S P500 Vs M2 Apollo Academy

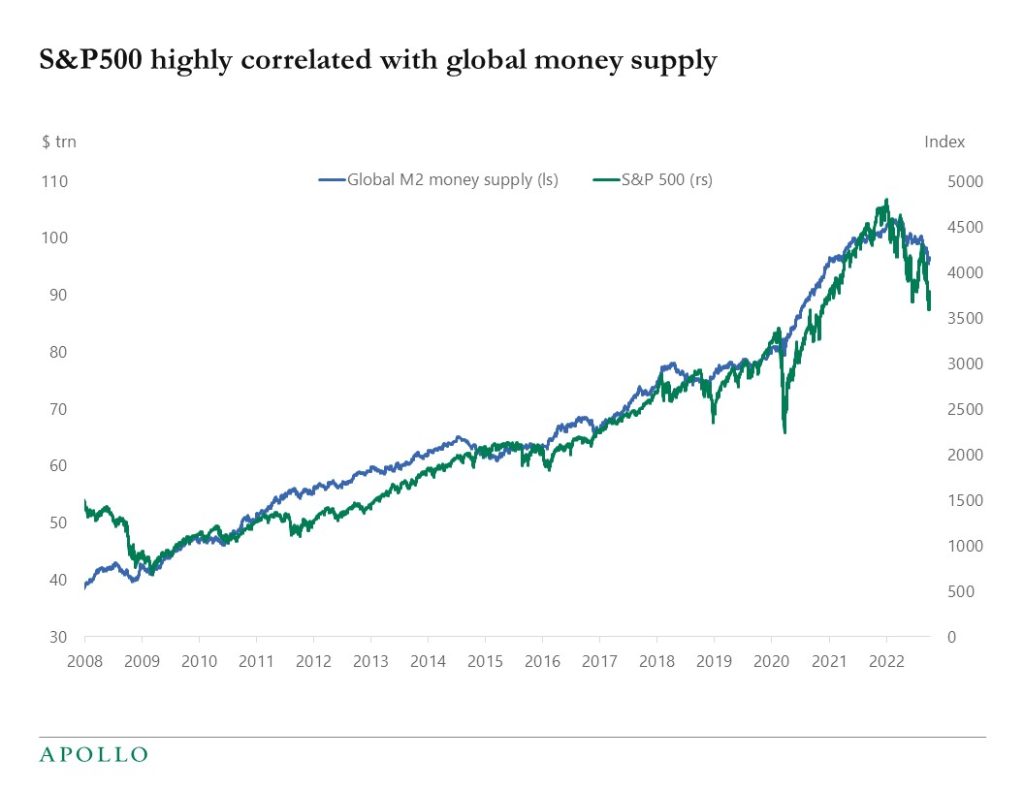

S P500 Vs M2 Apollo Academy S&p500 vs. m2. central banks are withdrawing liquidity, and it is having a negative impact on credit and equity markets, see chart below. this presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of apollo global management, inc. (together with its subsidiaries. It is found that m2 at lag 8 gives the best regression model for predicting s&p 500 index. it has the linear equation yt = 0.300xt 8 – 1431. using this linear model, forecasts for s&p 500 index.

