Roth Ira Vs Traditional Ira Which Is Best For You

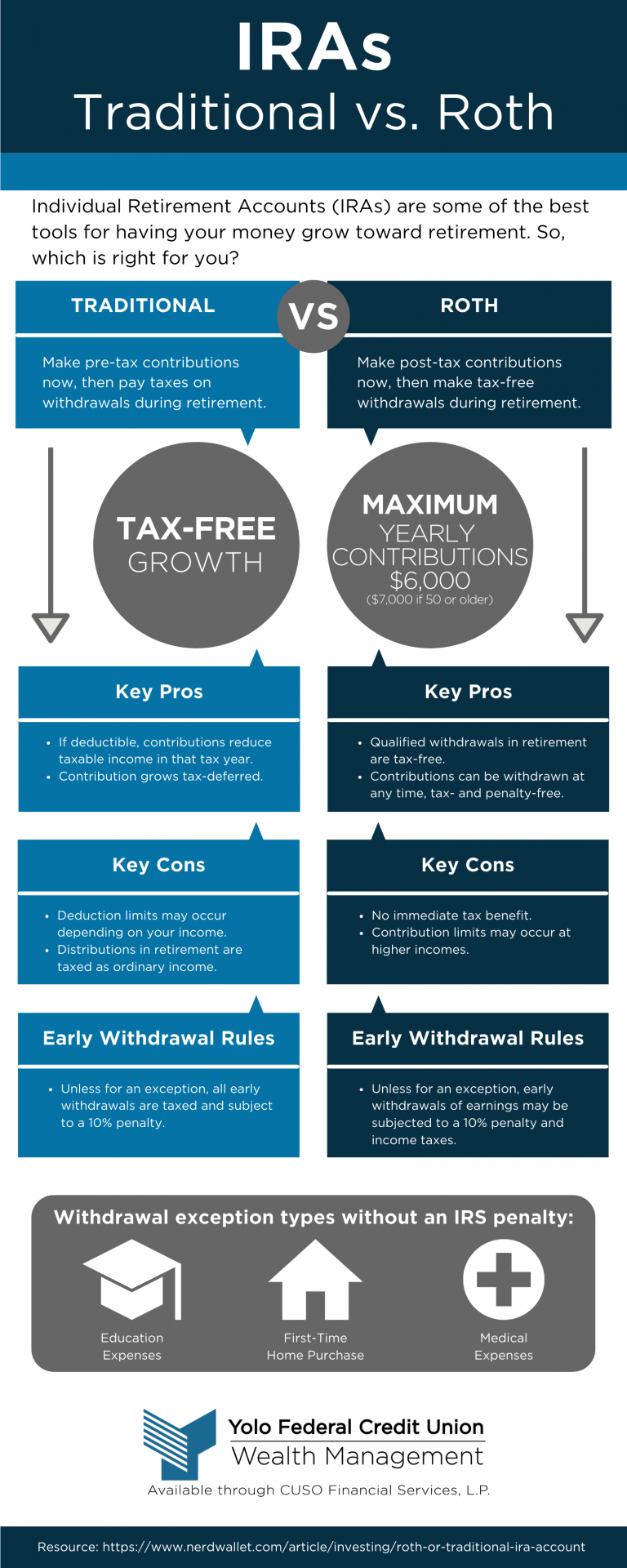

Traditional Vs Roth Ira Yolo Federal Credit Union The main difference between a roth ira and a traditional ira is how and when you get a tax break. contributions to traditional iras are tax deductible, but withdrawals in retirement are taxable as. The best ira for you—a roth ira or a traditional ira—depends on the timing of their tax breaks, their eligibility standards, and the access they offer.

