Repurchase Agreement Repo Definition Examples And Risks

:max_bytes(150000):strip_icc()/repurchaseagreement_final-b6e7c46c5bdd404e93d5ac0cc47ca328.jpg)

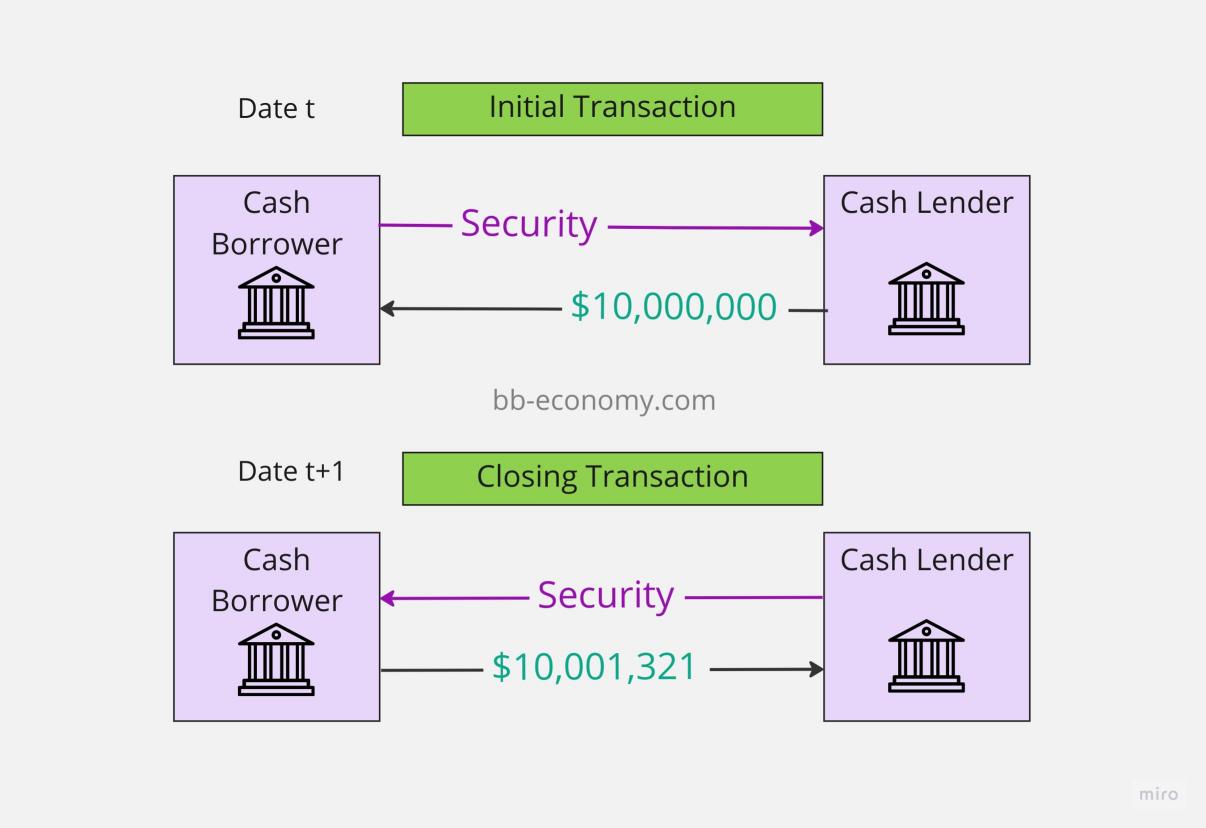

Repurchase Agreement Repo Definition Examples And Risks A repurchase agreement (repo) is a form of short term borrowing for dealers in government securities. for a repo, a dealer sells government securities to an investor, usually overnight, and buys. To summarize, repurchase agreements (repo) are widely used financial instruments that provide short term funding solutions by temporarily selling securities and repurchasing them at a later date. understanding how they work and the associated risks is essential for anyone involved in the money markets. explore the world of finance with our.