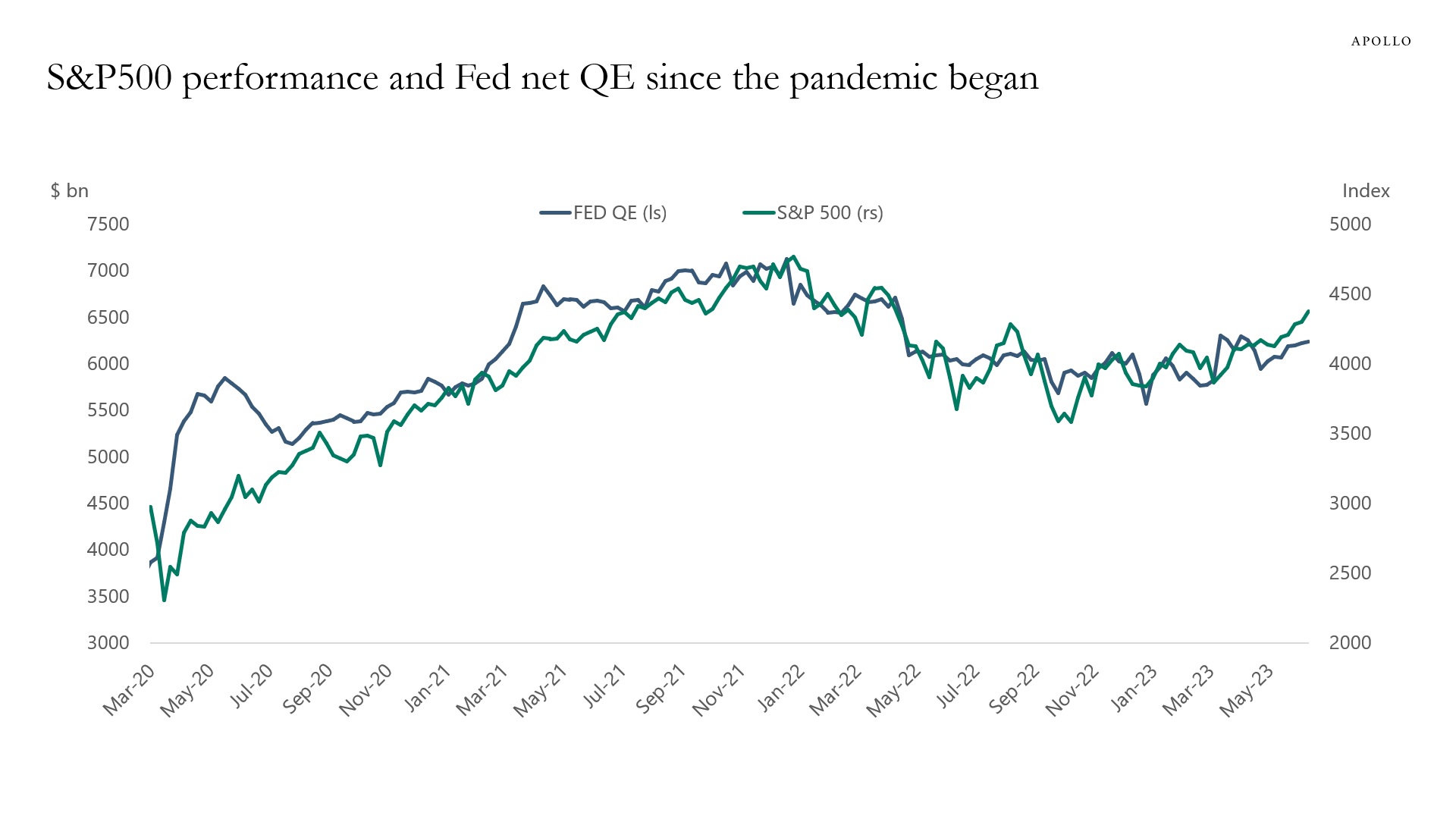

S P500 And Fed Qe Highly Correlated Apollo Academy Graph and download economic data for s&p 500 m2 from jan 1959 to nov 2024 about stock market, indexes, usa, m2, and monetary aggregates. The analysis of the s&p 500 index and u.s. money supply m2 from 1970 to may 2024 reveals a general upward trend for both indices, with the money supply m2 showing stable growth and the s&p 500 index exhibiting higher volatility. the correlation between the two suggests that while increases in the money supply can contribute to stock market. M1 : equals the total of all currency, plus checkable deposits and traveler's checks (assets that can be used to pay bills and debts). m1 does not include the bank reserves included in the monetary base. m2 : equals m1, plus savings deposits, money market deposits, and time deposits less than $100,000. for many, m2 is the figure to watch in. It looks at the sp500 index level divided by the value for the monetary aggregate measure known as m2. for the uninitiated, m2 consists of all of the currency in circulation and in bank vaults, plus travelers checks, demand deposits, other checkable deposits, savings accounts, and money market funds. it is a commonly used measure of the total.

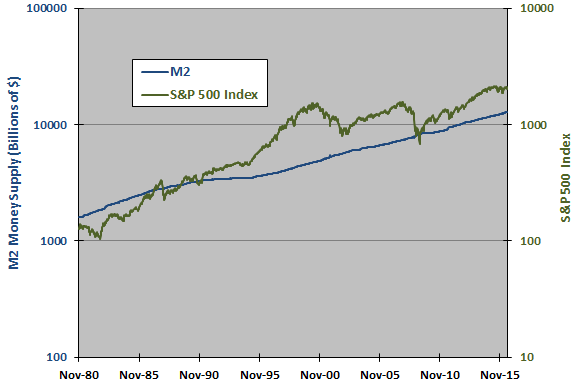

Money Supply M2 And The Stock Market Cxo Advisory M1 : equals the total of all currency, plus checkable deposits and traveler's checks (assets that can be used to pay bills and debts). m1 does not include the bank reserves included in the monetary base. m2 : equals m1, plus savings deposits, money market deposits, and time deposits less than $100,000. for many, m2 is the figure to watch in. It looks at the sp500 index level divided by the value for the monetary aggregate measure known as m2. for the uninitiated, m2 consists of all of the currency in circulation and in bank vaults, plus travelers checks, demand deposits, other checkable deposits, savings accounts, and money market funds. it is a commonly used measure of the total. M1 money supply vs. s&p 500 index. comparison on m1 money supply to s&p 500 index 2011 2020. in early march 2020, m1 money supply was at $4 trillion. today, m1 supply has been increased by 55% to $6.2 trillion as s&p 500 index is at record highs. paul mangione. Since 1972, the total market and s&p 500 are 99.9% the same, with a slight edge to the total market (source). i’m not a fan of the russell indexes but small caps have destroyed large caps historically, especially small cap value with more than 3% better returns over 50 years. but the premiums are not constant, they are intermittent.

Comments are closed.