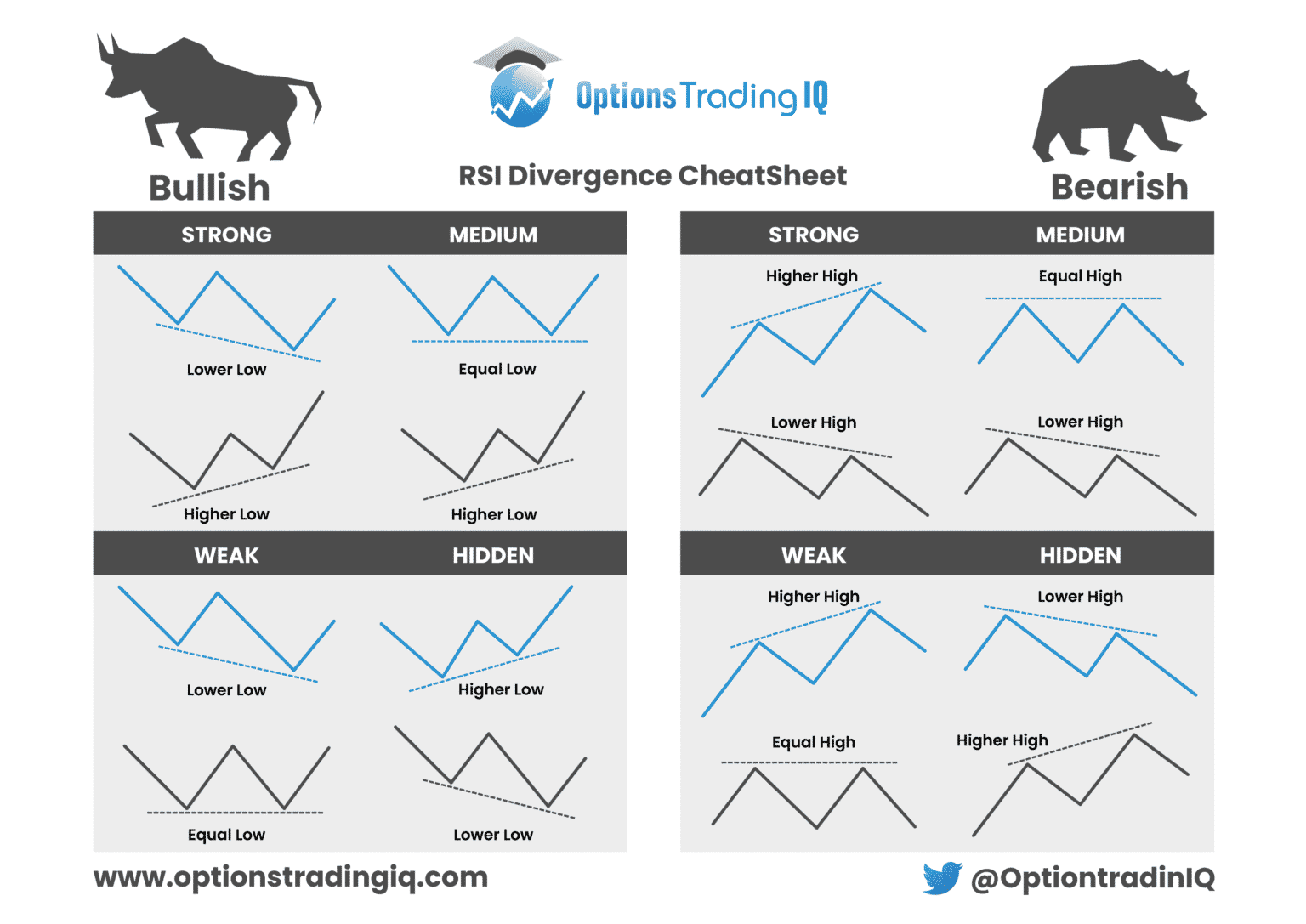

Rsi Divergence Cheat Sheet Stock Chart Patterns Stock Trading

Rsi Divergence Cheat Sheet Options Trading Iq A regular bearish rsi divergence occurs when the rsi indicator shows lower lows while the asset’s price forms higher highs. when this happens, the rsi regular bearish divergence signals the possibility of a trend reversal, and a bearish trend or price correction is very likely to occur. the hidden bearish divergence occurs when the asset’s. Traders can exploit these price discrepancies for profit. the divergence cheat sheet below offers an easily accessible, in depth look at what a divergence is, the different types of divergences, and how to trade divergence efficiently. note: you can get your free divergence cheat sheet pdf below.

