Saver S Credit Eligibility Income Limit Qualify Plans Form 8880

:max_bytes(150000):strip_icc()/2022Form8880-8fe5fa4359674a21bcfd5a8fa5c692b4.jpg)

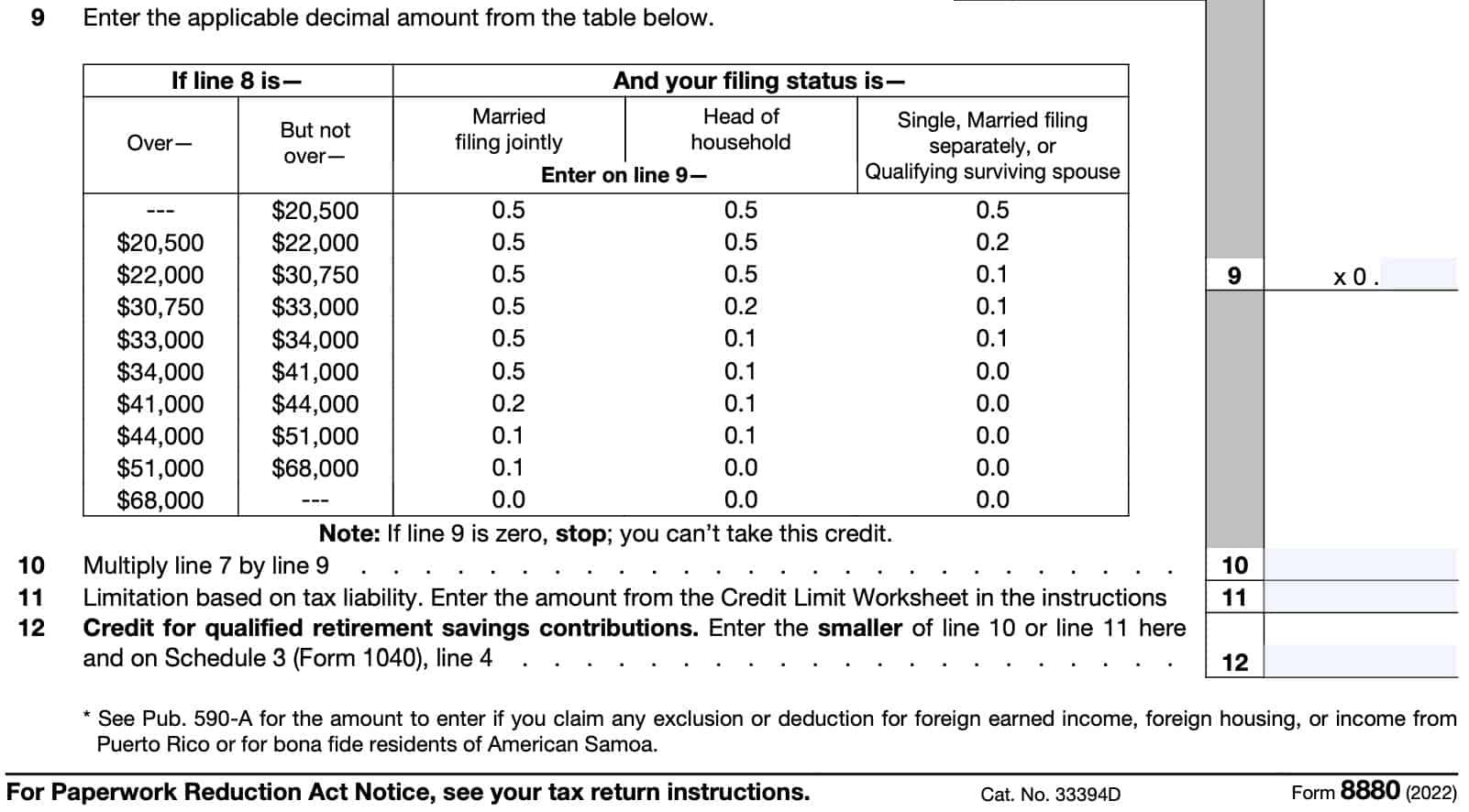

Irs Form 8880 Who Qualifies For The Retirement Saver S Credit The maximum contribution amount that may qualify for the credit is $2,000 ($4,000 if married filing jointly), making the maximum credit $1,000 ($2,000 if married filing jointly). use the chart below to calculate your credit. example: jill, who works at a retail store, is married and earned $41,000 in 2021. jill’s spouse was unemployed in 2021. See the instructions to form 8880, credit for qualified retirement savings contributions, for a list of qualifying workplace retirement plans and additional details. eligibility. to be eligible, taxpayers must be 18 years of age and older, not claimed as a dependent and not a full time student. the saver's credit has income limits based on a.

:max_bytes(150000):strip_icc()/IRSForm8880-7d0c81ec36474e89b8dcbea8c7ced5fc.jpg)

Form 8880 Credit For Qualified Retirement Savings Contributions Anyone who plans to claim the saver's credit on their taxes will complete form 8880 and file it with their tax return. to be eligible for the saver's credit, you must: be at least 18 years old. The saver's credit is a tax credit that low and moderate income individuals may claim for qualified contributions to eligible retirement accounts. it is a nonrefundable credit, meaning it can only reduce taxes, even to a point where taxes may be reduced to $0. you may still receive a tax refund if you had taxes withheld greater than your tax. Form 8880 is used to claim the saver's credit, and its instructions have details on figuring the credit correctly. in tax year 2020, the most recent year for which complete figures are available, saver's credits totaling more than $1.7 billion were claimed on about 9.4 million individual income tax returns. that's an average of about $186 per. Key takeaways. you use irs form 8880 to calculate and claim the saver's credit, a tax benefit designed to encourage lower income individuals to save for retirement. the credit is a percentage of your contributions to qualified retirement plans like iras and 401 (k)s, ranging from 10% to 50%, depending on your income.

Learn How To Fill The Form 8880 Credit For Qualified Retirement Savings Form 8880 is used to claim the saver's credit, and its instructions have details on figuring the credit correctly. in tax year 2020, the most recent year for which complete figures are available, saver's credits totaling more than $1.7 billion were claimed on about 9.4 million individual income tax returns. that's an average of about $186 per. Key takeaways. you use irs form 8880 to calculate and claim the saver's credit, a tax benefit designed to encourage lower income individuals to save for retirement. the credit is a percentage of your contributions to qualified retirement plans like iras and 401 (k)s, ranging from 10% to 50%, depending on your income. The nonrefundable tax credit is worth 10%, 20%, or 50% of up to $2,000 of contributions based on filing status and income based on a phaseout range (for a maximum credit of $1,000). what are the income limits for the saver’s credit? for 2020, the following income limits apply to the saver's credit based on filing status:. The saver's credit is worth 10%, 20% or 50% of your retirement account contributions, with workers with the lowest income getting the biggest credit. retirement savers with an adjusted gross.

Saver S Credit Eligibility Income Limit Qualify Plans Form 8880 The nonrefundable tax credit is worth 10%, 20%, or 50% of up to $2,000 of contributions based on filing status and income based on a phaseout range (for a maximum credit of $1,000). what are the income limits for the saver’s credit? for 2020, the following income limits apply to the saver's credit based on filing status:. The saver's credit is worth 10%, 20% or 50% of your retirement account contributions, with workers with the lowest income getting the biggest credit. retirement savers with an adjusted gross.

Irs Form 8880 Instructions Retirement Savings Tax Credit

Comments are closed.