S P500 Vs Principal Strip

S P500 Vs Principal Strip The most notable case is fidelity zero large cap index fnilx. although the fund invests in “stocks of the largest 500 u.s. companies,” it is not in fact an s&p 500 clone. thus, while the index. Plsax principal large cap s&p 500 index a review the plsax stock price, growth, performance, sustainability and more to help you make the best investments.

S P 500 Dempricgetoar A principal only (po) strip is the part of a stripped mbs where the holder only receives principal payments. the other part of a stripped mbs is an interest only (io) strip. po strips holders. By becoming a strips, the $10,000 face value of the bond is separated and sold as a single zero coupon bond. an investor might purchase this principal strips at a price lower than $10,000, say. The s&p 500 index is this company’s flagship product, composed of the 500 largest u.s. companies when ranked by market value. an index fund is a diversified investment vehicle that is locked to. For example, although fourth cheapest overall over the trailing decade, schwab s&p 500 index swppx now boasts the lowest expense ratio of the group, at 0.02%. second, aside from rydex, each fund.

Bitcoin Analysis 10 18 22 Btc Vs S P500 For Coinbase Btcusd By The s&p 500 index is this company’s flagship product, composed of the 500 largest u.s. companies when ranked by market value. an index fund is a diversified investment vehicle that is locked to. For example, although fourth cheapest overall over the trailing decade, schwab s&p 500 index swppx now boasts the lowest expense ratio of the group, at 0.02%. second, aside from rydex, each fund. As is stated in the acronym, strips are simply bonds that have had the interest payments stripped away and sold separately, while the principal amount is still paid out at maturity. the u.s. Qqqm's paltry 0.7% 30 day sec yield is not going to turn heads, but historically it has been a top performer, with a 14% total annualized return since its inception in 2020. the low yield also.

S P500 Investing You Must Know The Difference Between Spx And Spy As is stated in the acronym, strips are simply bonds that have had the interest payments stripped away and sold separately, while the principal amount is still paid out at maturity. the u.s. Qqqm's paltry 0.7% 30 day sec yield is not going to turn heads, but historically it has been a top performer, with a 14% total annualized return since its inception in 2020. the low yield also.

