Saving For Retirement Faq Infographic Inside Your Ira Saving For

Saving For Retirement Faq Infographic Inside Your Ira Saving For Reaching your retirement savings goals starts with developing a roadmap now. that’s why we did the analysis and developed guidelines based on 4 key metrics: a yearly savings rate, a savings factor to help you see where you stand, an income replacement rate, and a potentially sustainable withdrawal rate. all 4 metrics are interconnected. Here are some statistics that may surprise you: 39% of households nearing retirement do not have a formal retirement plan. only 35% of americans are confident they can rely on social security. for a couple both 62 years old, there is a 47% chance that one of them will live to be 90. are you prepared to live 25 years on your retirement savings?.

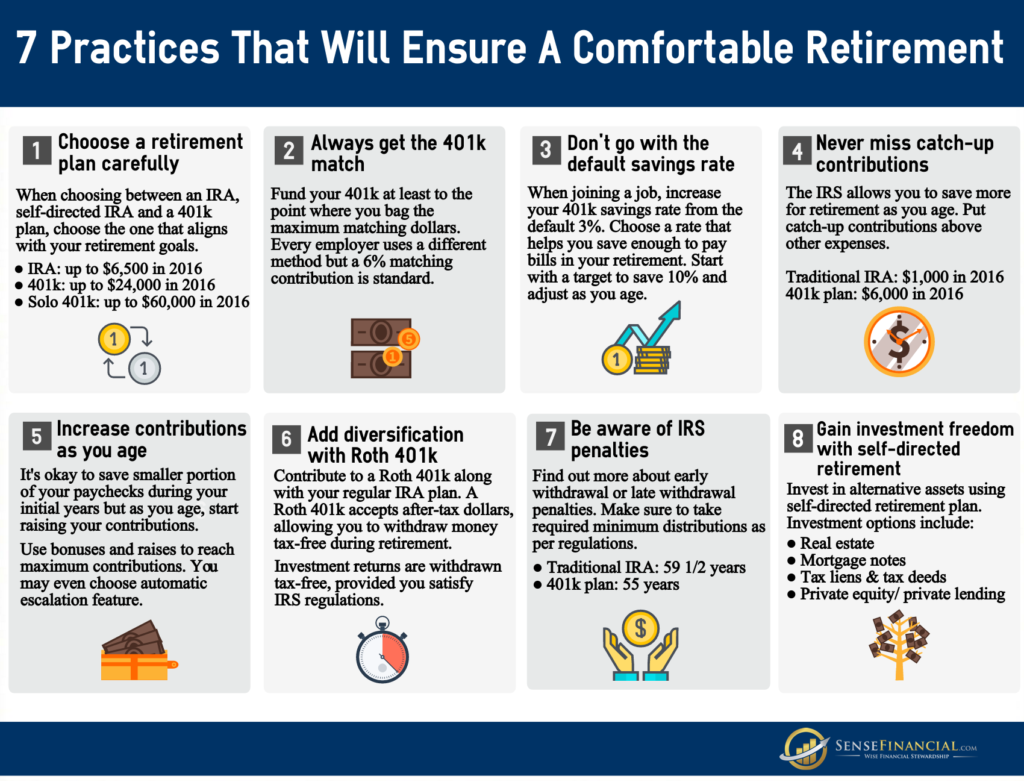

Infographic 8 Retirement Tips That Will Ensure A Comfortable Retirement Here’s how a savings plan might look, based on two assumptions: (i) your retirement income is equal to 70% of your current annual income, and (ii) you are able to generate an annual return of 7%. the key takeaway from this table is that the earlier you start saving for retirement, the lower your monthly burden will be. The order of operations for saving. step 1 save in your 401k (up to the match) step 2 save the max in your ira. step 3 continue to max your 401k contributions. step 4 max your hsa. step 5 side hustle and do a sep ira. step 6 save in a standard brokerage account. step 7 be smart about social security. The value of your investment will fluctuate over time, and you may gain or lose money. fidelity brokerage services llc, member nyse, sipc, 900 salem street, smithfield, ri 02917. 940064.2.0. discover how you can live the life you want in retirement. get tips and guidance on topics from today's market to how much to save here. When you open an ira savings account, the amount of money you contribute to it counts toward your annual ira contribution limit. for 2024, the ira contribution limit is $7,000 for people under age 50 and $8,000 for people age 50 or older. certain factors may reduce amounts you can contribute or take a tax deduction for the contribution.

Infographics 7 Retirement Savings Goals For 2017 The value of your investment will fluctuate over time, and you may gain or lose money. fidelity brokerage services llc, member nyse, sipc, 900 salem street, smithfield, ri 02917. 940064.2.0. discover how you can live the life you want in retirement. get tips and guidance on topics from today's market to how much to save here. When you open an ira savings account, the amount of money you contribute to it counts toward your annual ira contribution limit. for 2024, the ira contribution limit is $7,000 for people under age 50 and $8,000 for people age 50 or older. certain factors may reduce amounts you can contribute or take a tax deduction for the contribution. It is recommended that an individual have 10 to 12 times their annual income at retirement age. so, for example, if your annual income is $70,000, you should have $700,000 to $840,000 in savings. Money in roth iras or roth 401 (k)s is not taxable income when you withdraw from them — as long as you follow the rules, meaning account holders must be 59½ or older and have held the account.

7 Types Of Iras A Savings Comparison Inside Your Ira Investing For It is recommended that an individual have 10 to 12 times their annual income at retirement age. so, for example, if your annual income is $70,000, you should have $700,000 to $840,000 in savings. Money in roth iras or roth 401 (k)s is not taxable income when you withdraw from them — as long as you follow the rules, meaning account holders must be 59½ or older and have held the account.

Comments are closed.