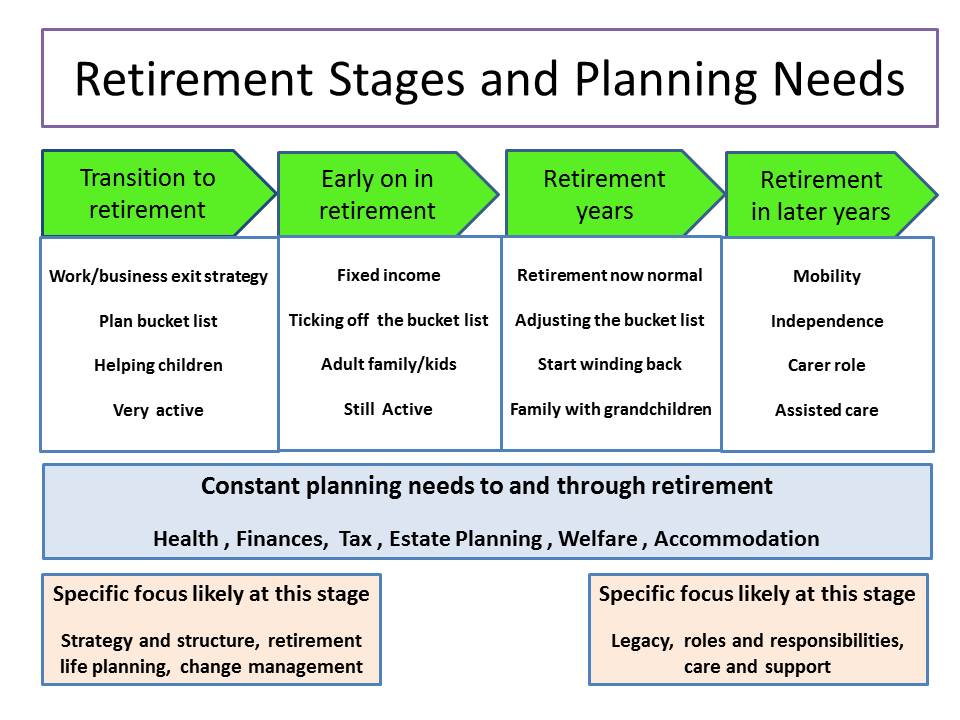

Retirement Stages And Planning Needs Primetime

Retirement Stages And Planning Needs Primetime Where most planning stops at achieving a financial goal, primetime becomes ever more relevant. primetime recognises 4 distinct phases through retirement which may span over 20 years. some aspects of planning are “constants”. this means that they planning should be done early and then maintained through life. other aspects are “specifics”. Phase 2: the leap. ‘the leap’ marks a monumental shift in the retirement journey — the actual transition from a structured working life to the freedom of retirement. this phase represents a significant life change as individuals step into an uncharted territory of new routines and realities.