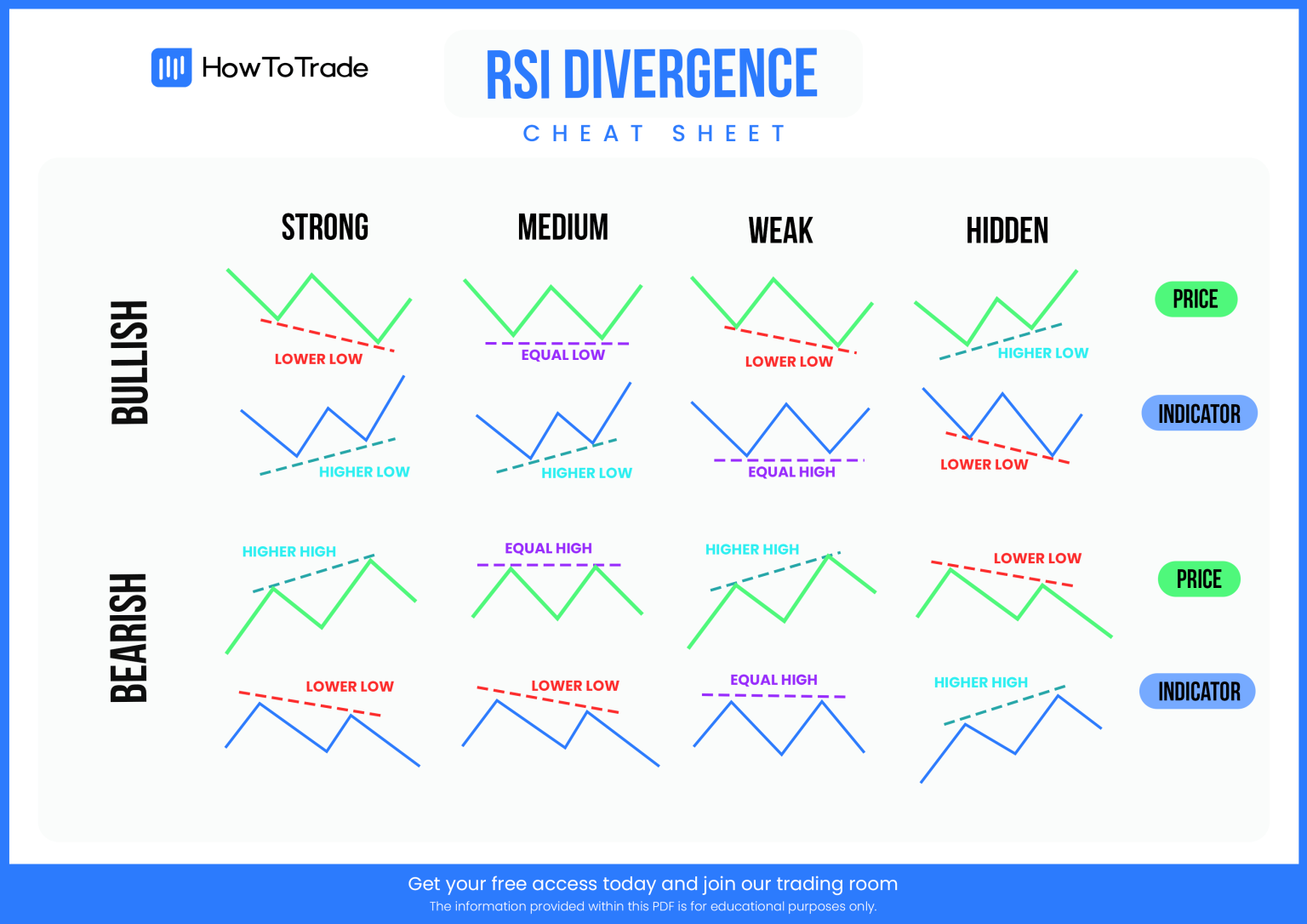

Rsi Divergence Cheat Sheet Pdf Free Download Rsi divergence cheat sheet and pdf guide. by stock markets guides. the relative strength index, or rsi as it is known, is a momentum indicator that you can use with your technical analysis. while you can use the rsi by itself in your trading, you can also use it to find and trade divergence. in this post, we go through exactly what the rsi is. In technical analysis, divergence refers to the phenomenon when the price and a technical indicator (like the rsi) display conflicting signals. for instance, if price forms a higher high while the rsi forms a lower high, it indicates bearish divergence. price and the rsi, which should typically move in tandem, end up showing contradictory signals. Rsi divergence occurs when the relative strength index (rsi) indicator and the price action of an asset move in opposite directions. this divergence can be a strong signal that the current trend might be weakening and potentially about to reverse. regular divergence: this happens when the price makes a new high or low that is not supported by. Observe the rsi showing higher lows, indicating a potential bullish divergence. 3. look for a bullish divergence between the price and the rsi indicator. note that the price is making lower lows, but the rsi is making higher lows. this signals a potential trend reversal from a downtrend to an uptrend. 4.

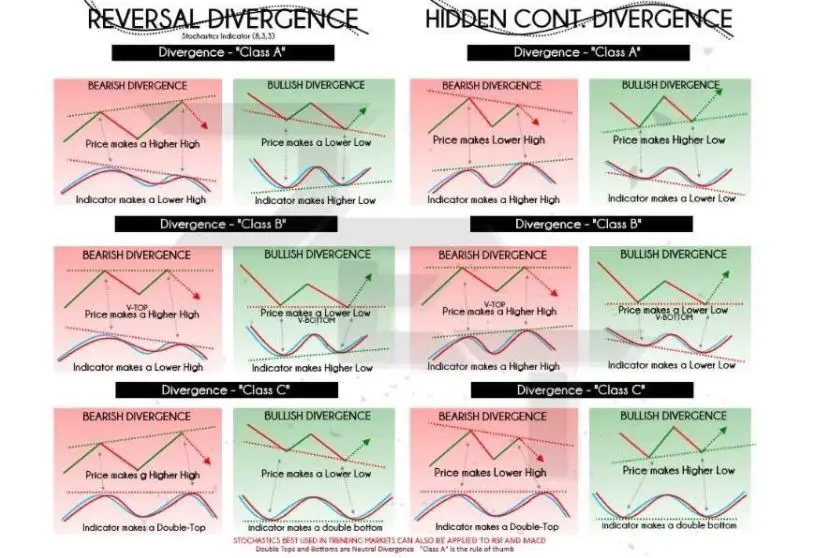

Rsi Divergence Cheat Sheet New Trader U Rsi divergence occurs when the relative strength index (rsi) indicator and the price action of an asset move in opposite directions. this divergence can be a strong signal that the current trend might be weakening and potentially about to reverse. regular divergence: this happens when the price makes a new high or low that is not supported by. Observe the rsi showing higher lows, indicating a potential bullish divergence. 