Rsi Divergence Cheat Sheet And Pdf Guide

Rsi Divergence Cheat Sheet Pdf Free Download Rsi divergence cheat sheet pdf [download] what is the rsi indicator and why is it so popular? developed in 1978 by j. welles wilder, the relative strength index (rsi) is a momentum oscillator indicator that measures the speed and price changes movements. traders use it to determine whether the asset is overbought or oversold. according to the. Rsi divergence cheat sheet and pdf guide. the relative strength index, or rsi as it is known, is a momentum indicator that you can use with your technical analysis. while you can use the rsi by itself in your trading, you can also use it to find and trade divergence. in this post, we go through exactly what the rsi is, how to trade it, and find.

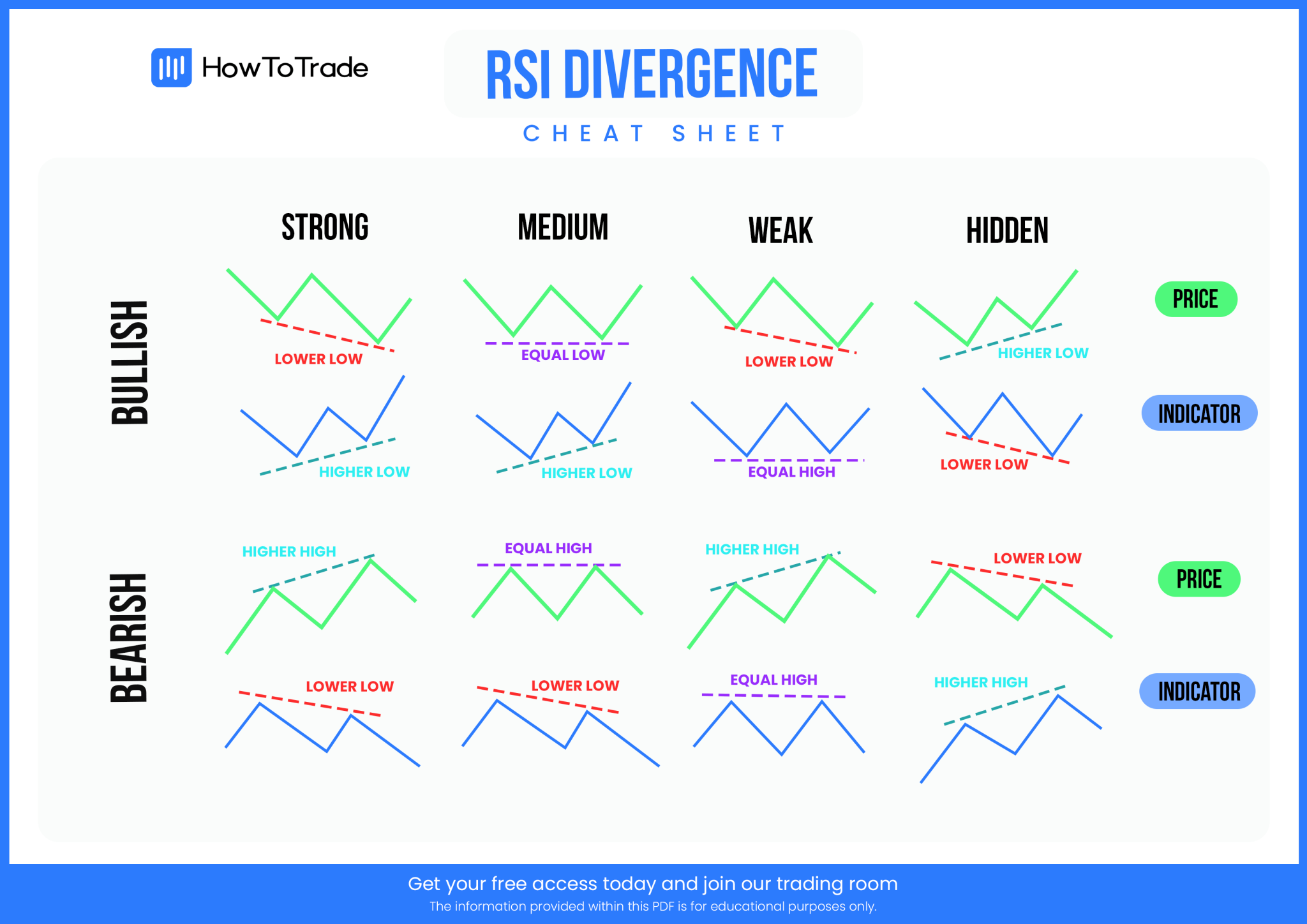

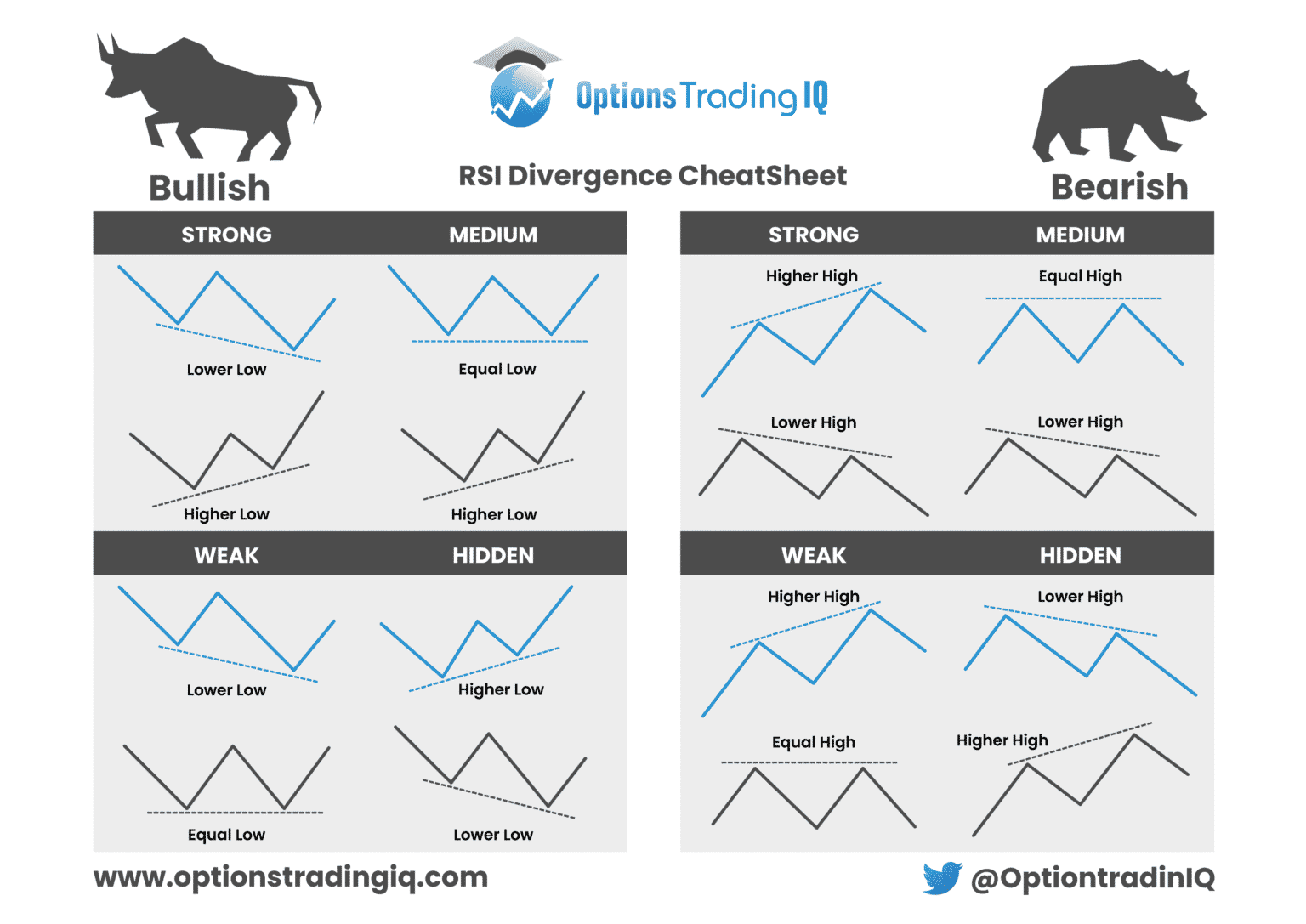

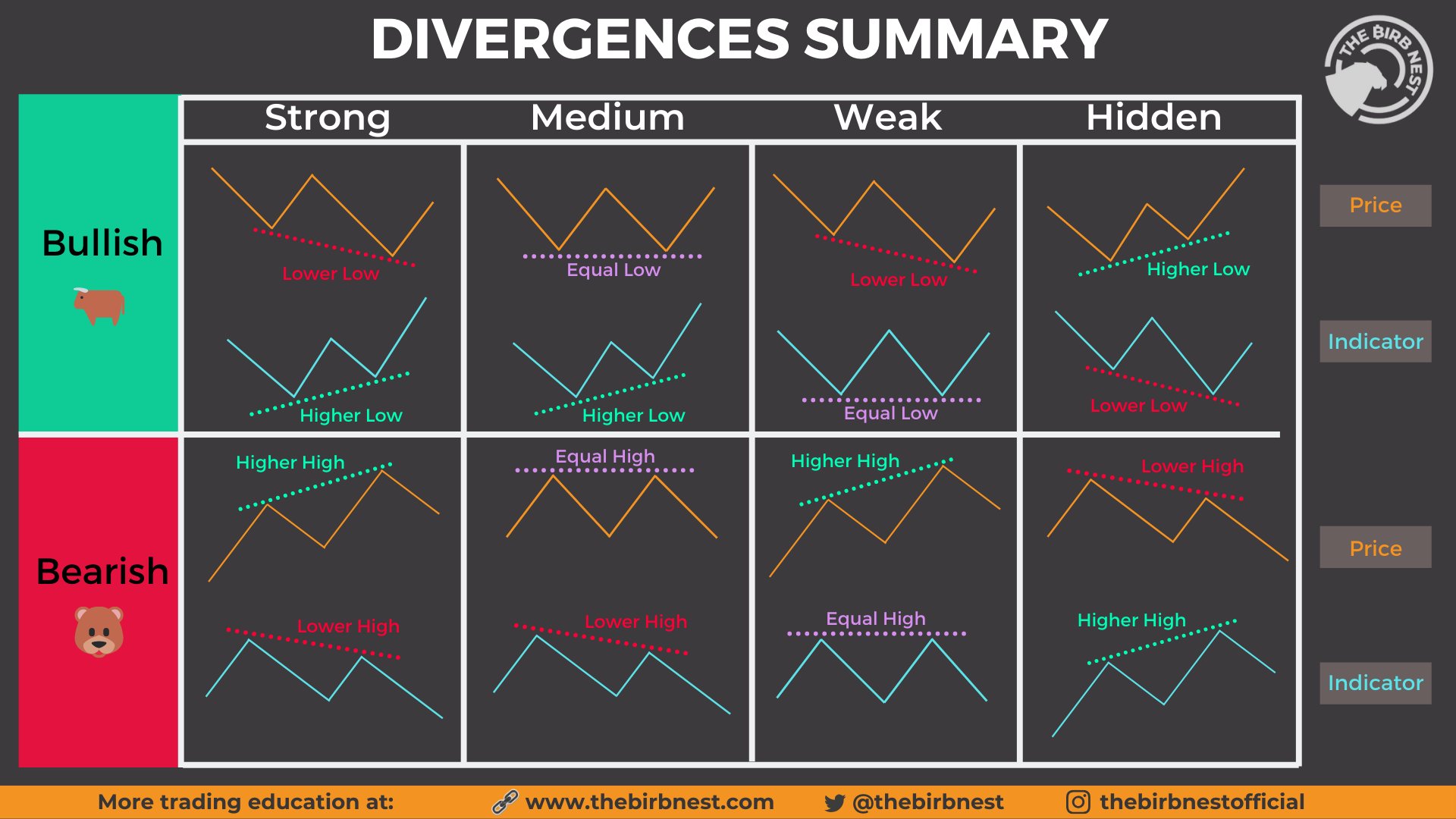

Rsi Divergence Cheat Sheet Options Trading Iq Traders can exploit these price discrepancies for profit. the divergence cheat sheet below offers an easily accessible, in depth look at what a divergence is, the