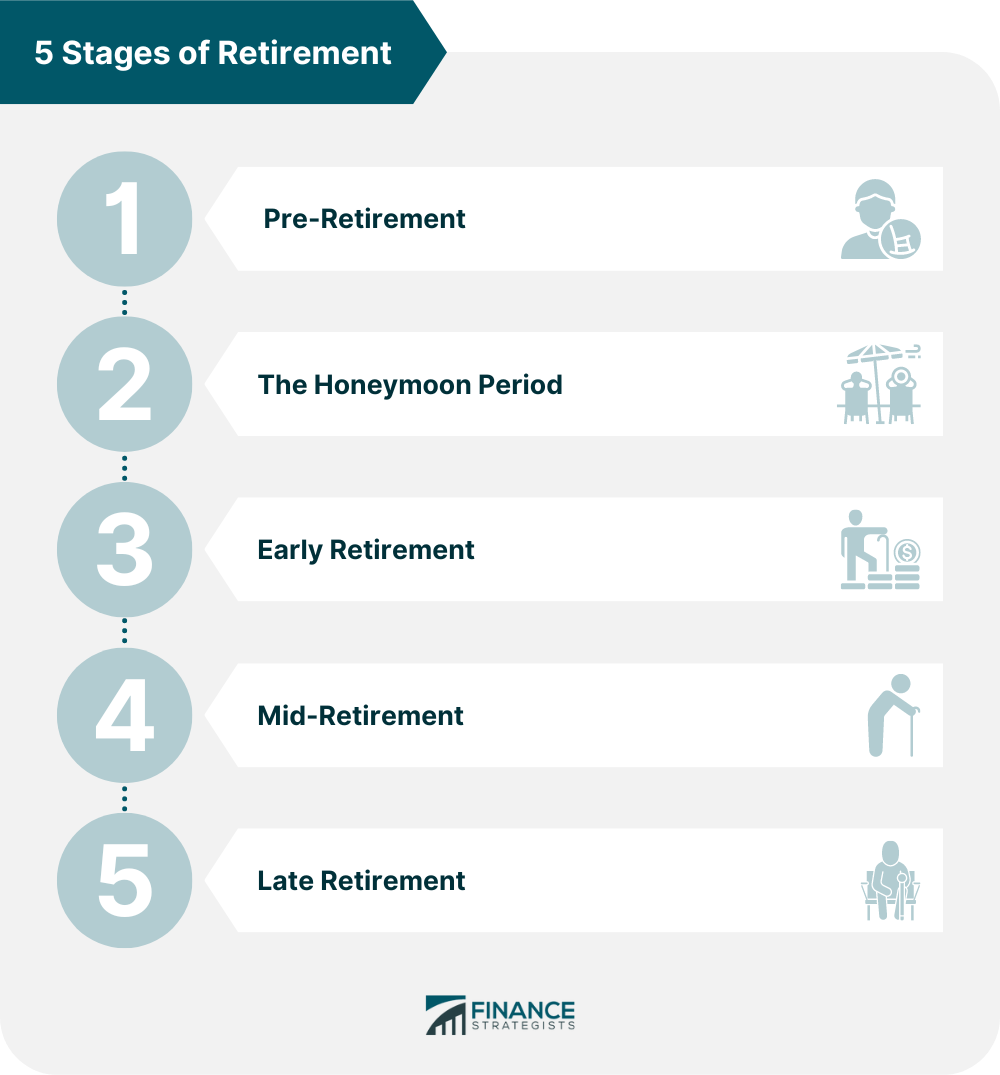

Retirement Planning Definition Importance Stages Factors Steps 5. reconciliation and stability. the final stage involves restoring a sense of purpose and direction in life. finding stability in day to day living becomes paramount, leading to a balanced and. Putting $100 into a retirement account every month starting at age 20 is more effective than putting $100,000 into a retirement account at age 65. even assuming a relatively low 5% rate of return. Let's take a closer look at each of the six stages of retirement. 1. pre retirement: planning time. during your working years, retirement can appear to be both an oncoming burden and a distant. One benefit of this retirement planning stage is catch up contributions. from age 50 on, you can contribute an additional $1,000 a year to your traditional or roth ira and an additional $7,500 a.

The 3 Main Phases Of Retirement Planning Let's take a closer look at each of the six stages of retirement. 1. pre retirement: planning time. during your working years, retirement can appear to be both an oncoming burden and a distant. One benefit of this retirement planning stage is catch up contributions. from age 50 on, you can contribute an additional $1,000 a year to your traditional or roth ira and an additional $7,500 a. Phase 1: pre retirement. set clear financial goals that align with your desired retirement lifestyle. calculate your expected retirement income needs and create a budget. phase 2: early retirement. enjoy the freedom of retirement by engaging in activities you love, such as traveling or pursuing hobbies. A guide to the 5 stages of retirement smartasset. everyone's retirement looks a little different, but you can expect to encounter a few distinct stages and experiences over the course of your golden years.

5 Steps For Retirement Planning Posteezy Phase 1: pre retirement. set clear financial goals that align with your desired retirement lifestyle. calculate your expected retirement income needs and create a budget. phase 2: early retirement. enjoy the freedom of retirement by engaging in activities you love, such as traveling or pursuing hobbies. A guide to the 5 stages of retirement smartasset. everyone's retirement looks a little different, but you can expect to encounter a few distinct stages and experiences over the course of your golden years.

Overview Of The 5 Stages Of Retirement Finance Strategists

6 Stages Of Retirement Such As Pre Retirement Phase Honeymoon

Comments are closed.