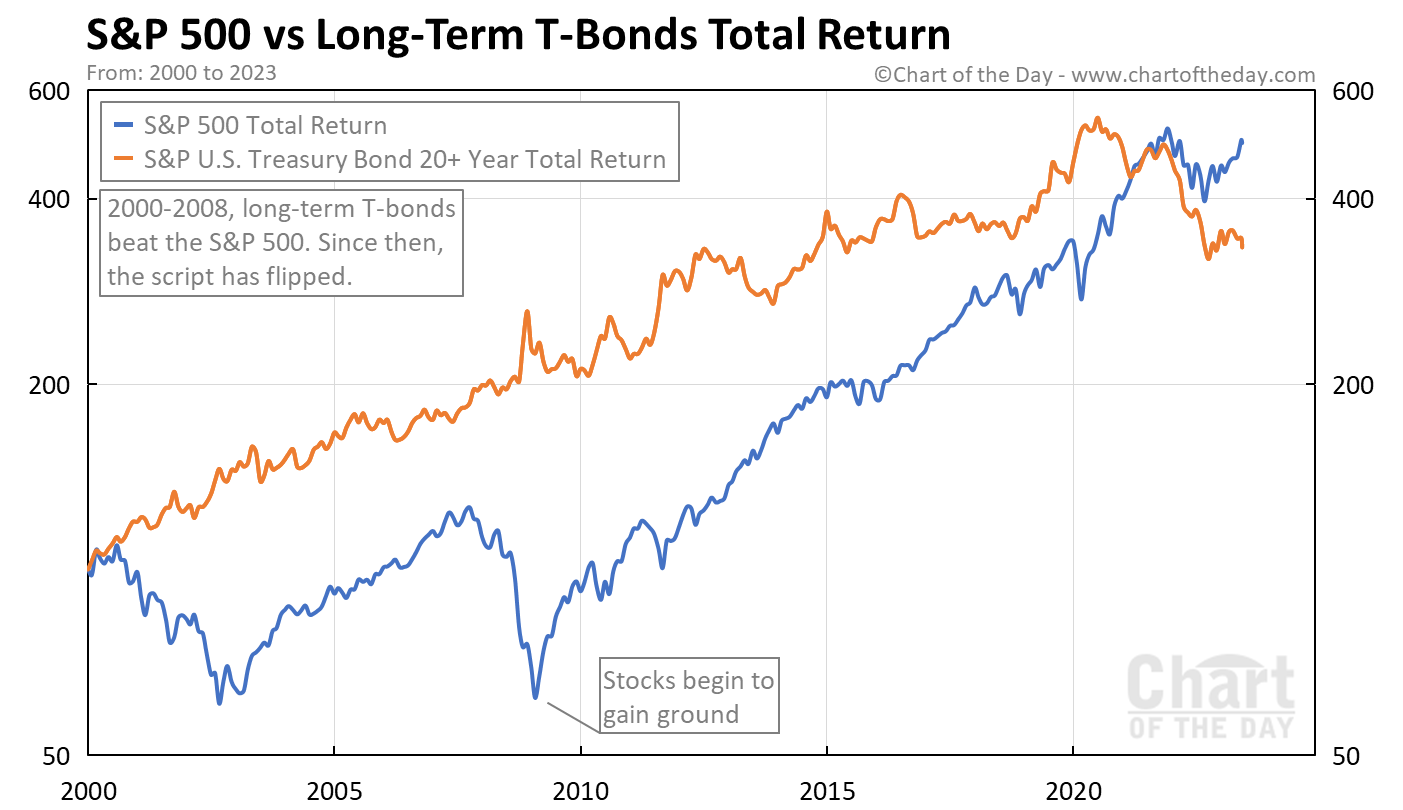

S P 500 Vs T Bonds Chart Of The Day

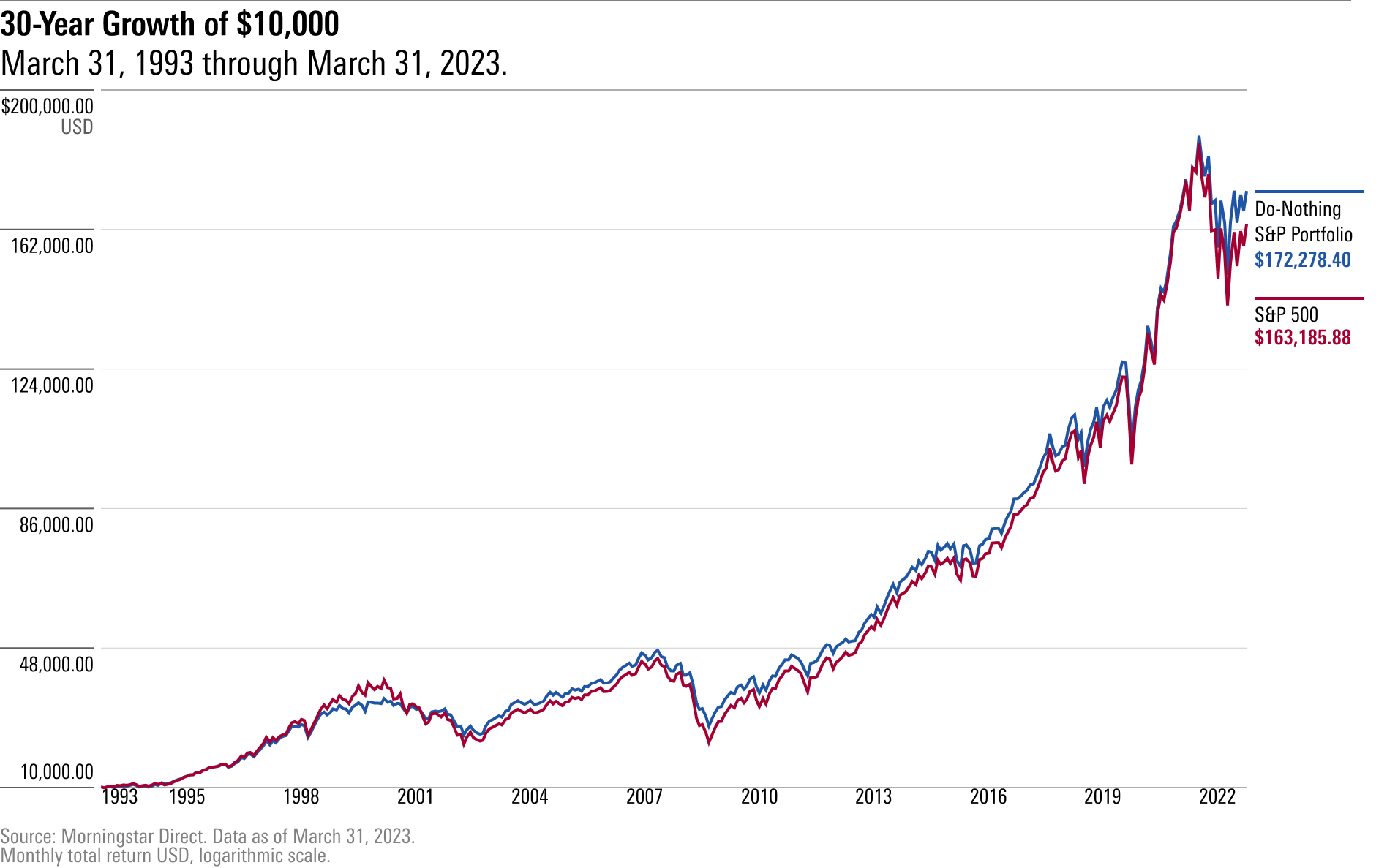

What Beat The S P 500 Over The Past Three Decades Doing Nothing

Comments are closed.