Retirement Plan Considerations At Different Stages Of Life Tcg A Hub

Retirement Plan Considerations At Different Stages Of Life Tcg A Hub While it’s generally not advisable to make frequent changes in your retirement plan investment mix, you will want to review your plan’s portfolio at least once each year and as major events (e.g., marriage, divorce, birth of a child, job change) occur throughout your life. Tcg helps you navigate through retirement planning by creating plans that are tailor made for you. together, we can help you prepare for tomorrow. 1 (512) 600 5200.

Retirement Planning Vs Life Stages Life Stages How To Plan A 401 (k) plan is a type of employer sponsored retirement plan in which you can elect to defer receipt of some of your wages until retirement. your employer offers a 401 (k) plan as a way to help you save for life beyond your full time working years. contributing regularly to a 401 (k) can give you the power and confidence to retire with more. From 2020 to 2022, it was 72. if you reach age 73 after dec. 31, 2032, your rmd age is 75. 6 qualified withdrawals from roth accounts are those made after a five year waiting period and you either reach age 59½, die or become disabled. 7 withdrawals from your employer sponsored retirement savings plan prior to age 59½ may be subject to. Read tcg's blog posts on retirement planning to learn how to prepare for retirement, what types of retirement plans are available to you, and how they work. 1 (512) 600 5200 facebook. Retirement plan considerations at different stages of life prepared for: todd katona december 18, 2020 throughout your career, retirement planning will likely be one of the most important components of your overall financial plan. whether you have just graduated and taken your first job, are starting a family, are enjoying your peak earning.

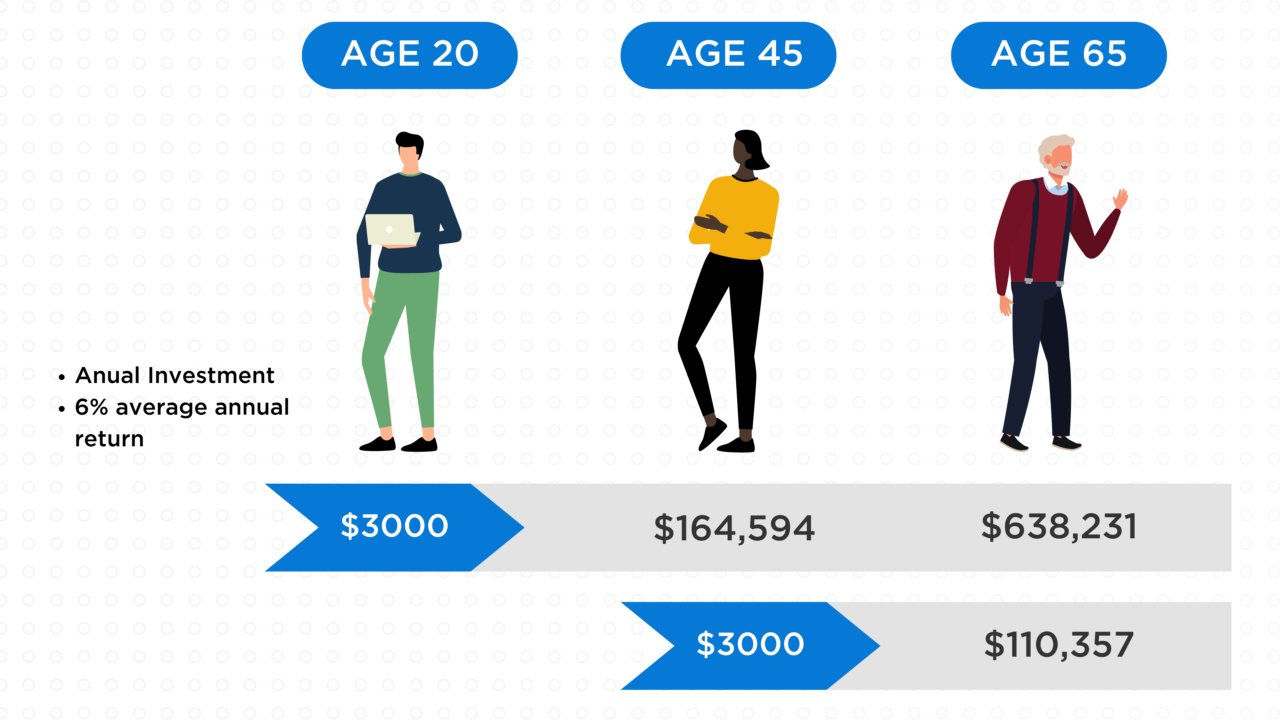

Retirement Planning Tcg A Hub International Company Read tcg's blog posts on retirement planning to learn how to prepare for retirement, what types of retirement plans are available to you, and how they work. 1 (512) 600 5200 facebook. Retirement plan considerations at different stages of life prepared for: todd katona december 18, 2020 throughout your career, retirement planning will likely be one of the most important components of your overall financial plan. whether you have just graduated and taken your first job, are starting a family, are enjoying your peak earning. Over time, the process can snowball. example: say at age 20, you begin investing $3,000 each year for retirement. at age 65, you would have invested $135,000. if you assume a 6% average annual return, you would have accumulated a total of $638,231 by age 65. however, if you wait until age 45 to begin investing that $3,000 annually and earn the. 6%. $110,357. at age 20, you begin investing $3,000 a year for retirement. assuming 6% average annual return, you'd have invested $135,000 and accumulated a total of $638,231. at age 45, you'd have invested $60,000, and accumulated a total of $110,357. even though you'd have invested $75,000 more by starting early, you would have accumulated.

Retirement Planning Tcg A Hub International Company Over time, the process can snowball. example: say at age 20, you begin investing $3,000 each year for retirement. at age 65, you would have invested $135,000. if you assume a 6% average annual return, you would have accumulated a total of $638,231 by age 65. however, if you wait until age 45 to begin investing that $3,000 annually and earn the. 6%. $110,357. at age 20, you begin investing $3,000 a year for retirement. assuming 6% average annual return, you'd have invested $135,000 and accumulated a total of $638,231. at age 45, you'd have invested $60,000, and accumulated a total of $110,357. even though you'd have invested $75,000 more by starting early, you would have accumulated.

Retirement Plan Considerations At Different Stages Of Life Mission Wealth

Comments are closed.