Savers Credit Retirement Savings Contributions Credit

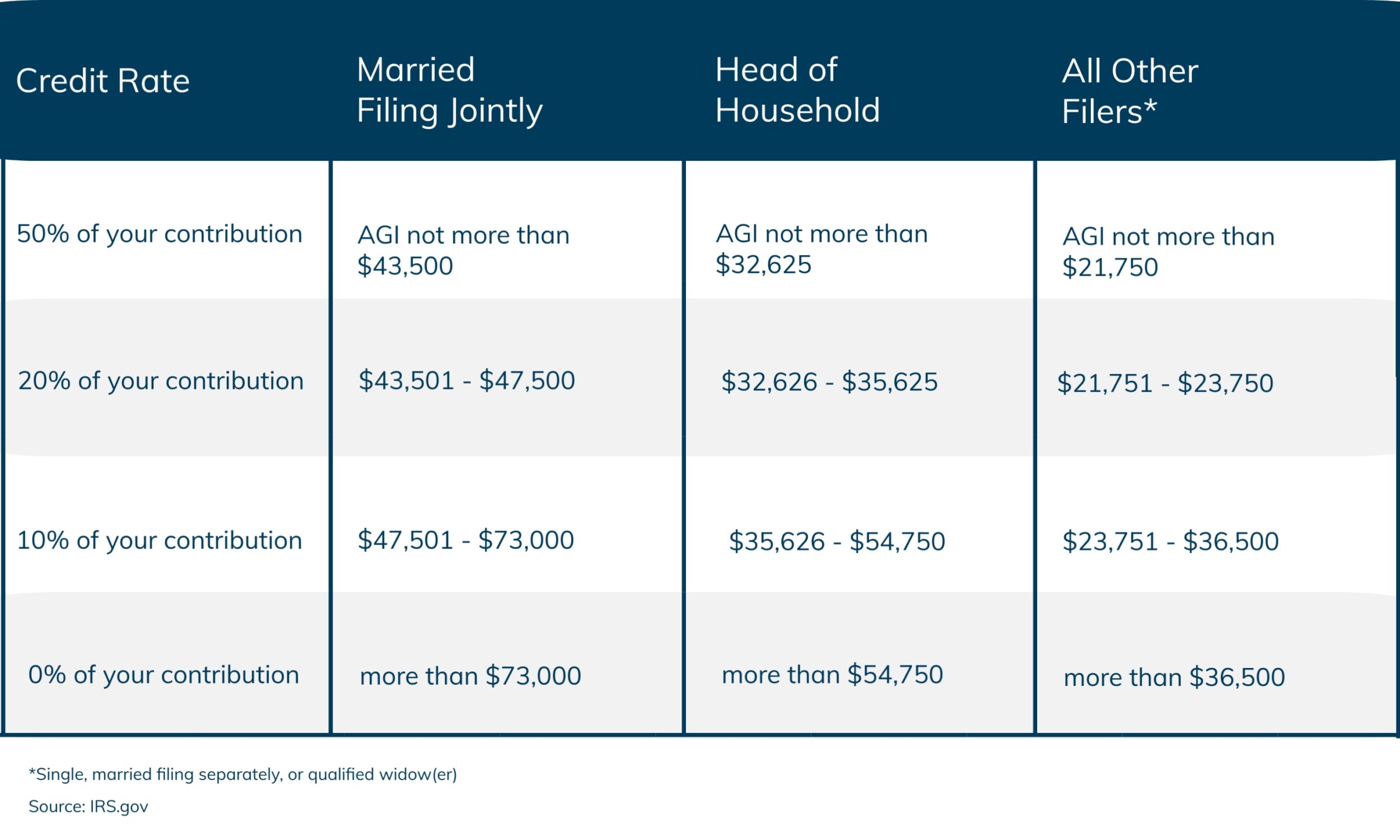

The Retirement Savings Contributions Credit Sweetercpa The maximum contribution amount that may qualify for the credit is $2,000 ($4,000 if married filing jointly), making the maximum credit $1,000 ($2,000 if married filing jointly). use the chart below to calculate your credit. example: jill, who works at a retail store, is married and earned $41,000 in 2021. jill’s spouse was unemployed in 2021. The retirement savings contribution credit — the "saver’s credit" for short — is a nonrefundable tax credit worth up to $1,000 ($2,000 if married filing jointly) for mid and low income.

What You Need To Know About The Saver S Credit "retirement savings contributions credit (saver's credit)." internal revenue service. " 2023 form 8880 ." internal revenue service. " 2024 limitations adjusted as provided in section 415(d), etc. Saving for retirement can be its own reward. but some retirement savers may get an extra incentive. a special part of the tax code known as the retirement savings contributions credit, or the saver's credit for short, provides a tax credit up to $2,000 to certain taxpayers saving for retirement. The retirement savings contributions credit, also known as the saver's credit, helps offset part of the first $2,000 workers voluntarily contribute to individual retirement arrangements (iras), 401(k) plans and similar workplace retirement programs. the credit also helps any eligible person with a disability who is the designated beneficiary of. Eligible workers still have time to make qualifying retirement contributions and get the saver's credit on their 2022 tax return. people have until april 18, 2023 the due date for filing their 2022 return to set up a new ira or add money to an existing ira for 2022.

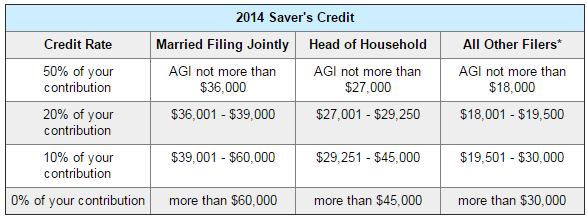

Retirement Savings Contributions Credit The Saver S Credit Vantagepoint The retirement savings contributions credit, also known as the saver's credit, helps offset part of the first $2,000 workers voluntarily contribute to individual retirement arrangements (iras), 401(k) plans and similar workplace retirement programs. the credit also helps any eligible person with a disability who is the designated beneficiary of. Eligible workers still have time to make qualifying retirement contributions and get the saver's credit on their 2022 tax return. people have until april 18, 2023 the due date for filing their 2022 return to set up a new ira or add money to an existing ira for 2022. 2023 saver’s credit income limits. the maximum possible tax credit is capped at $1,000 for a single filer or $2,000 if you’re married and filing jointly. if you’re single and your agi. The saver's credit is worth 10%, 20% or 50% of your retirement account contributions, with workers with the lowest income getting the biggest credit. retirement savers with an adjusted gross.

Comments are closed.