Rsi Trading Strategy Rsi Indicator How To Use Rsi Indicator

How To Trade Blog What Is The Rsi Indicator How To Use The Rsi A rsi 14 trading strategy involves using the relative strength index (rsi) indicator, which measures the magnitude of recent price changes to evaluate whether a stock is overbought or oversold. the rsi is calculated based on the average gains and losses over a specific period, typically 14 days. Rsi trading strategies include (but are not limited to) overbought oversold identification, 50 crossover, divergence, and failure swings. combining rsi with other indicators like moving averages, bollinger bands, macd, stochastic oscillator, and fibonacci retracements may enhance market analysis. rsi has limitations, such as producing false.

Secret Of Rsi How To Use Rsi Indicator Relative Strength Index Trading strategies using the relative strength index indicator although the rsi is an effective tool, it is always better to combine it with other technical indicators to validate trading decisions. the relative strength index trading strategies we will cover in the next section will show you how to reduce the number of false signals so. Rsi is a momentum oscillator, so it helps traders gauge the strength of a trend. for example, if the rsi stays above 50 during an uptrend, it confirms the strength of that upward momentum. this confirmation can give traders confidence in continuing to hold their positions. 4. reversal signals. The actual rsi value is calculated by indexing the indicator to 100, through the use of the following rsi formula example: rsi = 100 (100 1 rs) if you are using metatrader (mt4), you can attach the indicator on your mt4 chart, and simply drag and drop it to the main chart window. Rsi is short for relative strength index. it is a trading indicator used in technical analysis (a momentum oscillator) that measures the magnitude of recent price moves to determine whether overbought or oversold conditions are present in the price of a stock. the rsi is typically measured on a scale of 0 to 100, with the default overbought and.

How To Use The Relative Strength Index Rsi Charles Schwab The actual rsi value is calculated by indexing the indicator to 100, through the use of the following rsi formula example: rsi = 100 (100 1 rs) if you are using metatrader (mt4), you can attach the indicator on your mt4 chart, and simply drag and drop it to the main chart window. Rsi is short for relative strength index. it is a trading indicator used in technical analysis (a momentum oscillator) that measures the magnitude of recent price moves to determine whether overbought or oversold conditions are present in the price of a stock. the rsi is typically measured on a scale of 0 to 100, with the default overbought and. The relative strength index (rsi) is a momentum indicator used in technical analysis. rsi measures the speed and magnitude of a security's recent price changes to detect overvalued or undervalued. It oscillates between 0 and 100 and the purpose is to measure the “speed” of a price movement. this means the faster the price goes up, the higher the rsi value (and vice versa). here’s the rsi indicator formula…. rsi = 100 – 100 [1 rs] where rs = average gain average loss. wait!.

How To Use Relative Strength Index Rsi In Forex Trading Rsi Indicator The relative strength index (rsi) is a momentum indicator used in technical analysis. rsi measures the speed and magnitude of a security's recent price changes to detect overvalued or undervalued. It oscillates between 0 and 100 and the purpose is to measure the “speed” of a price movement. this means the faster the price goes up, the higher the rsi value (and vice versa). here’s the rsi indicator formula…. rsi = 100 – 100 [1 rs] where rs = average gain average loss. wait!.

The Ultimate Guide To The Rsi Indicator New Trader U

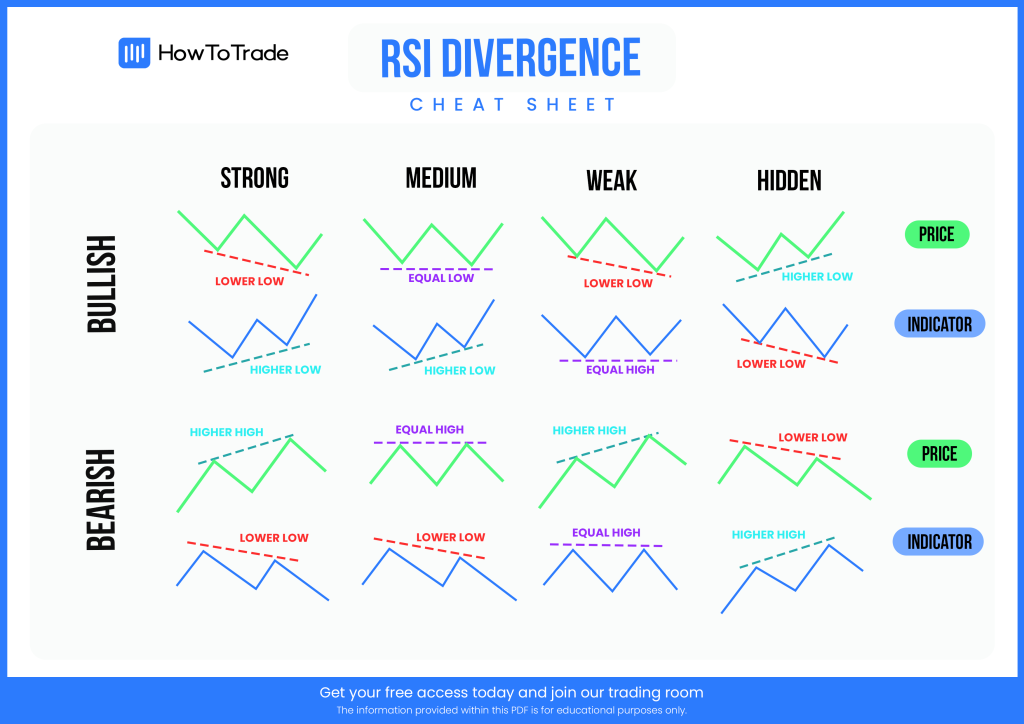

Rsi Divergence Cheat Sheet Pdf Free Download

Comments are closed.