Rsi Divergence Cheat Sheet New Trader U

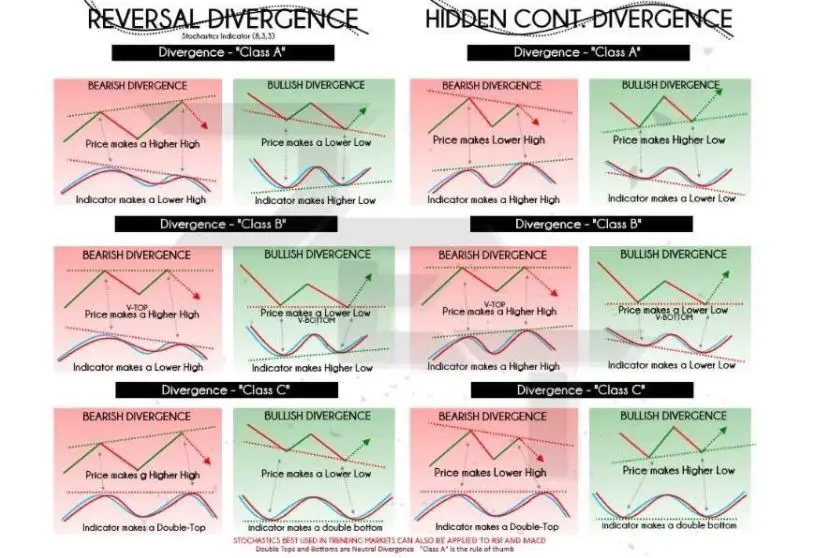

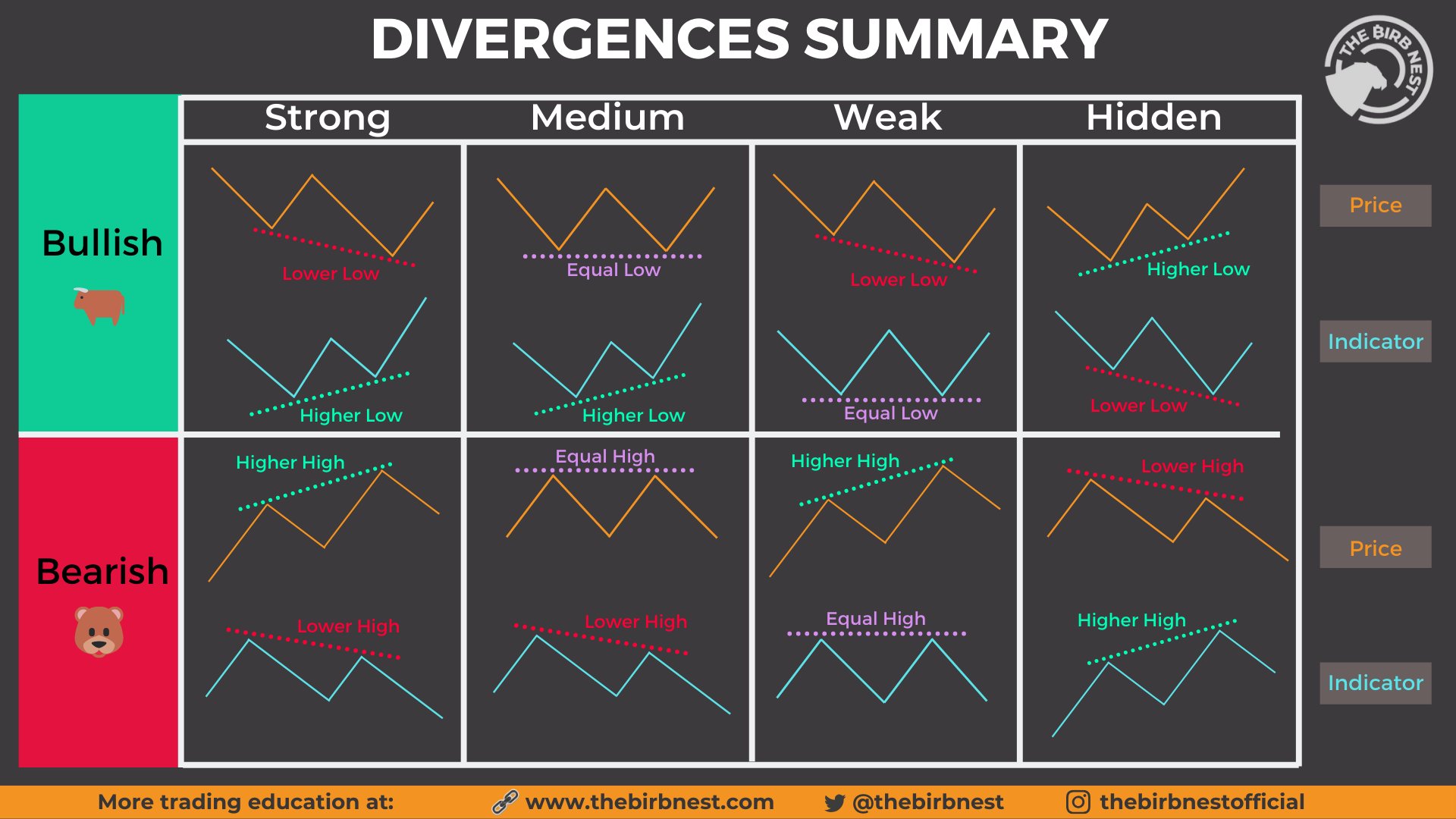

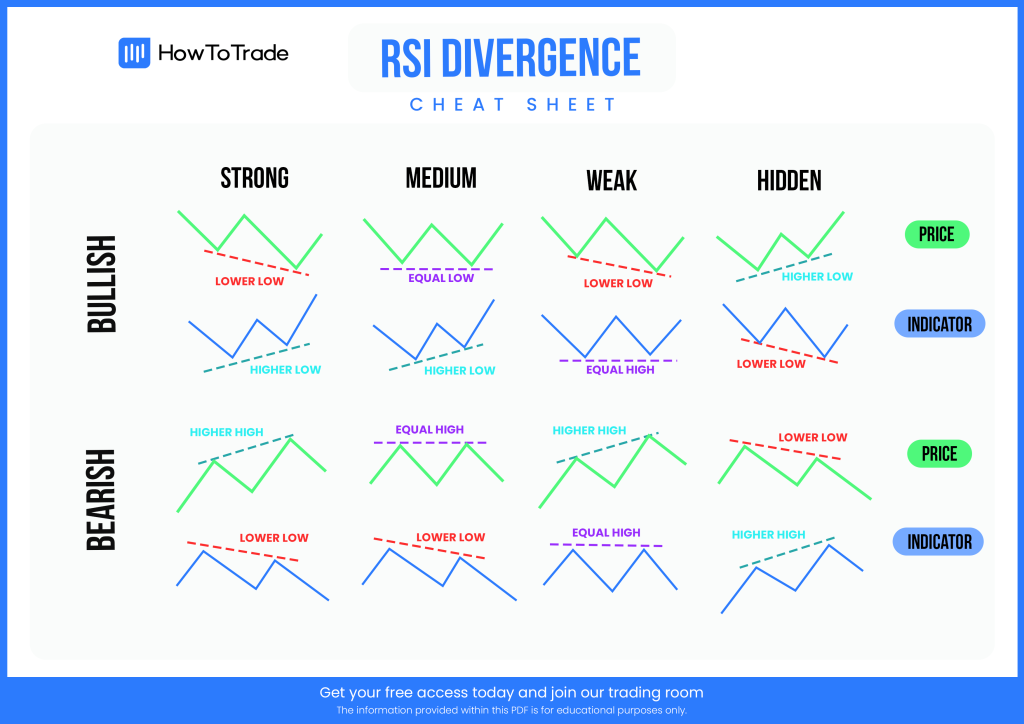

Rsi Divergence Cheat Sheet New Trader U Rsi divergence cheat sheet. an rsi divergence indicator signal shows traders when price action and the rsi are no longer showing the same momentum. the rsi shows the magnitude of a price move in a specific timeframe. the rsi is one of the most popular oscillators used in technical analysis. a divergence looks at it in relation to the current. Divergence cheat sheet. a divergence in an uptrend happens when price action makes a new higher high but the technical indicator used on the chart doesn’t. a divergence happens during a downtrend when price action makes a new lower low, but the technical indicator used on the chart doesn’t. if a divergence is signaled, it can be a high.

Rsi Divergence New Trader U Technical oscillators used in identifying a divergence include the popular relative strength index (rsi). the rsi not only measures the extremes of overbought (70) or oversold (30) but can also show divergences between it making lower lows while price is making higher highs. rsi can not only signal bullish or bearish levels to enter or exit. A regular bearish rsi divergence occurs when the rsi indicator shows lower lows while the asset’s price forms higher highs. when this happens, the rsi regular bearish divergence signals the possibility of a trend reversal, and a bearish trend or price correction is very likely to occur. the hidden bearish divergence occurs when the asset’s. The rsi forms this type of divergence occurs when it makes a higher low, while the price swing is making a lower low. this divergence mostly forms after a prolonged downtrend or a multi legged pullback in an uptrend, and it indicates a bullish reversal