Rsi Divergence New Trader U

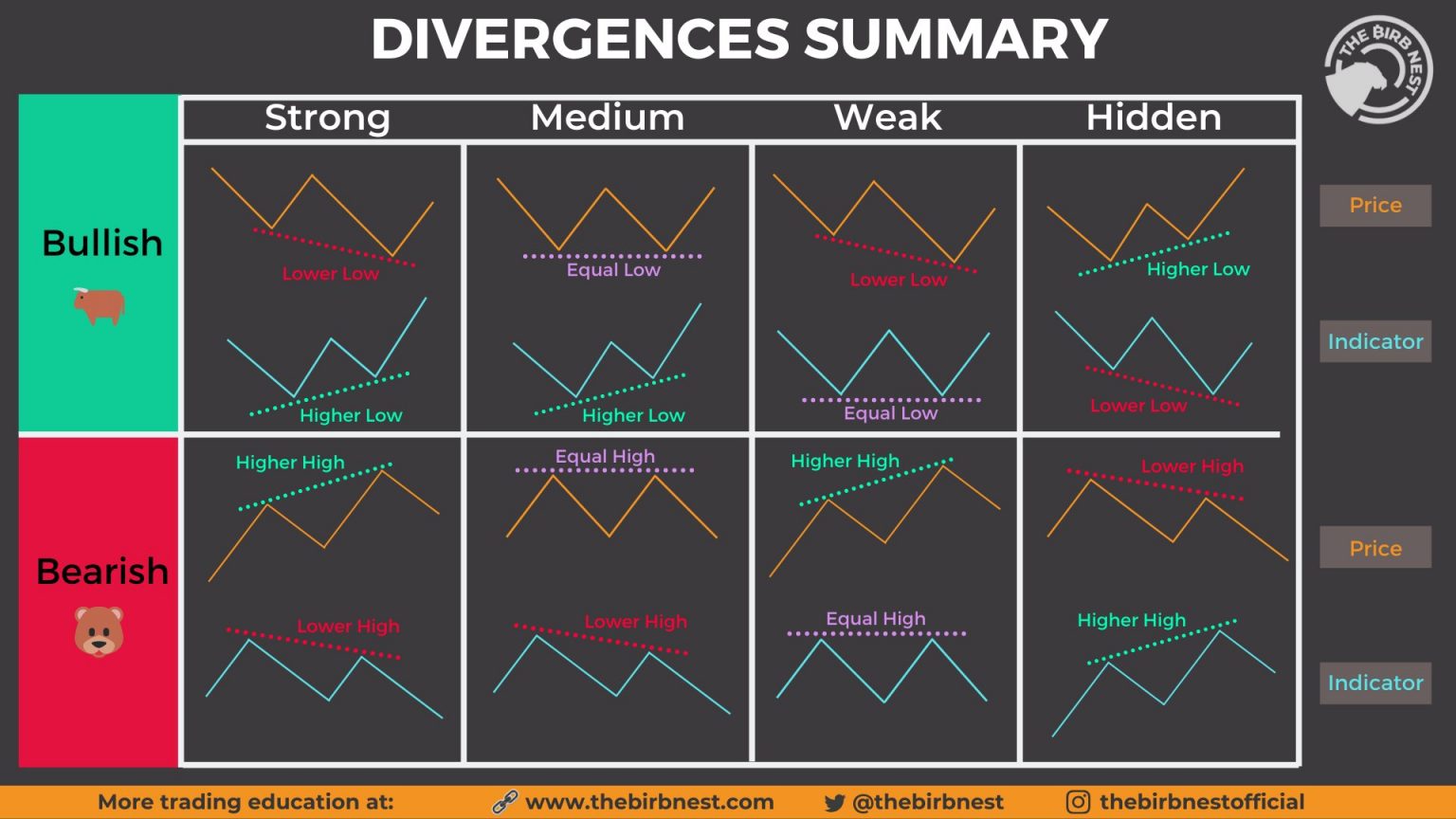

Rsi Divergence New Trader U Rsi divergence cheat sheet. an rsi divergence indicator signal shows traders when price action and the rsi are no longer showing the same momentum. the rsi shows the magnitude of a price move in a specific timeframe. the rsi is one of the most popular oscillators used in technical analysis. a divergence looks at it in relation to the current. Technical oscillators used in identifying a divergence include the popular relative strength index (rsi). the rsi not only measures the extremes of overbought (70) or oversold (30) but can also show divergences between it making lower lows while price is making higher highs. rsi can not only signal bullish or bearish levels to enter or exit.

