Rsi Divergence How To Use Rsi Divergence Intraday Trading Strategy

Rsi Divergence How To Use Rsi Divergence Intraday Trading Strategy This is a warning sign that the trend direction might change from a downtrend to an uptrend. rsi divergence is widely used in forex technical analysis. some traders prefer to use higher time frames (h4, daily) for trading rsi divergence. using these strategies, you can achieve various rsi indicator buy and sell signals. Rsi trading strategy (91% win rate): backtest, indicator, and settings. the rsi trading strategy identifies overbought and oversold conditions in markets, measuring momentum on a scale. readings above indicate overbought, while below signify oversold. traders monitor divergence between price and rsi for potential reversals, often confirming.

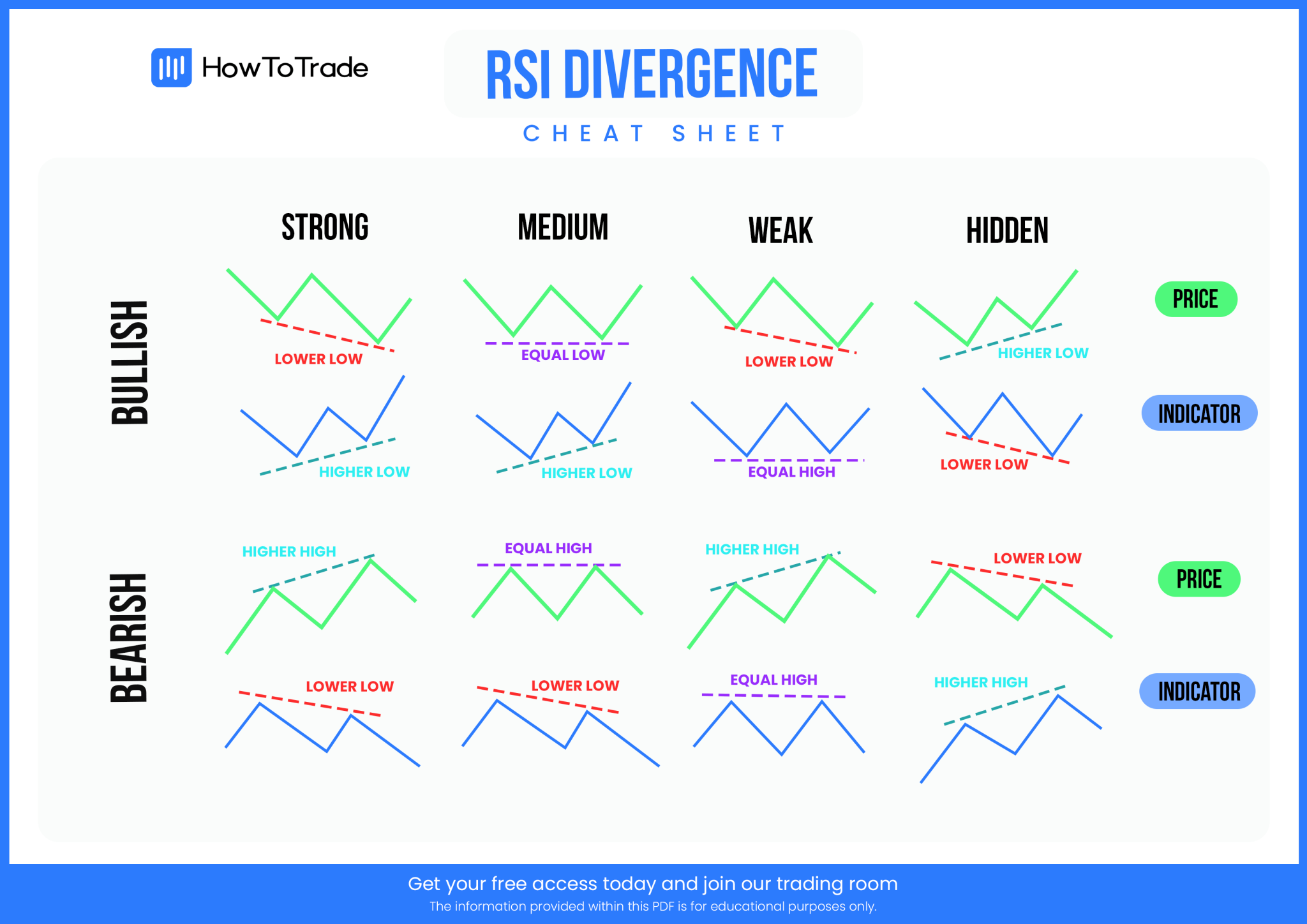

Rsi Divergence Cheat Sheet Pdf Free Download Without offering a change to the rsi “look back” period (typically set at 14), the rsi is best used to watch market peaks, valleys, and divergence when trading short term or intraday. however, the rsi is very adaptable and has many useful assets for every type of trader who understands how to adjust it for their specific use. Rsi divergence is considered to be a quite reliable signal of a coming trend violation and change. though newbie traders think that the application of the divergence is quite complicated, in practice, you can easily identify it with the following tips: 💠first of all, let's start with the settings. for the input, we will take 7 close. Step 1 – identify an uptrend characterized by a sequence of consistently higher highs. finding rsi bearish divergences is the opposite of finding rsi bullish divergences. to find a bearish rsi divergence, we first have to spot an uptrend or a series of consistently higher highs. finding a long term uptrend with numerous higher highs is not. Observe the rsi showing higher lows, indicating a potential bullish divergence. 3. look for a bullish divergence between the price and the rsi indicator. note that the price is making lower lows, but the rsi is making higher lows. this signals a potential trend reversal from a downtrend to an uptrend. 4.

What Is Rsi Divergence Learn How To Spot It Step 1 – identify an uptrend characterized by a sequence of consistently higher highs. finding rsi bearish divergences is the opposite of finding rsi bullish divergences. to find a bearish rsi divergence, we first have to spot an uptrend or a series of consistently higher highs. finding a long term uptrend with numerous higher highs is not. Observe the rsi showing higher lows, indicating a potential bullish divergence. 3. look for a bullish divergence between the price and the rsi indicator. note that the price is making lower lows, but the rsi is making higher lows. this signals a potential trend reversal from a downtrend to an uptrend. 4. Step 4 – find the divergence = different color lines. the lines have color just to be easier to find the divergence. basically, we just want to find colors that don’t match. that would be, a red line on the price, consecutive lower lows. and a green line on the rsi indicator, consecutive higher lows. This technical analysis tool is crucial for spotting potential reversals in the market before they happen, giving traders a unique advantage. understanding rsi divergence is essential because it helps traders identify possible points where the market could change direction. for anyone looking to enhance their trading strategy, getting to grips.

Comments are closed.