Reduce Your Tax Bill Tax Depreciation Accounting Firms

Reduce Your Tax Bill Tax Depreciation Accounting Firms In short, tax depreciation is the depreciation expense that can be reported by a business for a given reporting period. it is the recovery of an asset cost over a number of years or, in other words, the asset’s useful life. when businesses deduct the declining value of assets used in their income generating activities, it reduces the amount. Reason 4: a tax incentive with a time limit. the government sometimes offers bonus depreciation as a tax incentive to encourage businesses to invest in new equipment. this allows companies to deduct a larger portion of the asset’s cost in the year it’s placed in service, further reducing taxable income.

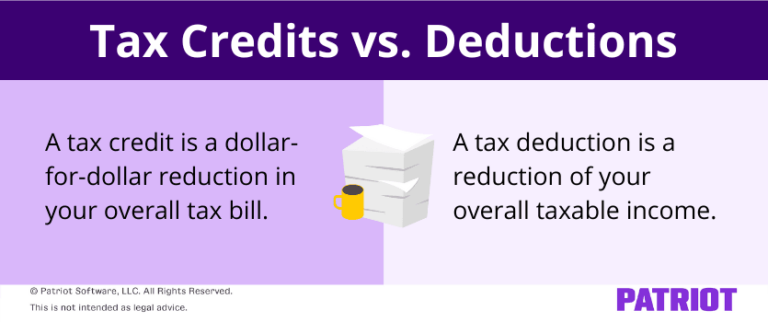

How To Reduce Your Tax Bill Stewart Accounting Finally, you can use the sum of the year's digits to accelerate depreciation and reduce your taxable business income. with this method, you add the years of depreciation together. with a five year property depreciation, you would add 5 4 3 2 1 to get 15, then divide the current year's depreciation by the total. The concept behind depreciation is simple. it links the cost of an item to the benefit your business receives from the revenue the asset produces. you’re allowed to report income from the asset. additionally, you can also report an expense equal to a portion of the item’s value to reduce your taxable income during every year you use the item. Tax depreciation refers to the depreciation expenses of a business that is an allowable deduction by the irs. this means that by listing depreciation as an expense on their income tax return in the reporting period, a business can reduce its taxable income. depreciation is a method where the cost of fixed assets or tangible assets are allocated. In short, depreciation can result in a reduction in corporate taxes. tax depreciation is the depreciation expense that can be reported by a business for a given reporting period. it is the recovery of an asset cost over a number years or, in other words, the asset’s useful life.

Clever Ways To Reduce Your Tax Bill A A Tax Accounting Services Llc Tax depreciation refers to the depreciation expenses of a business that is an allowable deduction by the irs. this means that by listing depreciation as an expense on their income tax return in the reporting period, a business can reduce its taxable income. depreciation is a method where the cost of fixed assets or tangible assets are allocated. In short, depreciation can result in a reduction in corporate taxes. tax depreciation is the depreciation expense that can be reported by a business for a given reporting period. it is the recovery of an asset cost over a number years or, in other words, the asset’s useful life. Depreciation is a valuable tool that businesses can use to reduce their taxable income, ultimately leading to lower tax liabilities. by spreading out the cost of an asset over its useful life, depreciation allows businesses to recoup the expense of an asset over time, rather than all at once. this can be especially beneficial for businesses. Depreciation is defined as an accounting method of allocating the cost of a tangible or physical asset over its life expectancy. it represents how much of an asset’s value has been used. by calculating the decrease in your business assets’ value, depreciation can reduce the amount of taxes your business will pay. assets depreciate for two.

How To Reduce Your Tax Bill Rbizz Solutions Corporate Accounting Depreciation is a valuable tool that businesses can use to reduce their taxable income, ultimately leading to lower tax liabilities. by spreading out the cost of an asset over its useful life, depreciation allows businesses to recoup the expense of an asset over time, rather than all at once. this can be especially beneficial for businesses. Depreciation is defined as an accounting method of allocating the cost of a tangible or physical asset over its life expectancy. it represents how much of an asset’s value has been used. by calculating the decrease in your business assets’ value, depreciation can reduce the amount of taxes your business will pay. assets depreciate for two.

Business Tax Deductions How You Can Use Depreciation To Reduce Your

How To Reduce Your Tax Bill Lowering Business Taxes

Comments are closed.