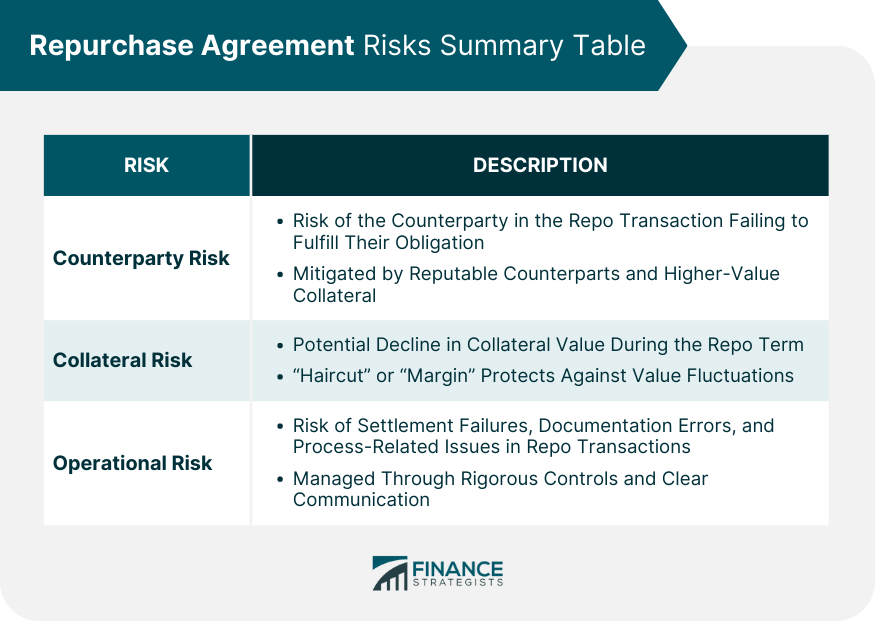

What Is A Repurchase Agreement Types Mechanics Risks A repurchase agreement (or ‘repo’ for short) is an agreement between two parties for the sale of government securities and the subsequent repurchase of those securities, usually the next day. A repurchase agreement, commonly known as a repo, is a short term agreement to sell securities to buy them back at a slightly higher price. the short term loan's interest rate, known as the repo rate, is determined by the difference between the initial sale price and the repurchase price. it is a financial transaction involving a sale and a. A repurchase agreement (repo) is a short term financial transaction in which securities are sold with an agreement to repurchase them later at a higher price. this provides liquidity and stability to financial markets while mitigating risks for borrowers and lenders. A repurchase agreement is a contractual arrangement between two parties, where one party agrees to sell securities to another party at a specified price with a commitment to buy the securities back at a later date for another (usually higher) specified price. repos that mature next day or at a specified date in the future are called "overnight.

Repurchase Agreements And Counterparty Risk Sociology Systems Research A repurchase agreement (repo) is a short term financial transaction in which securities are sold with an agreement to repurchase them later at a higher price. this provides liquidity and stability to financial markets while mitigating risks for borrowers and lenders. A repurchase agreement is a contractual arrangement between two parties, where one party agrees to sell securities to another party at a specified price with a commitment to buy the securities back at a later date for another (usually higher) specified price. repos that mature next day or at a specified date in the future are called "overnight. Indeed, the treasury, through its federal reserve bank banking system, is a large purchaser of repos, providing important liquidity for short term market traders. a repurchase agreement is the sale of a security combined with an agreement to repurchase the same security at a higher price at a future date. Repurchase agreements (repos): a primer. repurchase agreements (repos) are a major source of short term funding for financial institutions. repos are a policy concern because they have long been identified as a potential source of systemic risk, meaning that problems in that market could lead to broader financial instability.

Repurchase Agreement Features Definition Of Repurchase Agreement Isra Indeed, the treasury, through its federal reserve bank banking system, is a large purchaser of repos, providing important liquidity for short term market traders. a repurchase agreement is the sale of a security combined with an agreement to repurchase the same security at a higher price at a future date. Repurchase agreements (repos): a primer. repurchase agreements (repos) are a major source of short term funding for financial institutions. repos are a policy concern because they have long been identified as a potential source of systemic risk, meaning that problems in that market could lead to broader financial instability.

Free Stock Repurchase Agreement Template Rocket Lawyer

Reverse Repurchase Agreement Vs Repurchase Agreement Quant Rl

Comments are closed.