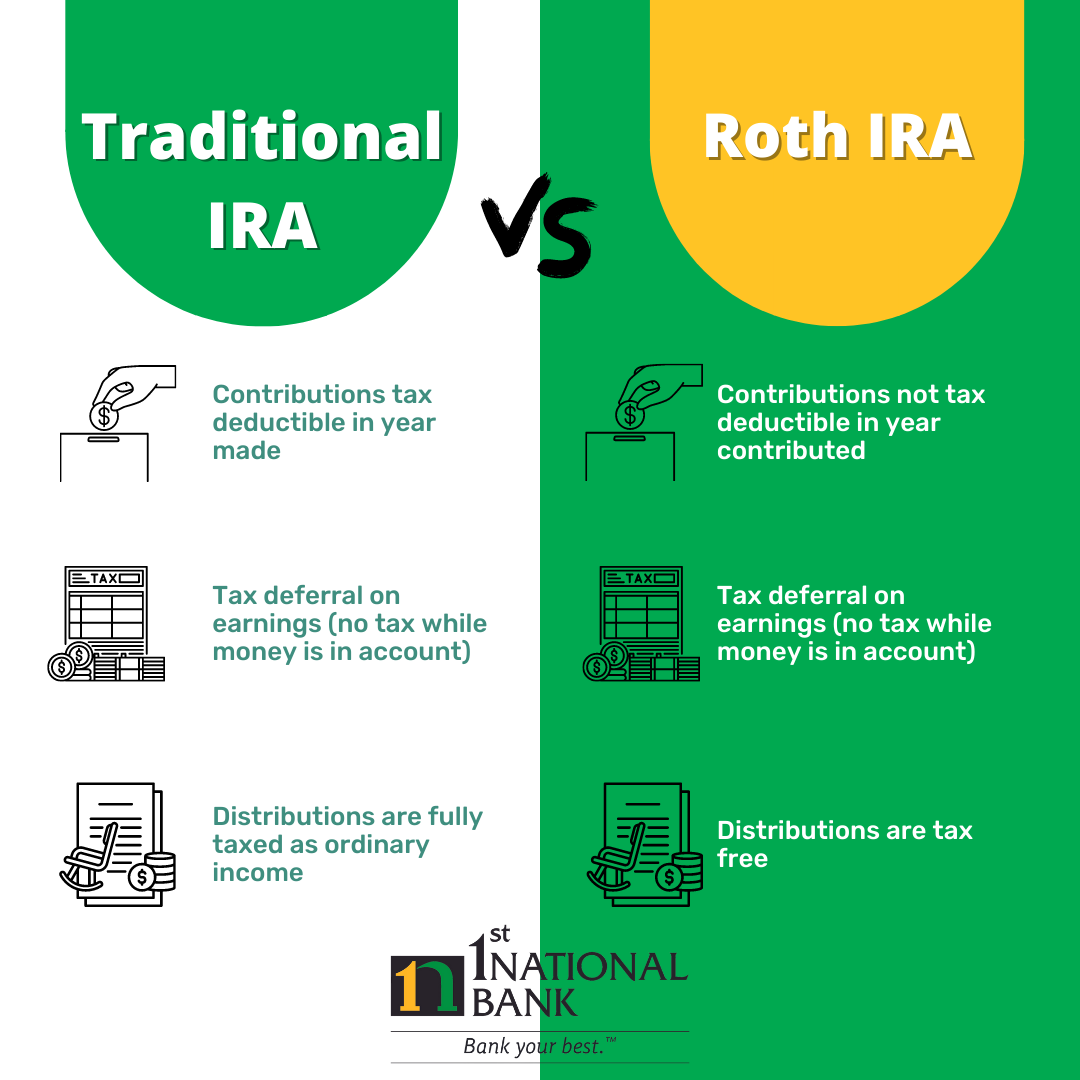

Traditional Iras Vs Roth Iras Comparison 1st National Bank With a roth 401 (k), you can contribute a portion or all your paycheck up to certain limits. you can also choose to have some of your paycheck go pre tax into a traditional 401 (k) and some post tax into a roth 401 (k). unlike a roth ira, contributions to a roth 401 (k) are not subject to earnings limits. this means if you aren't eligible to. In 2024, the annual contribution limit for iras, including roth and traditional iras, is $7,000. if you're age 50 or older, you can contribute an additional $1,000 annually. to be eligible to contribute the maximum amount to a roth ira in 2024, your modified adjusted gross income must be less than $146,000 if single and $230,000 if married and. The difference between a traditional ira and a roth ira comes down to taxes. with a roth ira, you contribute funds on which you’ve already paid income taxes, commonly referred to as post tax. The key distinctions between roth iras and traditional iras involve two main considerations: taxes and timing. traditional iras offer the potential for tax deductibility in the present, while roth.

Roth Ira Vs Traditional Ira How To Know What Is Best For You The difference between a traditional ira and a roth ira comes down to taxes. with a roth ira, you contribute funds on which you’ve already paid income taxes, commonly referred to as post tax. The key distinctions between roth iras and traditional iras involve two main considerations: taxes and timing. traditional iras offer the potential for tax deductibility in the present, while roth. Common questions roth vs. traditional ira—which is best suited for me and my retirement goals? the right ira for you depends on many factors, such as your income level, what other retirement accounts you may have, and your age. generally speaking, a roth ira is best suited for those who expect to be in a higher tax bracket when they start taking withdrawals, and a traditional ira is best. Here’s a simple system to help you break down the choice. traditional iras and roth iras both offer tax advantaged growth of money. the contribution for both account types for 2024 is $7,000, or.

Comments are closed.