different types of divergences, and how to trade divergence efficiently. note: you can get your free divergence cheat sheet pdf below. The rsi divergence cheat sheet provides a quick reference guide for identifying and interpreting different types of rsi divergences. traders can use this cheat sheet to spot potential trading opportunities and make informed trading decisions. for example, if the price of an asset is making a new high, but the rsi is making a lower high, it. Divergence cheat sheet (free download) trading divergences is a common strategy focusing on finding a miscorrelation between the asset’s price and a technical indicator. with this strategy, divergence traders are looking for price reversals or trend continuation signals to capture long price movements. and, if used properly, it can turn out. The rsi forms this type of divergence occurs when it makes a higher low, while the price swing is making a lower low. this divergence mostly forms after a prolonged downtrend or a multi legged pullback in an uptrend, and it indicates a bullish reversal signal. classical bearish divergence. the classical bearish divergence forms on the rsi when.

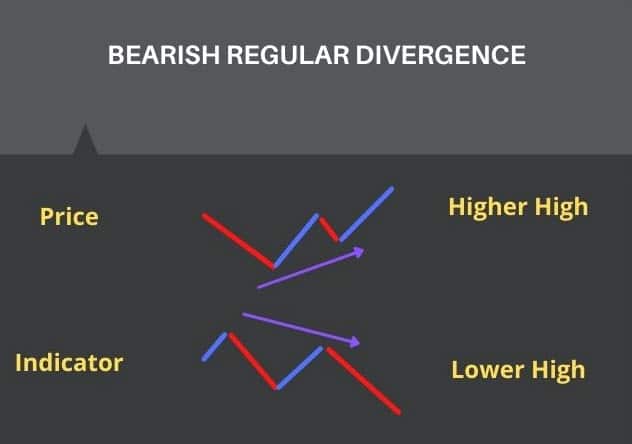

Rsi Divergence Cheat Sheet And Pdf Guide Divergence cheat sheet (free download) trading divergences is a common strategy focusing on finding a miscorrelation between the asset’s price and a technical indicator. with this strategy, divergence traders are looking for price reversals or trend continuation signals to capture long price movements. and, if used properly, it can turn out. The rsi forms this type of divergence occurs when it makes a higher low, while the price swing is making a lower low. this divergence mostly forms after a prolonged downtrend or a multi legged pullback in an uptrend, and it indicates a bullish reversal signal. classical bearish divergence. the classical bearish divergence forms on the rsi when. 1. in technical analysis, when there is a mismatch between momentum and the actual price, it’s referred to as a divergence. traders can exploit these price discrepancies for profit. divergences are concepts that allow investors to spot trend reversal signals in bullish and bearish markets. In technical analysis, divergence refers to the phenomenon when the price and a technical indicator (like the rsi) display conflicting signals. for instance, if price forms a higher high while the rsi forms a lower high, it indicates bearish divergence. price and the rsi, which should typically move in tandem, end up showing contradictory signals.

Rsi Divergence Cheat Sheet And Pdf Guide 1. in technical analysis, when there is a mismatch between momentum and the actual price, it’s referred to as a divergence. traders can exploit these price discrepancies for profit. divergences are concepts that allow investors to spot trend reversal signals in bullish and bearish markets. In technical analysis, divergence refers to the phenomenon when the price and a technical indicator (like the rsi) display conflicting signals. for instance, if price forms a higher high while the rsi forms a lower high, it indicates bearish divergence. price and the rsi, which should typically move in tandem, end up showing contradictory signals.

Rsi Divergence New Trader U

Rsi Divergence Cheat Sheet And Pdf Guide

Comments are closed.