Reverse 1031 Exchange Definition How It Works Legalities

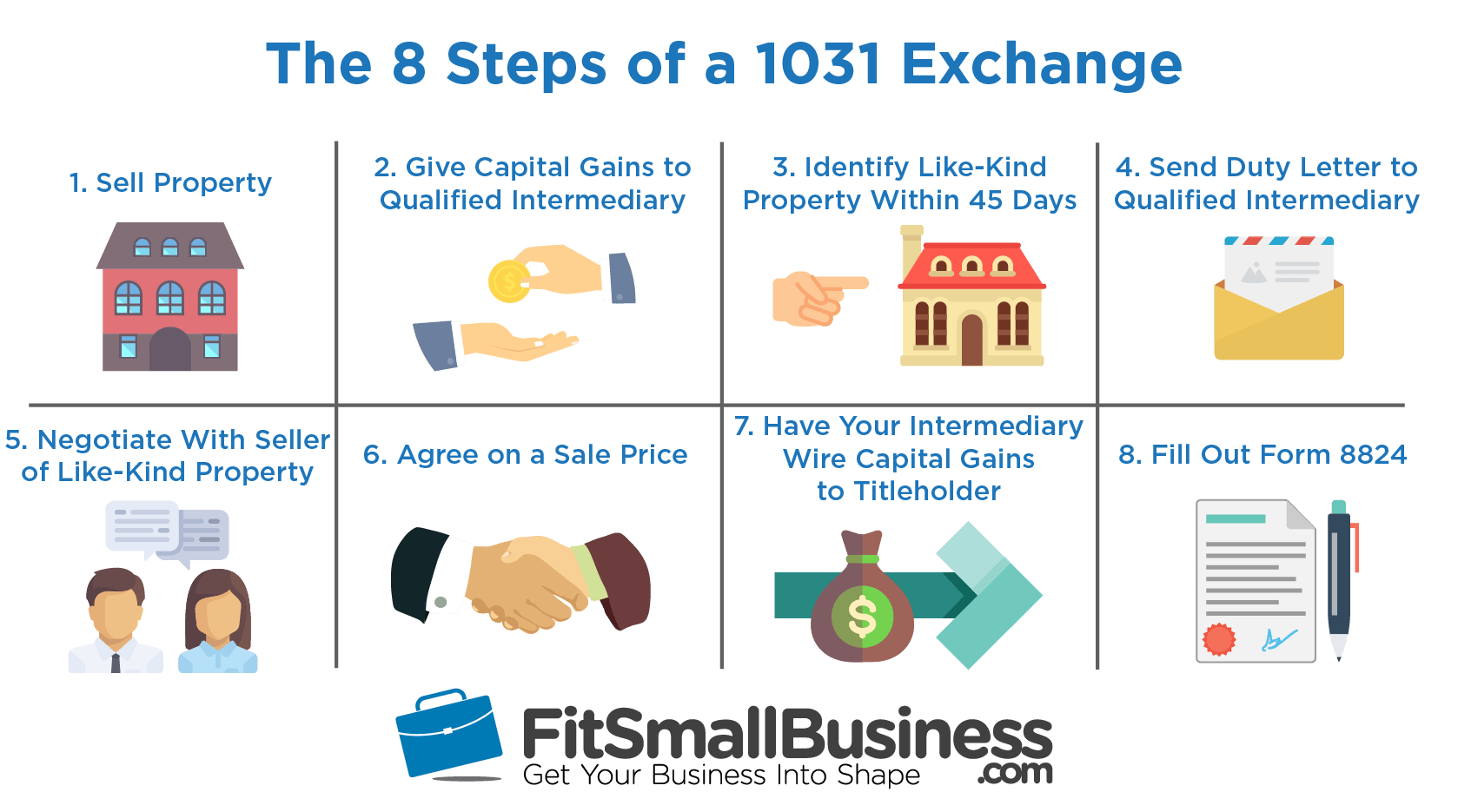

Reverse 1031 Exchange Definition How It Works Legalities A reverse 1031 exchange is a tax deferral strategy that allows real estate investors to acquire a replacement property before selling their relinquished property. this reversal of the typical 1031 exchange timeline provides flexibility in property acquisition and mitigates risks in competitive markets. by securing the replacement property first. Here are eight steps to the reverse exchange process: step 1: find a replacement property and decide how you will fund the purchase. investors may choose to buy in cash or go through a lender. both the lender and title company need to be made aware that you are performing a reverse 1031 exchange.

