Saver S Credit Guide Transamerica Institute

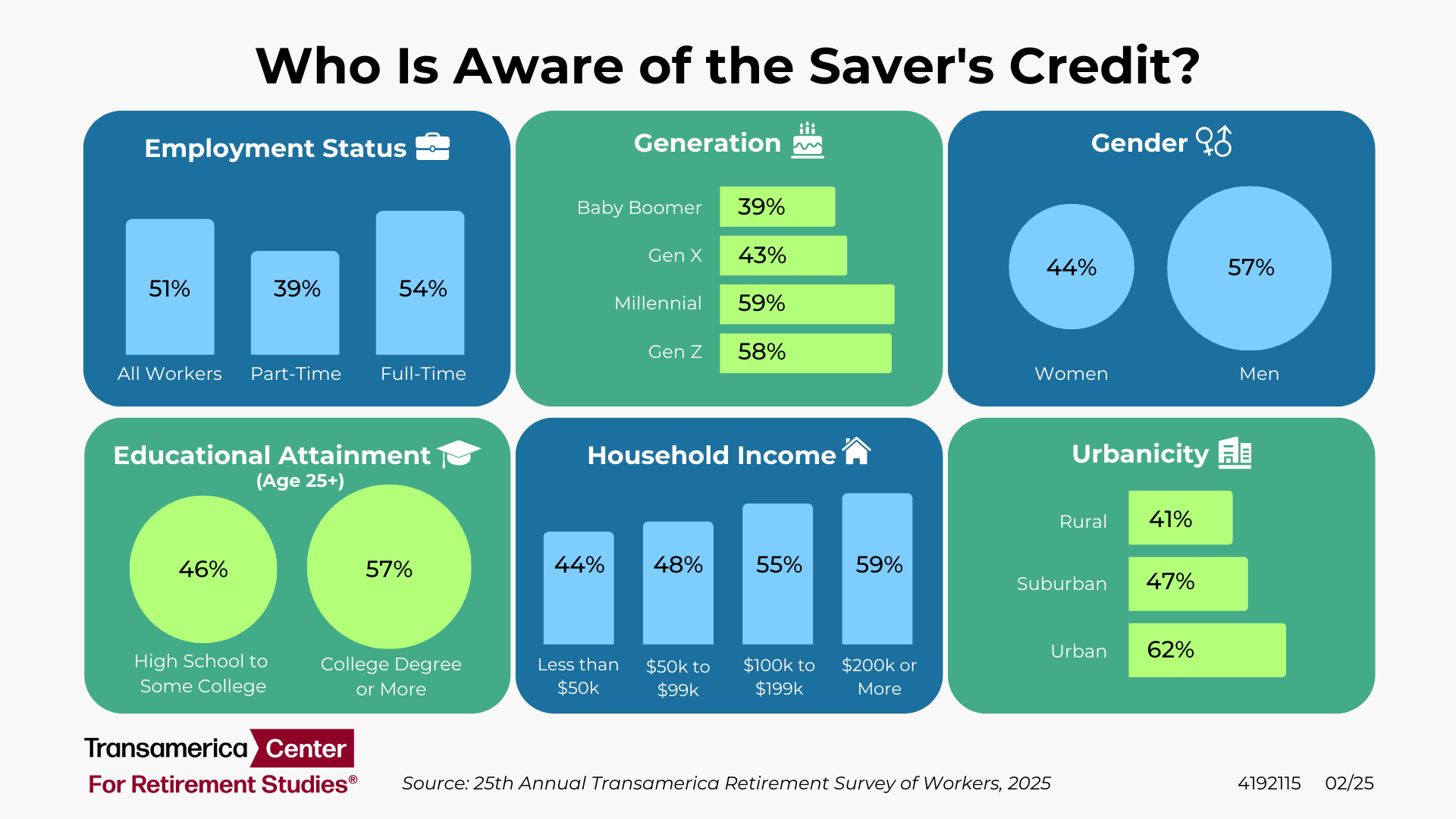

Saver S Credit Guide Transamerica Institute Your credit rate can be as low as 10% or as high as 50%, depending on your income and filing status. that's a maximum credit of up to $1,000 for single filers or individuals and up to $2,000 for married couples filing jointly. the average amount of the saver's credit was $191 in 2021, according to an analysis of irs data by tcrs. The saver’s credit, a tax credit, is designed as an incentive to help low to moderate income workers save for retirement in a 401 (k), 403 (b), or similar plan, or ira. it was established in 2001, and more than 20 years later, many workers are unaware of it. in 2027, the saver’s credit will be replaced with a new saver’s match, a.

Saver S Credit Guide Transamerica Institute The saver’s credit represents the first piece of major legislation focused on promoting tax qualified retirement savings among low to moderate income workers. it was established with the enactment of the economic growth and tax reconciliation relief act of 2001 and made permanent in the pension protection act of 2006, both laws resulting. The maximum contribution amount that may qualify for the credit is $2,000 ($4,000 if married filing jointly), making the maximum credit $1,000 ($2,000 if married filing jointly). use the chart below to calculate your credit. example: jill, who works at a retail store, is married and earned $41,000 in 2021. jill’s spouse was unemployed in 2021. Transamerica institute is funded by contributions from transamerica life insurance company and its affiliates. for more information please refer to transamericainstitute.org 3347008 02 24 2 the saver’s credit the amount of the credit you can get is based on the contribu˜ons you make and your “credit rate.” your credit rate. The saver’s credit was the first major legislation focused on promoting tax qualified retirement savings among low to moderate income workers. according to tcrs’ analysis of the irs statistics of income, the number of tax filers claiming the saver’s credit has increased steadily to 9.6 million in 2019—the most recent year in which irs.

Saver S Credit Guide Transamerica Institute Transamerica institute is funded by contributions from transamerica life insurance company and its affiliates. for more information please refer to transamericainstitute.org 3347008 02 24 2 the saver’s credit the amount of the credit you can get is based on the contribu˜ons you make and your “credit rate.” your credit rate. The saver’s credit was the first major legislation focused on promoting tax qualified retirement savings among low to moderate income workers. according to tcrs’ analysis of the irs statistics of income, the number of tax filers claiming the saver’s credit has increased steadily to 9.6 million in 2019—the most recent year in which irs. Transamerica institute ceo & president catherine collinson joins yahoo finance live to discuss the saver's tax credit, how individuals making less than $33,000 may qualify, and the irs free file. “in addition to the other tax advantages of saving for retirement in a 401(k), 403(b) or [individual retirement account], the saver’s credit is a benefit that may reduce a person’s federal tax bill,” catherine collinson, ceo and president of transamerica institute and tcrs, said in a statement. “many retirement savers could be.

Comments are closed.