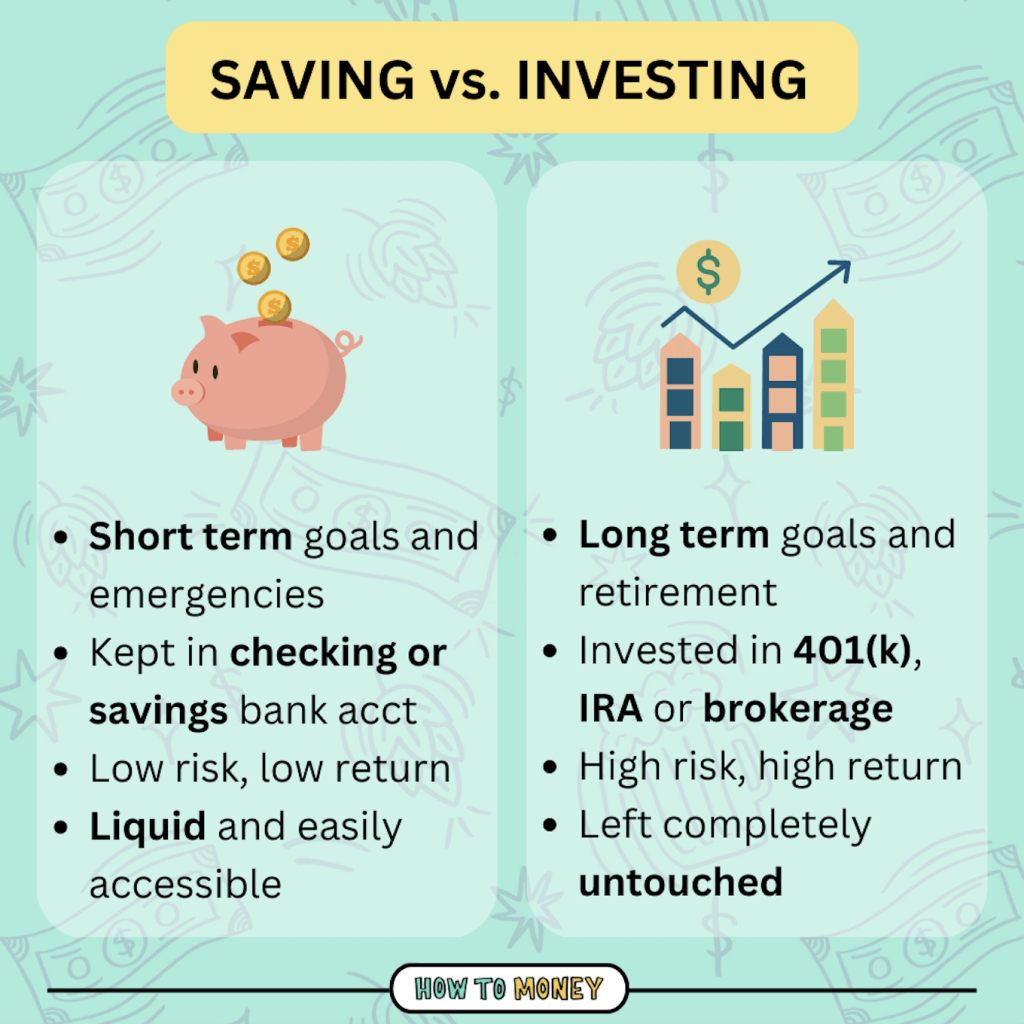

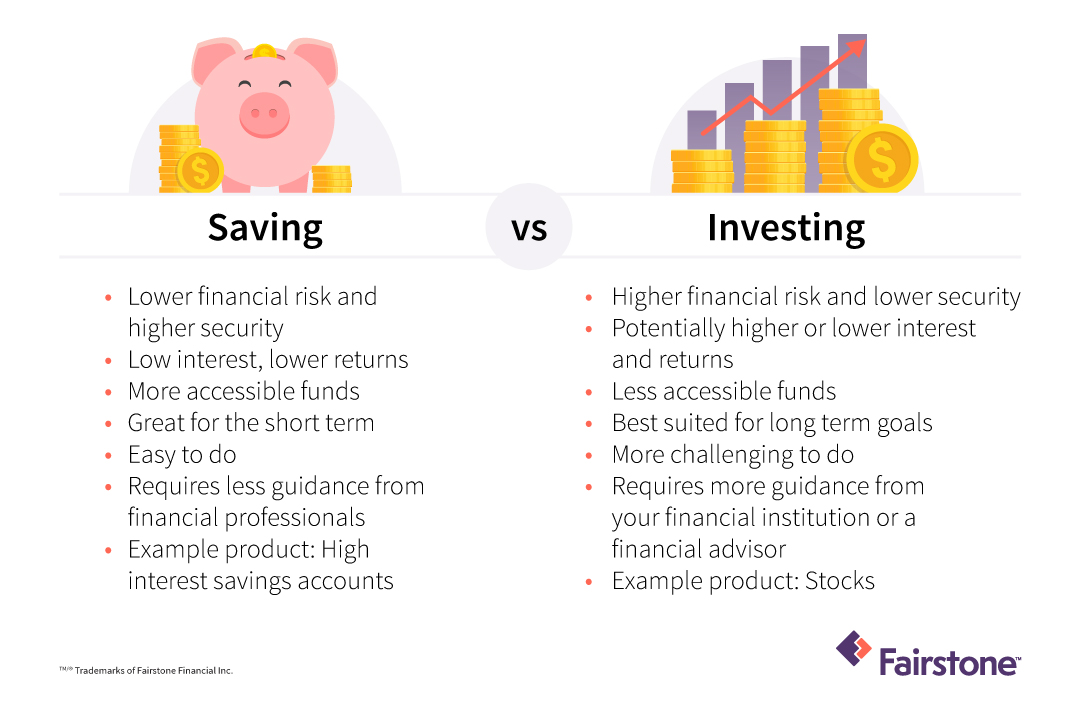

Saving Vs Investing Understanding The Key Differences 2024 Choose saving over investing if you’ll need the cash in the near future. there’s a difference between saving and investing: saving means putting away money for later use in a secure place. Saving money means storing it safely so that it is available when we need it and it has a low risk of losing value. investment comes with risk, but also the potential for higher returns. investing.

Saving Vs Investing Differences And How To Choose Key points. saving cash helps you achieve short term financial goals, while investing helps you achieve longer term goals. saving is low risk, but the inflation adjusted returns are negative. Savings accounts, even the best high yield ones, offer a relatively low return compared to investment accounts — sometimes even lower than the rate of inflation. “if a savings account has a. The biggest difference between saving and investing is the level of risk taken. saving typically results in you earning a lower return but with virtually no risk. in contrast, investing allows you. The difference between saving and investing. saving is generally considered a good approach if your financial goal can be reached in five years or less, such as planning for a vacation or buying a house. the money you put into a savings account is more liquid than the money you put into investments. investing, on the other hand, can help you.

Saving Vs Investing What S The Difference Fairstone The biggest difference between saving and investing is the level of risk taken. saving typically results in you earning a lower return but with virtually no risk. in contrast, investing allows you. The difference between saving and investing. saving is generally considered a good approach if your financial goal can be reached in five years or less, such as planning for a vacation or buying a house. the money you put into a savings account is more liquid than the money you put into investments. investing, on the other hand, can help you. You have to save more money to reach the same goal versus earning higher returns with investments. investing. potentially higher returns than saving. investments could decrease in value. due to higher returns, you may not have to contribute as much money to reach your goals. you may have to delay a goal if your investments decrease in value. Savings are often deposited into a savings account at a bank, a bank certificate of deposit (cd), or a bank money market account. in contrast, investing is usually done through a retirement account such as a 401 (k) or ira, or through a more general purpose brokerage account. these types of accounts hold the investments you purchase such as.

Comments are closed.