Saver S Credit Tax Credit

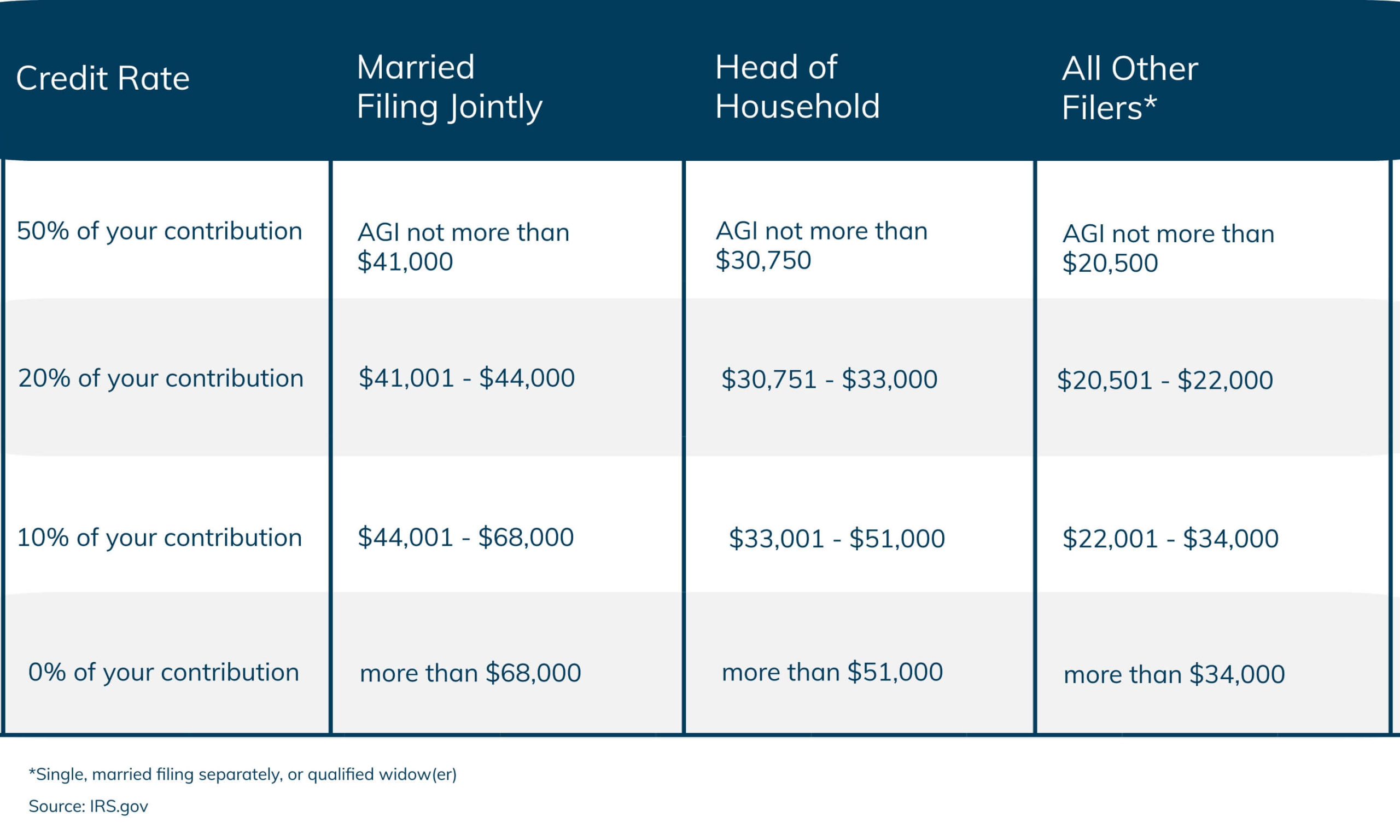

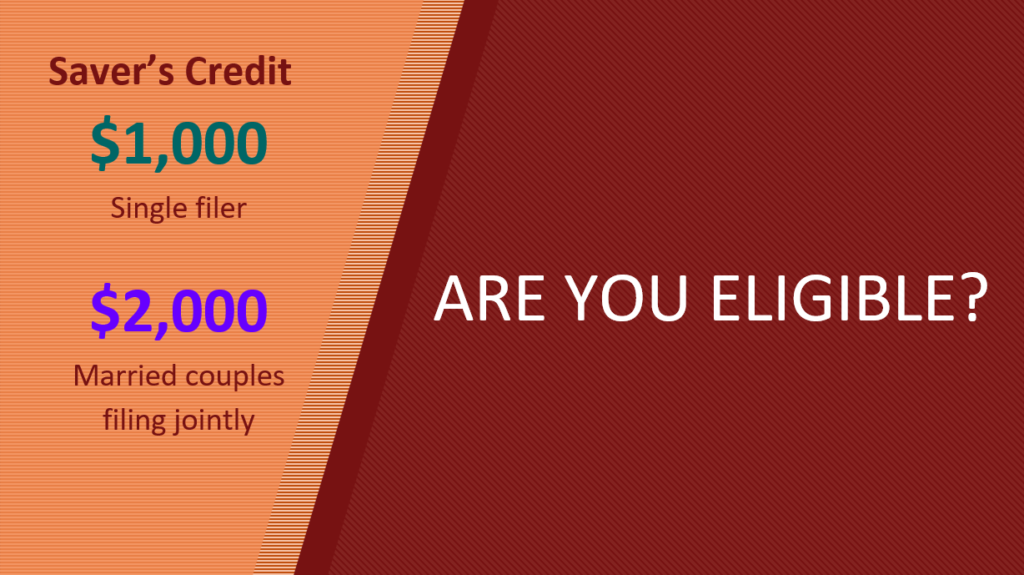

What You Need To Know About The Saver S Credit Low- and moderate-income workers who are saving something — anything — for retirement may be eligible to claim the Saver’s Credit, which is a dollar-for-dollar reduction of their tax bill To be For the 2025 tax year, the IRS is increasing the annual contribution the phase-out range rises by $6,000 to between $236,000 and $246,000 The Saver's Credit, also known as the Retirement Savings

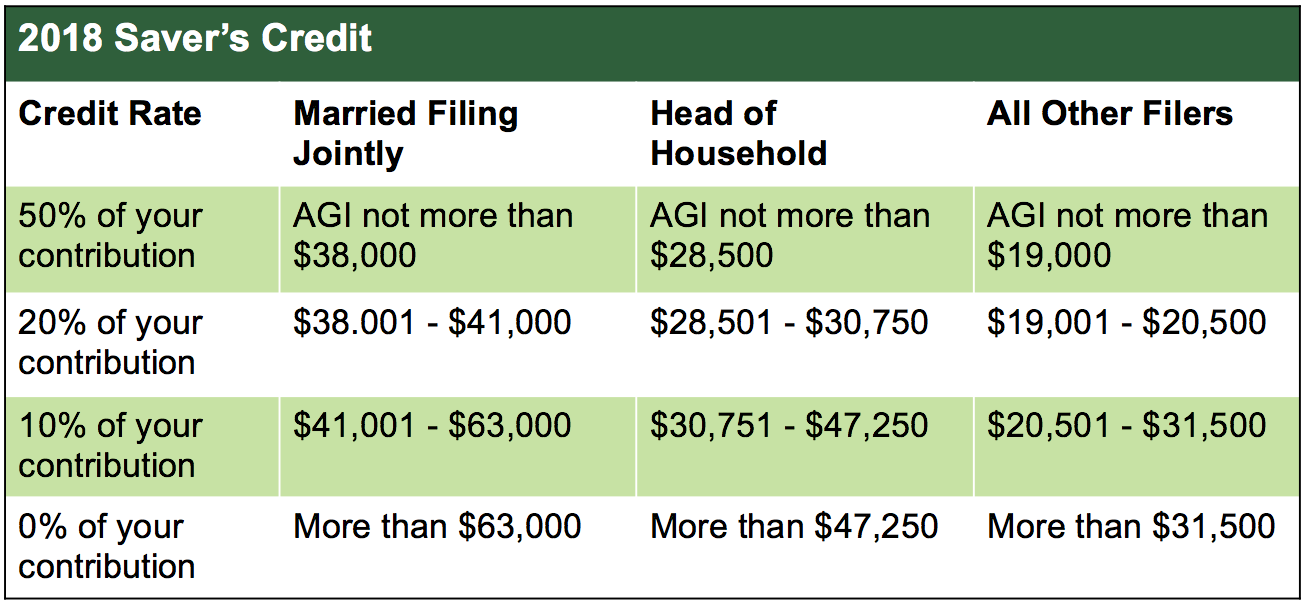

2018 Saver S Tax Credit Touchstone Retirement The IRS announced today it will increase 401(k) contribution limits to $23,500 (from $23,000 in 2024), the same increase as last year, while limits for employees over 50 remains unchanged The announcement provides information on all the cost-of-living adjustments affecting dollar limitations for retirement-related items in the tax year 2025 The chancellor’s Budget announcement that pensions will be liable for inheritance tax from April 2027 will have big implications for many people’s retirement plans We look at what to do now to avoid She's been writing about credit cards and reward travel since 2011 with articles on Forbes Advisor, BoardingArea, The Points Guy and more Her redemptio See Full Bio Becky PokoraCredit Card

Tax Credit For Retirement Savings Contributions Saver S Credit The chancellor’s Budget announcement that pensions will be liable for inheritance tax from April 2027 will have big implications for many people’s retirement plans We look at what to do now to avoid She's been writing about credit cards and reward travel since 2011 with articles on Forbes Advisor, BoardingArea, The Points Guy and more Her redemptio See Full Bio Becky PokoraCredit Card Low- and moderate-income workers who are saving something — anything — for retirement may be eligible to claim the Saver’s Credit, which is a dollar-for-dollar reduction of their tax bill

The Saver S Credit Are You Eligible Dupage Tax Solutions Low- and moderate-income workers who are saving something — anything — for retirement may be eligible to claim the Saver’s Credit, which is a dollar-for-dollar reduction of their tax bill

The Saver S Credit An Overlooked Tax Boost Surviving And Thriving

Comments are closed.