Retirement Planning Tips With A Pension

5 Simple Steps To Retirement Planning The Economic Times The typical advice is to replace 70% to 90% of your annual pre retirement income through savings and social security. with this strategy, a retiree who earns around $63,000 per year before. For more, tune in to our upcoming webinar how to maximize a pension – a planner’s guide. investment advisory and financial planning services are offered through summit financial llc, an sec.

Pension Plan Retirement Planning Meaning Importance Estimate your expenses: begin by estimating your anticipated expenses during retirement. consider factors such as housing, healthcare, transportation, groceries, leisure activities, and any outstanding debts or financial obligations. be realistic and factor in potential increases in prices due to inflation. Key takeaways. no matter your age, retirement planning includes five steps: estimating expenses, determining time horizons, calculating required after tax returns, assessing your risk tolerance. The retirement planning process sets retirement income goals and builds out the steps required to get there. these include determining income sources and expected expenses, creating a savings plan. The name of the game is to minimize principal withdrawals during a market downturn early in retirement. 2. lose your fear of inflation. nothing strikes as much fear into the hearts of retirees as.

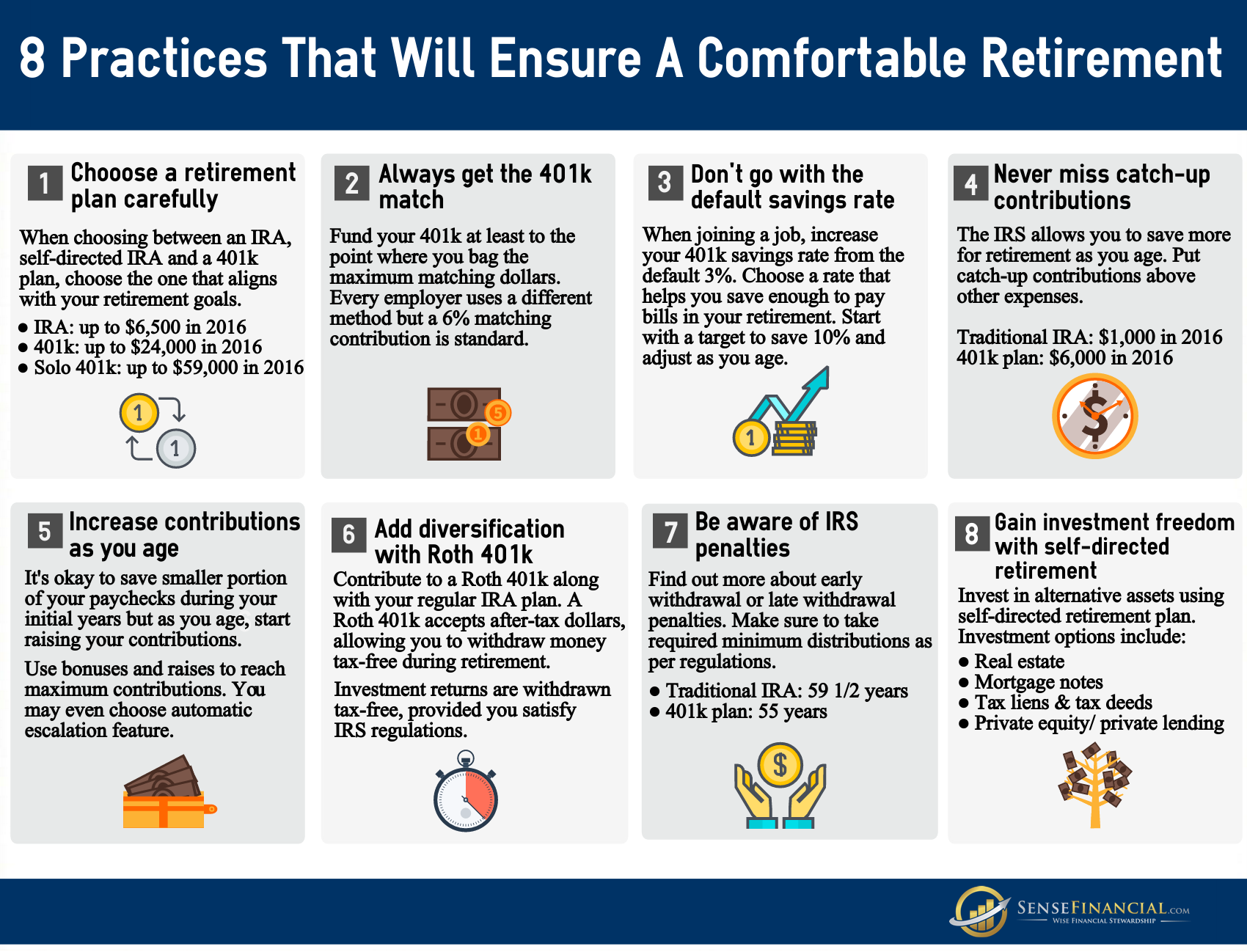

Infographic 8 Retirement Tips That Will Ensure A Comfortable Retirement The retirement planning process sets retirement income goals and builds out the steps required to get there. these include determining income sources and expected expenses, creating a savings plan. The name of the game is to minimize principal withdrawals during a market downturn early in retirement. 2. lose your fear of inflation. nothing strikes as much fear into the hearts of retirees as. Read viewpoints on fidelity : 5 ways hsas can help with your retirement. fidelity's guideline: save 15% of your income annually, including any match you get from your employer. this assumes you start saving at age 25 and plan to retire at age 67. 3. if 15% is too much, start where you can. To fill a health care saving gap, consider catch up contributions in 401 (k)s, hsas, and iras. the best time to invest in an annuity is when you need it. small spending tweaks can have a big impact on retirement success. consider a simple strategy to help reduce taxes on retirement income.

5 Best Tips To Plan For Retirement Read viewpoints on fidelity : 5 ways hsas can help with your retirement. fidelity's guideline: save 15% of your income annually, including any match you get from your employer. this assumes you start saving at age 25 and plan to retire at age 67. 3. if 15% is too much, start where you can. To fill a health care saving gap, consider catch up contributions in 401 (k)s, hsas, and iras. the best time to invest in an annuity is when you need it. small spending tweaks can have a big impact on retirement success. consider a simple strategy to help reduce taxes on retirement income.

Retirement Planning Step By Step First Point Wealth Management

Comments are closed.