signal. classical bearish divergence. the classical bearish divergence forms on the rsi when. The rsi divergence cheat sheet provides a quick reference guide for identifying and interpreting different types of rsi divergences. traders can use this cheat sheet to spot potential trading opportunities and make informed trading decisions. for example, if the price of an asset is making a new high, but the rsi is making a lower high, it.

Rsi Divergence Cheat Sheet Pdf Free Download The rsi forms this type of divergence occurs when it makes a higher low, while the price swing is making a lower low. this divergence mostly forms after a prolonged downtrend or a multi legged pullback in an uptrend, and it indicates a bullish reversal signal. classical bearish divergence. the classical bearish divergence forms on the rsi when. The rsi divergence cheat sheet provides a quick reference guide for identifying and interpreting different types of rsi divergences. traders can use this cheat sheet to spot potential trading opportunities and make informed trading decisions. for example, if the price of an asset is making a new high, but the rsi is making a lower high, it. Rsi divergence occurs when the relative strength index (rsi) indicator and the price action of an asset move in opposite directions. this divergence can be a strong signal that the current trend might be weakening and potentially about to reverse. regular divergence: this happens when the price makes a new high or low that is not supported by. Rsi divergence cheat sheet bullish rsi divergence a bullish rsi divergence pattern is defined on a chart when price makes new lower lows but the rsi technical indicator doesn’t make a new low at the same time. this is a signal that bearish sentiment is losing momentum with the high probability that buyers are stepping […].

Comments are closed.