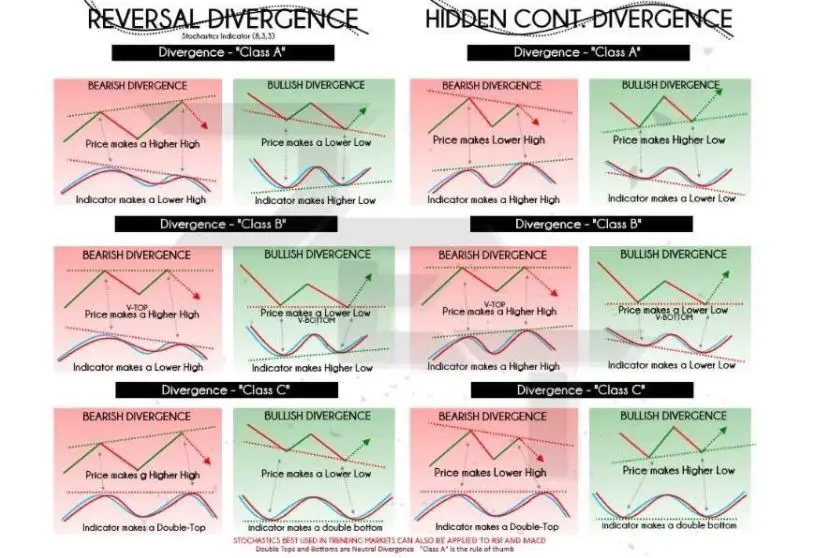

Rsi Divergence New Trader U Rsi divergence signals show traders when price action and the rsi are no longer showing the same momentum. the rsi shows the magnitude of a price move in a specific timeframe. the rsi is one of the most popular oscillators used in technical analysis. a divergence shows the relation between the rsi and current price action is becoming uncorrelated. A regular bearish rsi divergence occurs when the rsi indicator shows lower lows while the asset’s price forms higher highs. when this happens, the rsi regular bearish divergence signals the possibility of a trend reversal, and a bearish trend or price correction is very likely to occur. the hidden bearish divergence occurs when the asset’s. The rsi forms this type of divergence occurs when it makes a higher low, while the price swing is making a lower low. this divergence mostly forms after a prolonged downtrend or a multi legged pullback in an uptrend, and it indicates a bullish reversal signal. classical bearish divergence. the classical bearish divergence forms on the rsi when. For example, someone might consider any number above 80 as overbought and anything below 20 as oversold. this is entirely at the trader’s discretion. divergence. rsi divergence occurs when there is a difference between what the price action is indicating and what rsi is indicating. these differences can be interpreted as an impending reversal.

Rsi Divergence Cheat Sheet New Trader U The rsi forms this type of divergence occurs when it makes a higher low, while the price swing is making a lower low. this divergence mostly forms after a prolonged downtrend or a multi legged pullback in an uptrend, and it indicates a bullish reversal signal. classical bearish divergence. the classical bearish divergence forms on the rsi when. For example, someone might consider any number above 80 as overbought and anything below 20 as oversold. this is entirely at the trader’s discretion. divergence. rsi divergence occurs when there is a difference between what the price action is indicating and what rsi is indicating. these differences can be interpreted as an impending reversal. Combined with the rsi divergence dots on the rsi line and divergence signals on the overbought and oversold lines, this indicator has four ways to communicate that divergence has occurred. the rsi indicator is a great tool when used correctly. the rsi’s greatest ability is finding divergence and identifying market tops market bottoms. The default setting for rsi is 14. rsi has fixed boundaries with values ranging from 0 to 100. divergence helps a trader recognize and react appropriately to a change in price action. it tells.

Comments are closed.