Reverse 1031 Exchange Definition How It Works Legalities 1031 rules and requirements for reverse exchanges are the same rules followed for forward 1031 exchanges when the old property is closed before the replacement is acquired and closed. reverse exchanges must be completed within 180 calendar days of the initial closing. the taxpayer buying must be the same as the taxpayer selling. Reverse 1031 exchange fees and costs. reverse 1031 exchanges are more expensive than conventional 1031 exchanges, with reverse 1031 exchange base fees starting at $3,500. fees increase rapidly in proportion to the size and complexity of the transaction. for comparison, a conventional delayed 1031 exchange costs around $1,000. A 1031 exchange is a powerful tool for wealth preservation and growth by offering investors a unique opportunity to defer capital gains taxes and unlock the full potential of their real estate investments. while many individuals are familiar with the conventional forward 1031 exchange, a lesser known but increasingly intriguing option has. A reverse 1031 exchange is an advanced real estate strategy that allows investors to defer capital gains taxes on the sale of a property by acquiring a replacement property before selling their current property. this article aims to provide a comprehensive understanding of reverse 1031 exchanges, including the basics, the concept, the benefits.

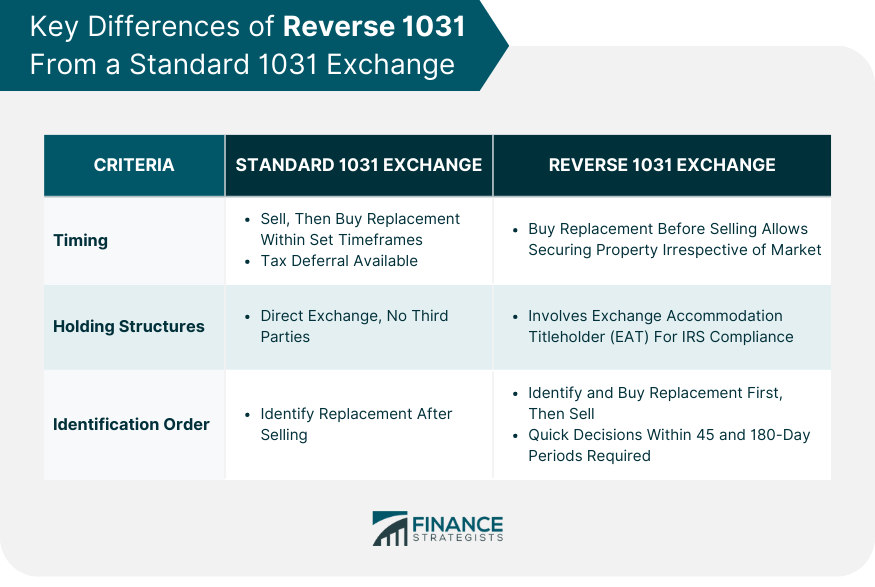

Reverse 1031 Exchange Process Timeline Explained Investor Guide A 1031 exchange is a powerful tool for wealth preservation and growth by offering investors a unique opportunity to defer capital gains taxes and unlock the full potential of their real estate investments. while many individuals are familiar with the conventional forward 1031 exchange, a lesser known but increasingly intriguing option has. A reverse 1031 exchange is an advanced real estate strategy that allows investors to defer capital gains taxes on the sale of a property by acquiring a replacement property before selling their current property. this article aims to provide a comprehensive understanding of reverse 1031 exchanges, including the basics, the concept, the benefits. The 1031 reverse exchange time limit dictates that the investor must identify a buyer for their current property within 45 days of purchasing the replacement property and complete the sale within 180 days. as such, the reverse 1031 exchange timeline requires careful planning and management. A reverse 1031 exchange is used by real estate investors who want to purchase the replacement property before selling the relinquished property. you must use a third party eat (exchange accommodation titleholder) to handle the transaction. similar to 1031 exchanges, the 45 day and 180 day deadlines apply to reverse exchanges.

Reverse 1031 Exchange Process Timeline Explained Investor Guide The 1031 reverse exchange time limit dictates that the investor must identify a buyer for their current property within 45 days of purchasing the replacement property and complete the sale within 180 days. as such, the reverse 1031 exchange timeline requires careful planning and management. A reverse 1031 exchange is used by real estate investors who want to purchase the replacement property before selling the relinquished property. you must use a third party eat (exchange accommodation titleholder) to handle the transaction. similar to 1031 exchanges, the 45 day and 180 day deadlines apply to reverse exchanges.

Reverse 1031 Exchange Diagram

Reverse 1031 Exchange Diagram Wiring Diagram Pictures

Comments are closed.