Refinance Home Mortgage Exposing The True Hidden Cost

Refinance Home Mortgage Exposing The True Hidden Cost Youtube Refinance home mortgage why you should never refinance your home mortgage without understanding the ramification and the true cost. in this video, i'm goi. Application fee. cost: $75 to $300. this covers the costs of processing your loan refinance request, including the lender checking your credit report. you will likely have to pay this fee, unlike.

Hidden Costs When Refinancing Your Mortgage Bay National Title For example, if you’re refinancing a $200,000 loan and decide to pay one discount point, you would need to pay $2,000 upfront. this additional cost contributes to your closing costs. while paying discount points upfront can increase your closing costs, it can also lead to long term savings on your interest rate. The precise refinancing fees you pay depend on the loan type, lender and local fees. but here are estimates of the most common refinancing expenses: application fee: $0 to $500. attorney fees. How refinance closing costs are determined. average closing costs normally range from 2 5% of the loan amount. if you’re refinancing a $200,000 mortgage loan, for example, you could expect to. If you feel ready to refinance, no closing cost or otherwise, get started with rocket mortgage® and apply online today, or give us a call at (833) 326 6018. a no closing cost refinance lets you refinance without paying closing costs upfront. learn how to refinance without closing costs and when it makes sense to do so.

The True Cost Of Refinancing Your Mortgage Dream Financial Planning How refinance closing costs are determined. average closing costs normally range from 2 5% of the loan amount. if you’re refinancing a $200,000 mortgage loan, for example, you could expect to. If you feel ready to refinance, no closing cost or otherwise, get started with rocket mortgage® and apply online today, or give us a call at (833) 326 6018. a no closing cost refinance lets you refinance without paying closing costs upfront. learn how to refinance without closing costs and when it makes sense to do so. If you’re refinancing a $200,000 mortgage, say, you might be looking at anywhere between $4,000 and $10,000 in closing costs. here’s a breakdown of common closing costs: closing costs. fee. Origination fees also typically cost around 0.5% – 1% of the total loan amount. other expenses that might be included in your refinance closing costs include a recording fee (if you’re updating ownership of the property), a credit report fee and an underwriting fee. you can expect to pay around 3% – 6% of your loan balance in closing costs.

Refinancing Your Home Can Be A Serious Financial Decision Make Sure If you’re refinancing a $200,000 mortgage, say, you might be looking at anywhere between $4,000 and $10,000 in closing costs. here’s a breakdown of common closing costs: closing costs. fee. Origination fees also typically cost around 0.5% – 1% of the total loan amount. other expenses that might be included in your refinance closing costs include a recording fee (if you’re updating ownership of the property), a credit report fee and an underwriting fee. you can expect to pay around 3% – 6% of your loan balance in closing costs.

Refinancing A Home 101 Is It Right For Your Mortgage Trulia Home

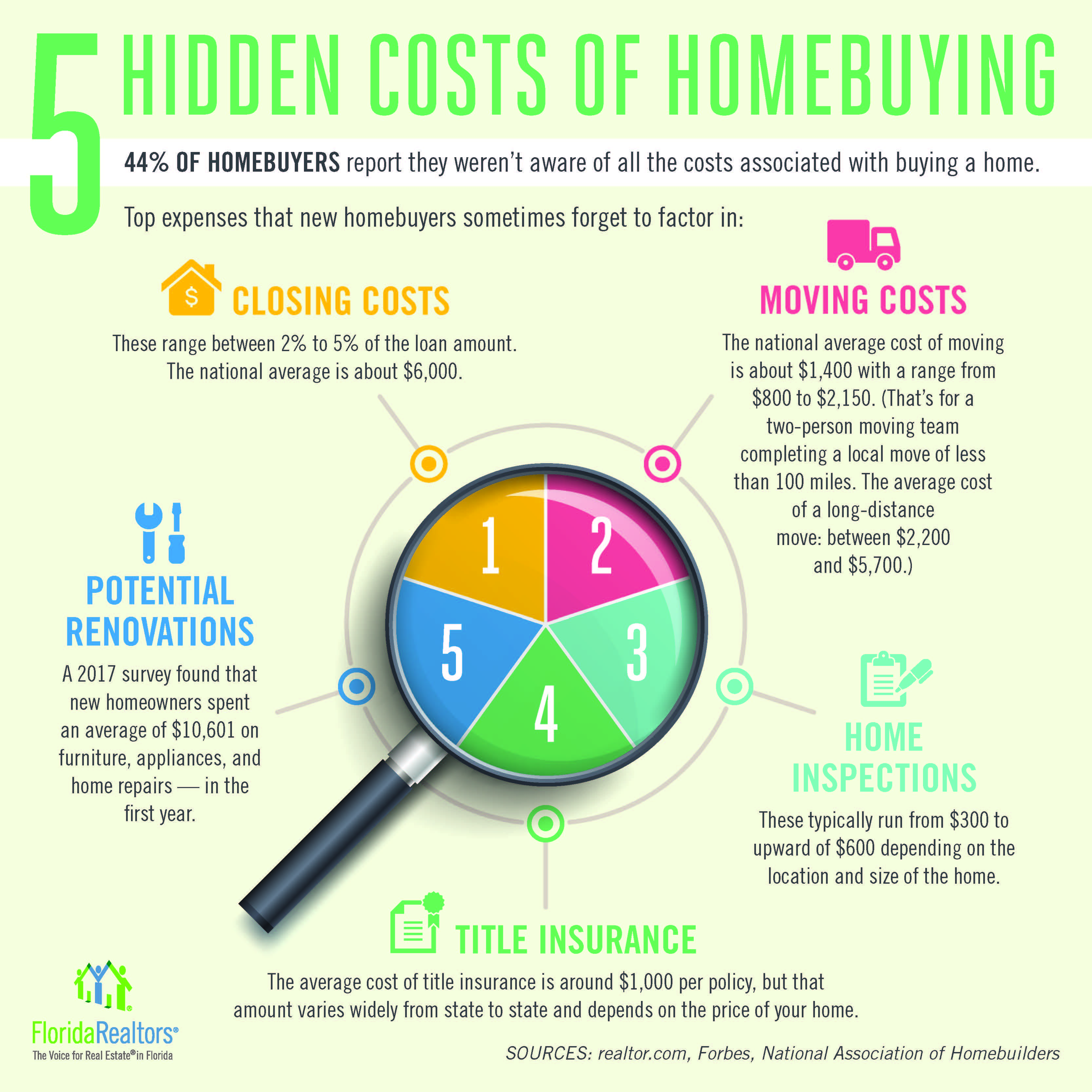

Hidden Costs Of Homebuying Florida Realtors

Comments are closed.