3. look for a bullish divergence between the price and the rsi indicator. note that the price is making lower lows, but the rsi is making higher lows. this signals a potential trend reversal from a downtrend to an uptrend. 4. Trading the divergence cheatsheet comes only with three simple steps: spot a reversal divergence. go into the lower timeframe. wait and trade the flag pattern. go back into the higher timeframe and use the indicator to manage your trade. spotting a divergence can be tricky enough at times. The ultimate divergence cheat sheet. anes bukhdir 2 7 2024. if you’re looking to elevate your trading game and achieve success in the financial markets, understanding the concept of divergence is an essential skill to master. divergence refers to a powerful trading signal that can provide valuable insights into market trends and potential.

The Ultimate Divergence Cheat Sheet A Comprehensive Guide For Traders Trading the divergence cheatsheet comes only with three simple steps: spot a reversal divergence. go into the lower timeframe. wait and trade the flag pattern. go back into the higher timeframe and use the indicator to manage your trade. spotting a divergence can be tricky enough at times. The ultimate divergence cheat sheet. anes bukhdir 2 7 2024. if you’re looking to elevate your trading game and achieve success in the financial markets, understanding the concept of divergence is an essential skill to master. divergence refers to a powerful trading signal that can provide valuable insights into market trends and potential.

Comments are closed.